Empowered Funds LLC purchased a new position in Topgolf Callaway Brands Corp. (NYSE:MODG - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 309,249 shares of the company's stock, valued at approximately $3,396,000. Empowered Funds LLC owned approximately 0.17% of Topgolf Callaway Brands at the end of the most recent reporting period.

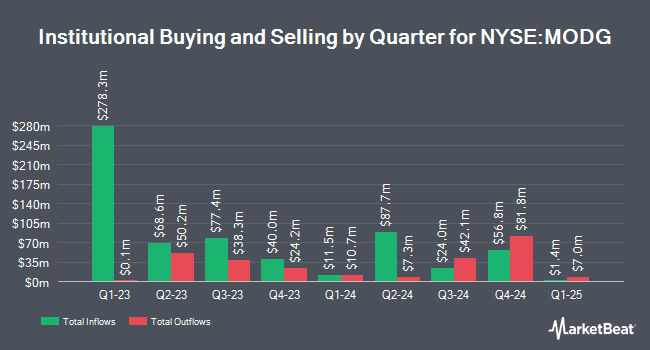

A number of other institutional investors have also recently made changes to their positions in the stock. Fifth Third Bancorp raised its holdings in shares of Topgolf Callaway Brands by 327.6% during the 2nd quarter. Fifth Third Bancorp now owns 2,527 shares of the company's stock valued at $39,000 after buying an additional 1,936 shares in the last quarter. Dnca Finance purchased a new position in Topgolf Callaway Brands in the 2nd quarter worth approximately $134,000. Koss Olinger Consulting LLC bought a new stake in Topgolf Callaway Brands in the second quarter valued at approximately $160,000. Simon Quick Advisors LLC purchased a new stake in shares of Topgolf Callaway Brands during the second quarter valued at approximately $161,000. Finally, QRG Capital Management Inc. bought a new position in shares of Topgolf Callaway Brands in the first quarter worth approximately $178,000. Institutional investors own 84.69% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts recently commented on MODG shares. TD Cowen lowered their price target on shares of Topgolf Callaway Brands from $13.00 to $10.00 and set a "hold" rating for the company in a report on Tuesday, September 17th. Raymond James lowered shares of Topgolf Callaway Brands from an "outperform" rating to an "underperform" rating in a report on Friday, August 23rd. Morgan Stanley reduced their price target on Topgolf Callaway Brands from $11.00 to $10.00 and set an "underweight" rating on the stock in a report on Thursday, August 8th. Bank of America dropped their price objective on Topgolf Callaway Brands from $14.00 to $12.00 and set a "neutral" rating for the company in a report on Thursday, September 12th. Finally, The Goldman Sachs Group cut their price objective on Topgolf Callaway Brands from $14.00 to $12.00 and set a "neutral" rating on the stock in a research report on Thursday, November 14th. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $14.92.

View Our Latest Research Report on Topgolf Callaway Brands

Topgolf Callaway Brands Stock Up 4.2 %

MODG stock traded up $0.35 during midday trading on Tuesday, hitting $8.51. The stock had a trading volume of 3,213,347 shares, compared to its average volume of 2,518,542. The business has a 50-day moving average of $10.01 and a two-hundred day moving average of $12.66. The company has a debt-to-equity ratio of 0.37, a current ratio of 1.93 and a quick ratio of 1.14. The firm has a market cap of $1.56 billion, a price-to-earnings ratio of -106.31, a price-to-earnings-growth ratio of 5.89 and a beta of 1.75. Topgolf Callaway Brands Corp. has a 52-week low of $7.95 and a 52-week high of $16.89.

Topgolf Callaway Brands Profile

(

Free Report)

Topgolf Callaway Brands Corp. designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally. The Topgolf segment operates Topgolf venues equipped with technology-enabled hitting bays, bars, dining areas, and event spaces, as well as Toptracer ball-flight tracking technology; and World Golf Tour digital golf game.

Featured Articles

Before you consider Topgolf Callaway Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Topgolf Callaway Brands wasn't on the list.

While Topgolf Callaway Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.