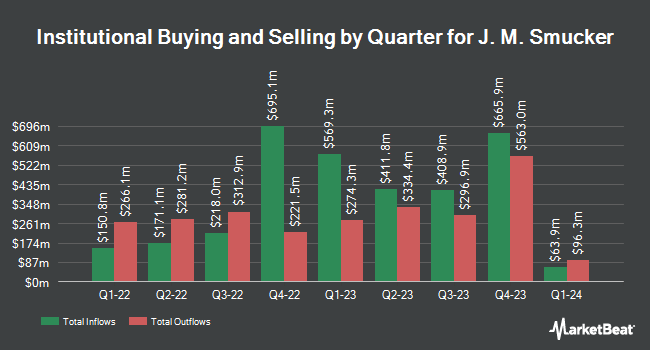

Entropy Technologies LP acquired a new position in shares of The J. M. Smucker Company (NYSE:SJM - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm acquired 6,573 shares of the company's stock, valued at approximately $796,000.

A number of other hedge funds have also modified their holdings of SJM. Boston Partners acquired a new position in shares of J. M. Smucker in the 1st quarter valued at about $364,990,000. Bank of Montreal Can increased its holdings in shares of J. M. Smucker by 186.3% during the 2nd quarter. Bank of Montreal Can now owns 805,029 shares of the company's stock valued at $90,195,000 after acquiring an additional 523,803 shares during the last quarter. Ariel Investments LLC raised its holdings in J. M. Smucker by 56.0% in the 2nd quarter. Ariel Investments LLC now owns 1,354,999 shares of the company's stock worth $147,749,000 after acquiring an additional 486,624 shares during the period. Ilex Capital Partners UK LLP acquired a new position in J. M. Smucker during the 1st quarter worth $48,207,000. Finally, Champlain Investment Partners LLC boosted its holdings in J. M. Smucker by 29.0% during the first quarter. Champlain Investment Partners LLC now owns 1,457,995 shares of the company's stock valued at $183,518,000 after acquiring an additional 327,680 shares during the period. 81.66% of the stock is currently owned by institutional investors and hedge funds.

J. M. Smucker Stock Performance

Shares of NYSE SJM traded down $2.72 during midday trading on Friday, hitting $106.92. 1,900,709 shares of the company's stock were exchanged, compared to its average volume of 1,156,393. The company's 50 day moving average price is $117.52 and its 200 day moving average price is $115.61. The company has a quick ratio of 0.25, a current ratio of 0.55 and a debt-to-equity ratio of 0.87. The firm has a market capitalization of $11.38 billion, a PE ratio of 15.66, a price-to-earnings-growth ratio of 3.18 and a beta of 0.25. The J. M. Smucker Company has a 12 month low of $105.69 and a 12 month high of $134.62.

J. M. Smucker (NYSE:SJM - Get Free Report) last posted its quarterly earnings data on Wednesday, August 28th. The company reported $2.44 earnings per share for the quarter, topping the consensus estimate of $2.17 by $0.27. The business had revenue of $2.13 billion during the quarter, compared to analysts' expectations of $2.13 billion. J. M. Smucker had a net margin of 8.77% and a return on equity of 14.22%. J. M. Smucker's revenue was up 17.7% compared to the same quarter last year. During the same quarter in the prior year, the business posted $2.21 earnings per share. As a group, analysts predict that The J. M. Smucker Company will post 9.8 earnings per share for the current fiscal year.

J. M. Smucker Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 2nd. Stockholders of record on Friday, November 15th will be given a $1.08 dividend. This represents a $4.32 annualized dividend and a dividend yield of 4.04%. The ex-dividend date of this dividend is Friday, November 15th. J. M. Smucker's dividend payout ratio (DPR) is presently 61.10%.

Analyst Upgrades and Downgrades

A number of research firms have recently commented on SJM. DA Davidson reiterated a "neutral" rating and issued a $121.00 price objective on shares of J. M. Smucker in a research note on Thursday, August 29th. Citigroup cut their price target on J. M. Smucker from $138.00 to $136.00 and set a "buy" rating for the company in a report on Thursday, August 29th. BNP Paribas upgraded shares of J. M. Smucker to a "strong sell" rating in a research note on Thursday, August 29th. Bank of America cut their price objective on shares of J. M. Smucker from $130.00 to $122.00 and set a "neutral" rating for the company in a research report on Thursday, August 29th. Finally, Stifel Nicolaus lowered J. M. Smucker from a "buy" rating to a "hold" rating and lowered their price target for the company from $135.00 to $125.00 in a research note on Friday, October 25th. One research analyst has rated the stock with a sell rating, eight have given a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $127.09.

Get Our Latest Research Report on SJM

About J. M. Smucker

(

Free Report)

The J. M. Smucker Company manufactures and markets branded food and beverage products worldwide. It operates in three segments: U.S. Retail Pet Foods, U.S. Retail Coffee, and U.S. Retail Consumer Foods. The company offers mainstream roast, ground, single serve, and premium coffee; peanut butter and specialty spreads; fruit spreads, toppings, and syrups; jelly products; nut mix products; shortening and oils; frozen sandwiches and snacks; pet food and pet snacks; and foodservice hot beverage, foodservice portion control, and flour products, as well as dog and cat food, frozen handheld products, juices and beverages, and baking mixes and ingredients.

Featured Articles

Before you consider J. M. Smucker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and J. M. Smucker wasn't on the list.

While J. M. Smucker currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.