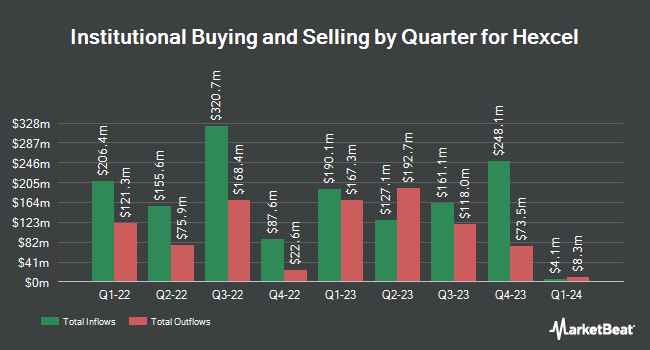

Entropy Technologies LP purchased a new stake in Hexcel Co. (NYSE:HXL - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 13,836 shares of the aerospace company's stock, valued at approximately $855,000.

Other hedge funds have also recently bought and sold shares of the company. Quantbot Technologies LP purchased a new position in shares of Hexcel during the 1st quarter valued at approximately $393,000. SG Americas Securities LLC grew its holdings in Hexcel by 263.8% during the 1st quarter. SG Americas Securities LLC now owns 8,138 shares of the aerospace company's stock worth $593,000 after acquiring an additional 5,901 shares in the last quarter. Headlands Technologies LLC bought a new stake in shares of Hexcel in the 1st quarter worth about $119,000. Russell Investments Group Ltd. raised its stake in shares of Hexcel by 258.8% in the 1st quarter. Russell Investments Group Ltd. now owns 39,428 shares of the aerospace company's stock valued at $2,872,000 after purchasing an additional 28,439 shares in the last quarter. Finally, US Bancorp DE lifted its position in shares of Hexcel by 31.3% during the first quarter. US Bancorp DE now owns 40,522 shares of the aerospace company's stock worth $2,952,000 after purchasing an additional 9,655 shares during the last quarter. Institutional investors and hedge funds own 95.47% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts recently weighed in on the company. StockNews.com raised Hexcel from a "hold" rating to a "buy" rating in a report on Wednesday, October 23rd. UBS Group boosted their price target on Hexcel from $67.00 to $69.00 and gave the company a "neutral" rating in a report on Friday, October 25th. BMO Capital Markets reduced their price objective on Hexcel from $70.00 to $68.00 and set a "market perform" rating on the stock in a research note on Monday, October 28th. Truist Financial lowered their target price on shares of Hexcel from $78.00 to $76.00 and set a "buy" rating for the company in a research note on Friday, October 18th. Finally, Royal Bank of Canada downgraded shares of Hexcel from an "outperform" rating to a "sector perform" rating and reduced their price target for the stock from $76.00 to $68.00 in a research report on Wednesday, August 14th. Two research analysts have rated the stock with a sell rating, eight have assigned a hold rating and four have given a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $71.54.

Read Our Latest Stock Analysis on Hexcel

Hexcel Stock Performance

NYSE:HXL traded down $1.22 during mid-day trading on Thursday, hitting $60.08. The stock had a trading volume of 149,344 shares, compared to its average volume of 867,064. The company has a current ratio of 2.76, a quick ratio of 1.51 and a debt-to-equity ratio of 0.51. The company has a 50 day simple moving average of $61.12 and a 200-day simple moving average of $64.00. The stock has a market capitalization of $4.87 billion, a price-to-earnings ratio of 46.81, a P/E/G ratio of 1.81 and a beta of 1.30. Hexcel Co. has a 52 week low of $57.50 and a 52 week high of $77.09.

Hexcel (NYSE:HXL - Get Free Report) last released its quarterly earnings results on Monday, October 21st. The aerospace company reported $0.47 earnings per share for the quarter, beating analysts' consensus estimates of $0.46 by $0.01. Hexcel had a return on equity of 9.99% and a net margin of 5.73%. The company had revenue of $457.00 million for the quarter, compared to analysts' expectations of $457.07 million. During the same quarter in the previous year, the company posted $0.38 earnings per share. The business's revenue for the quarter was up 8.9% compared to the same quarter last year. On average, research analysts expect that Hexcel Co. will post 2.02 earnings per share for the current fiscal year.

Hexcel Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, November 8th. Shareholders of record on Friday, November 1st were given a dividend of $0.15 per share. The ex-dividend date was Friday, November 1st. This represents a $0.60 dividend on an annualized basis and a yield of 1.00%. Hexcel's dividend payout ratio (DPR) is presently 45.80%.

Hexcel Company Profile

(

Free Report)

Hexcel Corporation develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications. It operates through two segments, Composite Materials and Engineered Products.

Read More

Before you consider Hexcel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hexcel wasn't on the list.

While Hexcel currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.