Entropy Technologies LP purchased a new stake in shares of Lennox International Inc. (NYSE:LII - Free Report) during the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm purchased 1,140 shares of the construction company's stock, valued at approximately $689,000.

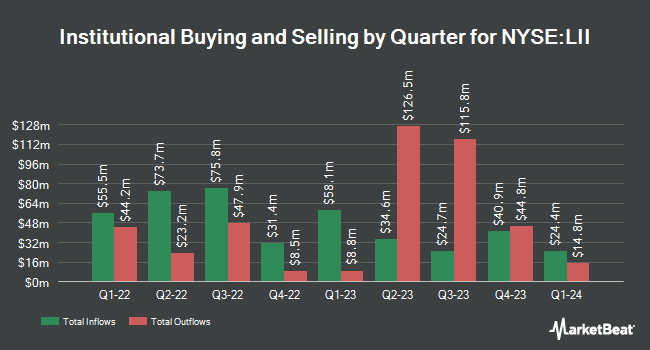

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the business. Rhumbline Advisers increased its stake in Lennox International by 3.1% in the 2nd quarter. Rhumbline Advisers now owns 99,181 shares of the construction company's stock worth $53,060,000 after acquiring an additional 2,958 shares during the last quarter. Achmea Investment Management B.V. boosted its holdings in shares of Lennox International by 7.3% in the 2nd quarter. Achmea Investment Management B.V. now owns 83,311 shares of the construction company's stock worth $44,570,000 after purchasing an additional 5,673 shares during the period. New York State Common Retirement Fund increased its position in shares of Lennox International by 3.8% during the 3rd quarter. New York State Common Retirement Fund now owns 55,113 shares of the construction company's stock valued at $33,304,000 after purchasing an additional 2,013 shares during the last quarter. National Pension Service increased its position in shares of Lennox International by 2.3% during the 3rd quarter. National Pension Service now owns 51,263 shares of the construction company's stock valued at $30,978,000 after purchasing an additional 1,140 shares during the last quarter. Finally, Swedbank AB purchased a new stake in shares of Lennox International in the first quarter valued at $15,416,000. Institutional investors own 67.07% of the company's stock.

Lennox International Price Performance

NYSE LII traded down $8.11 during trading hours on Friday, hitting $609.75. 194,268 shares of the company's stock traded hands, compared to its average volume of 272,151. The company has a debt-to-equity ratio of 1.10, a current ratio of 1.39 and a quick ratio of 0.87. The firm's 50-day moving average is $603.28 and its 200-day moving average is $557.96. Lennox International Inc. has a 52-week low of $397.34 and a 52-week high of $653.83. The company has a market capitalization of $21.72 billion, a PE ratio of 29.10, a PEG ratio of 1.90 and a beta of 1.07.

Lennox International (NYSE:LII - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The construction company reported $6.68 earnings per share (EPS) for the quarter, topping the consensus estimate of $5.95 by $0.73. The company had revenue of $1.50 billion during the quarter, compared to analysts' expectations of $1.42 billion. Lennox International had a return on equity of 148.52% and a net margin of 14.63%. The firm's quarterly revenue was up 9.6% compared to the same quarter last year. During the same quarter last year, the firm earned $5.37 earnings per share. Equities analysts forecast that Lennox International Inc. will post 21.1 EPS for the current fiscal year.

Lennox International Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Monday, September 30th were given a dividend of $1.15 per share. The ex-dividend date of this dividend was Monday, September 30th. This represents a $4.60 annualized dividend and a dividend yield of 0.75%. Lennox International's dividend payout ratio is currently 21.84%.

Insider Activity

In other news, EVP Prakash Bedapudi sold 5,374 shares of the business's stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $584.00, for a total transaction of $3,138,416.00. Following the completion of the transaction, the executive vice president now directly owns 16,162 shares of the company's stock, valued at approximately $9,438,608. The trade was a 24.95 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CAO Chris Kosel sold 200 shares of the firm's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $625.49, for a total transaction of $125,098.00. Following the completion of the sale, the chief accounting officer now owns 1,446 shares in the company, valued at $904,458.54. The trade was a 12.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 12,414 shares of company stock valued at $7,248,206. 10.40% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

LII has been the topic of several recent analyst reports. Wells Fargo & Company increased their price target on Lennox International from $570.00 to $615.00 and gave the stock an "equal weight" rating in a report on Monday, October 7th. Barclays raised their price objective on Lennox International from $575.00 to $624.00 and gave the company an "equal weight" rating in a research report on Thursday, October 24th. Mizuho lifted their price target on shares of Lennox International from $650.00 to $675.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Stephens reissued an "overweight" rating and set a $675.00 target price on shares of Lennox International in a report on Thursday, July 25th. Finally, Royal Bank of Canada lifted their price target on Lennox International from $604.00 to $619.00 and gave the company a "sector perform" rating in a research report on Thursday, October 24th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $583.92.

Read Our Latest Analysis on Lennox International

Lennox International Company Profile

(

Free Report)

Lennox International Inc, together with its subsidiaries, designs, manufactures, and markets a range of products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally. The Home Comfort Solutions segment provides furnaces, air conditioners, heat pumps, packaged heating and cooling systems, indoor air quality equipment, comfort control products, and replacement parts and supplies; residential heating, ventilation, cooling equipment, and air conditioning; and evaporator coils and unit heaters under Lennox, Dave Lennox Signature Collection, Armstrong Air, Ducane, AirEase, Concord, MagicPak, Advanced Distributor Products, Allied, Elite Series, Merit Series, Comfort Sync, Healthy Climate, iComfort, ComfortSense, and Lennox Stores name.

Read More

Before you consider Lennox International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lennox International wasn't on the list.

While Lennox International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report