Eagle Asset Management Inc. lessened its position in shares of Antero Resources Co. (NYSE:AR - Free Report) by 11.8% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,742,679 shares of the oil and natural gas company's stock after selling 367,489 shares during the period. Eagle Asset Management Inc. owned about 0.88% of Antero Resources worth $80,169,000 at the end of the most recent reporting period.

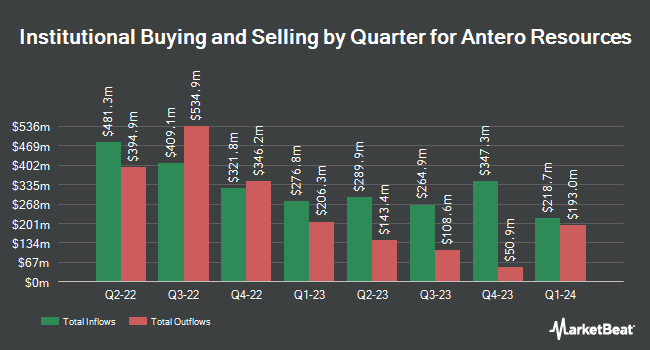

Other institutional investors also recently modified their holdings of the company. UMB Bank n.a. raised its position in Antero Resources by 357.3% in the 3rd quarter. UMB Bank n.a. now owns 878 shares of the oil and natural gas company's stock valued at $25,000 after buying an additional 686 shares during the last quarter. Capital Performance Advisors LLP acquired a new stake in shares of Antero Resources in the third quarter valued at approximately $45,000. Mattson Financial Services LLC acquired a new position in Antero Resources during the second quarter worth $64,000. GAMMA Investing LLC grew its position in Antero Resources by 27.8% in the second quarter. GAMMA Investing LLC now owns 3,012 shares of the oil and natural gas company's stock valued at $98,000 after purchasing an additional 655 shares in the last quarter. Finally, Signaturefd LLC increased its stake in Antero Resources by 19.9% in the 3rd quarter. Signaturefd LLC now owns 4,222 shares of the oil and natural gas company's stock valued at $121,000 after buying an additional 702 shares during the last quarter. 83.04% of the stock is currently owned by institutional investors.

Antero Resources Stock Performance

Shares of Antero Resources stock traded down $0.21 during trading on Friday, reaching $33.19. The company's stock had a trading volume of 2,143,423 shares, compared to its average volume of 4,089,488. Antero Resources Co. has a 52 week low of $20.10 and a 52 week high of $36.28. The firm has a market cap of $10.33 billion, a PE ratio of 238.57 and a beta of 3.36. The business's 50-day moving average price is $28.55 and its 200-day moving average price is $30.06. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.23.

Wall Street Analysts Forecast Growth

Several brokerages have recently weighed in on AR. Mizuho decreased their price objective on Antero Resources from $37.00 to $35.00 and set a "neutral" rating for the company in a report on Monday, September 16th. Scotiabank upgraded Antero Resources from a "sector perform" rating to a "sector outperform" rating and upped their price objective for the stock from $40.00 to $44.00 in a research note on Tuesday, August 20th. StockNews.com raised shares of Antero Resources to a "sell" rating in a research note on Friday, November 1st. The Goldman Sachs Group dropped their price target on shares of Antero Resources from $36.00 to $32.00 and set a "buy" rating on the stock in a research report on Friday, September 6th. Finally, Wells Fargo & Company decreased their price objective on shares of Antero Resources from $25.00 to $24.00 and set an "underweight" rating for the company in a research report on Friday, October 18th. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating, nine have assigned a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $33.50.

View Our Latest Stock Report on AR

About Antero Resources

(

Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Featured Articles

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.