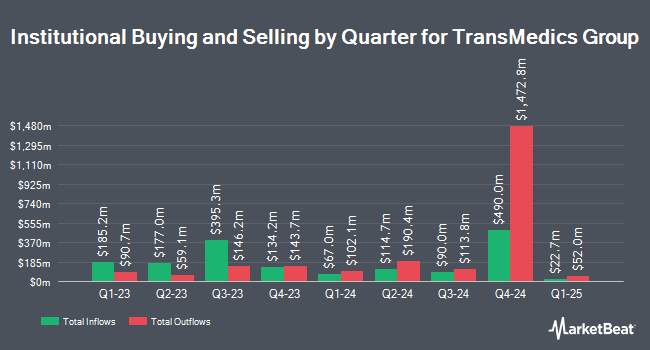

Eagle Asset Management Inc. trimmed its holdings in shares of TransMedics Group, Inc. (NASDAQ:TMDX - Free Report) by 16.3% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 129,094 shares of the company's stock after selling 25,214 shares during the period. Eagle Asset Management Inc. owned about 0.38% of TransMedics Group worth $20,268,000 at the end of the most recent quarter.

A number of other large investors also recently modified their holdings of the business. Vaughan Nelson Investment Management L.P. acquired a new stake in TransMedics Group in the 2nd quarter valued at about $39,862,000. Driehaus Capital Management LLC lifted its stake in TransMedics Group by 15.8% in the 2nd quarter. Driehaus Capital Management LLC now owns 1,486,073 shares of the company's stock valued at $223,832,000 after purchasing an additional 202,867 shares during the last quarter. Principal Financial Group Inc. lifted its stake in TransMedics Group by 260.1% in the 3rd quarter. Principal Financial Group Inc. now owns 202,287 shares of the company's stock valued at $31,759,000 after purchasing an additional 146,115 shares during the last quarter. Hood River Capital Management LLC acquired a new stake in TransMedics Group in the 2nd quarter valued at about $18,854,000. Finally, Canada Pension Plan Investment Board bought a new position in TransMedics Group in the 2nd quarter valued at about $16,086,000. 99.67% of the stock is currently owned by institutional investors and hedge funds.

TransMedics Group Stock Performance

Shares of NASDAQ:TMDX opened at $76.04 on Friday. TransMedics Group, Inc. has a 1 year low of $67.77 and a 1 year high of $177.37. The company has a debt-to-equity ratio of 2.42, a current ratio of 8.20 and a quick ratio of 7.33. The stock has a market capitalization of $2.55 billion, a price-to-earnings ratio of 80.89 and a beta of 2.08. The company's 50 day simple moving average is $120.68 and its 200 day simple moving average is $138.09.

TransMedics Group (NASDAQ:TMDX - Get Free Report) last issued its earnings results on Monday, October 28th. The company reported $0.12 earnings per share for the quarter, missing analysts' consensus estimates of $0.29 by ($0.17). TransMedics Group had a net margin of 8.14% and a return on equity of 18.74%. The company had revenue of $108.76 million during the quarter, compared to analyst estimates of $115.00 million. During the same quarter in the prior year, the business earned ($0.12) EPS. The business's quarterly revenue was up 63.7% on a year-over-year basis. As a group, research analysts predict that TransMedics Group, Inc. will post 1 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

TMDX has been the topic of several research analyst reports. Needham & Company LLC reissued a "hold" rating and issued a $109.00 price target on shares of TransMedics Group in a report on Friday. Canaccord Genuity Group lowered their price target on shares of TransMedics Group from $109.00 to $104.00 and set a "buy" rating on the stock in a report on Wednesday. Baird R W raised shares of TransMedics Group to a "strong-buy" rating in a report on Tuesday, September 24th. Robert W. Baird lowered their target price on shares of TransMedics Group from $200.00 to $150.00 and set an "outperform" rating on the stock in a report on Tuesday, October 29th. Finally, TD Cowen lowered their target price on shares of TransMedics Group from $175.00 to $120.00 and set a "buy" rating on the stock in a report on Monday, November 18th. Two investment analysts have rated the stock with a hold rating, eight have given a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $131.80.

Get Our Latest Stock Analysis on TransMedics Group

Insider Buying and Selling at TransMedics Group

In other news, insider Nicholas Corcoran sold 10,000 shares of TransMedics Group stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of $176.02, for a total transaction of $1,760,200.00. Following the transaction, the insider now owns 21,105 shares in the company, valued at approximately $3,714,902.10. The trade was a 32.15 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Tamer I. Khayal sold 2,958 shares of TransMedics Group stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $148.24, for a total transaction of $438,493.92. Following the transaction, the insider now owns 20,843 shares in the company, valued at approximately $3,089,766.32. This trade represents a 12.43 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 36,958 shares of company stock worth $5,230,528 over the last quarter. Corporate insiders own 7.00% of the company's stock.

TransMedics Group Company Profile

(

Free Report)

TransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TransMedics Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransMedics Group wasn't on the list.

While TransMedics Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.