Entropy Technologies LP cut its position in shares of Lyft, Inc. (NASDAQ:LYFT - Free Report) by 75.8% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 80,462 shares of the ride-sharing company's stock after selling 251,674 shares during the quarter. Entropy Technologies LP's holdings in Lyft were worth $1,026,000 as of its most recent SEC filing.

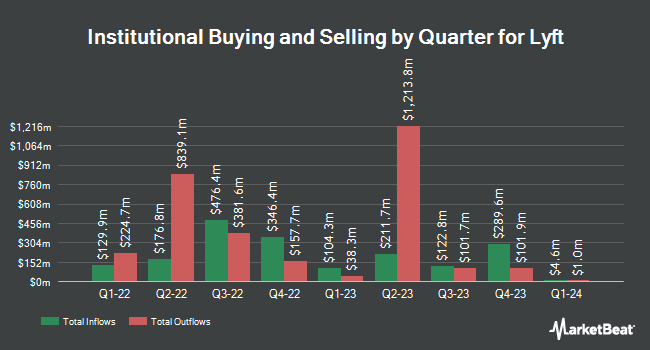

Other large investors have also added to or reduced their stakes in the company. Price T Rowe Associates Inc. MD increased its stake in shares of Lyft by 592.3% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,424,349 shares of the ride-sharing company's stock valued at $27,562,000 after purchasing an additional 1,218,620 shares during the last quarter. National Bank of Canada FI boosted its holdings in shares of Lyft by 27,739.2% during the 2nd quarter. National Bank of Canada FI now owns 1,192,910 shares of the ride-sharing company's stock worth $16,665,000 after buying an additional 1,188,625 shares in the last quarter. Bank of New York Mellon Corp grew its stake in shares of Lyft by 39.5% in the 2nd quarter. Bank of New York Mellon Corp now owns 2,870,599 shares of the ride-sharing company's stock valued at $40,475,000 after buying an additional 812,926 shares during the period. Vanguard Group Inc. raised its stake in shares of Lyft by 2.4% in the first quarter. Vanguard Group Inc. now owns 32,899,391 shares of the ride-sharing company's stock worth $636,603,000 after purchasing an additional 782,736 shares during the last quarter. Finally, Quadrature Capital Ltd grew its stake in Lyft by 600.2% in the 1st quarter. Quadrature Capital Ltd now owns 608,430 shares of the ride-sharing company's stock valued at $11,767,000 after purchasing an additional 521,537 shares during the period. Institutional investors and hedge funds own 83.07% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on LYFT. Jefferies Financial Group raised their price objective on shares of Lyft from $10.50 to $13.00 and gave the company a "hold" rating in a research report on Tuesday, October 22nd. Bank of America upped their price objective on shares of Lyft from $16.00 to $19.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Piper Sandler reissued an "overweight" rating and set a $23.00 price objective (up from $17.00) on shares of Lyft in a research report on Thursday, November 7th. Melius initiated coverage on Lyft in a research note on Monday, July 22nd. They set a "hold" rating and a $15.00 target price on the stock. Finally, Truist Financial lifted their price objective on Lyft from $13.00 to $20.00 and gave the stock a "hold" rating in a report on Thursday, November 7th. Twenty-eight investment analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Lyft presently has an average rating of "Hold" and an average target price of $17.48.

Check Out Our Latest Analysis on LYFT

Insiders Place Their Bets

In other Lyft news, Director John Patrick Zimmer sold 2,424 shares of Lyft stock in a transaction on Monday, September 16th. The shares were sold at an average price of $11.32, for a total value of $27,439.68. Following the completion of the sale, the director now directly owns 929,638 shares of the company's stock, valued at approximately $10,523,502.16. The trade was a 0.26 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Lindsay Catherine Llewellyn sold 4,242 shares of the stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $17.76, for a total value of $75,337.92. Following the completion of the sale, the insider now directly owns 755,847 shares of the company's stock, valued at approximately $13,423,842.72. This trade represents a 0.56 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 45,987 shares of company stock worth $619,025 over the last ninety days. Corporate insiders own 3.07% of the company's stock.

Lyft Price Performance

Shares of LYFT stock traded up $0.14 during trading hours on Thursday, reaching $17.92. 12,399,641 shares of the company were exchanged, compared to its average volume of 15,129,234. The stock's fifty day moving average is $13.36 and its two-hundred day moving average is $13.55. The company has a market cap of $7.35 billion, a price-to-earnings ratio of -113.31, a P/E/G ratio of 6.61 and a beta of 2.04. Lyft, Inc. has a fifty-two week low of $8.93 and a fifty-two week high of $20.82. The company has a debt-to-equity ratio of 0.88, a current ratio of 0.75 and a quick ratio of 0.75.

Lyft (NASDAQ:LYFT - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The ride-sharing company reported $0.29 EPS for the quarter, beating analysts' consensus estimates of $0.20 by $0.09. The company had revenue of $1.52 billion for the quarter, compared to analyst estimates of $1.44 billion. Lyft had a negative return on equity of 1.58% and a negative net margin of 1.19%. The company's quarterly revenue was up 31.6% compared to the same quarter last year. During the same period in the previous year, the company posted ($0.02) earnings per share. Sell-side analysts forecast that Lyft, Inc. will post 0.06 earnings per share for the current fiscal year.

Lyft Company Profile

(

Free Report)

Lyft, Inc operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada. It operates multimodal transportation networks that offer access to various transportation options through the Lyft platform and mobile-based applications. The company's platform provides a ridesharing marketplace, which connects drivers with riders; Express Drive, a car rental program for drivers; and a network of shared bikes and scooters in various cities to address the needs of riders for short trips.

Featured Articles

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.