Entropy Technologies LP bought a new position in shares of Acuity Brands, Inc. (NYSE:AYI - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 1,677 shares of the electronics maker's stock, valued at approximately $462,000.

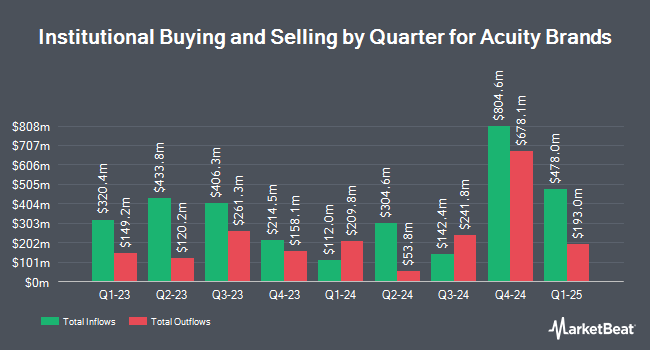

Several other large investors have also recently added to or reduced their stakes in AYI. Apollon Wealth Management LLC raised its holdings in shares of Acuity Brands by 2.9% in the 3rd quarter. Apollon Wealth Management LLC now owns 3,425 shares of the electronics maker's stock worth $943,000 after purchasing an additional 97 shares during the period. Venturi Wealth Management LLC raised its holdings in shares of Acuity Brands by 16.6% in the 3rd quarter. Venturi Wealth Management LLC now owns 352 shares of the electronics maker's stock worth $97,000 after purchasing an additional 50 shares during the period. Crossmark Global Holdings Inc. raised its holdings in shares of Acuity Brands by 9.8% in the 3rd quarter. Crossmark Global Holdings Inc. now owns 18,275 shares of the electronics maker's stock worth $5,033,000 after purchasing an additional 1,636 shares during the period. Covestor Ltd raised its holdings in shares of Acuity Brands by 12.7% in the 3rd quarter. Covestor Ltd now owns 427 shares of the electronics maker's stock worth $118,000 after purchasing an additional 48 shares during the period. Finally, Radnor Capital Management LLC raised its holdings in shares of Acuity Brands by 7.2% in the 3rd quarter. Radnor Capital Management LLC now owns 4,490 shares of the electronics maker's stock worth $1,237,000 after purchasing an additional 300 shares during the period. 98.21% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently commented on AYI shares. The Goldman Sachs Group raised their price objective on Acuity Brands from $266.00 to $303.00 and gave the stock a "neutral" rating in a report on Wednesday, October 2nd. Robert W. Baird raised their price objective on Acuity Brands from $280.00 to $318.00 and gave the stock a "neutral" rating in a report on Wednesday, October 2nd. Wells Fargo & Company raised their price objective on Acuity Brands from $289.00 to $305.00 and gave the stock an "equal weight" rating in a report on Wednesday, October 2nd. Oppenheimer increased their target price on Acuity Brands from $315.00 to $370.00 and gave the company an "outperform" rating in a research note on Wednesday, October 2nd. Finally, StockNews.com upgraded Acuity Brands from a "buy" rating to a "strong-buy" rating in a research note on Thursday, October 31st. Three analysts have rated the stock with a hold rating, one has issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, Acuity Brands has an average rating of "Moderate Buy" and a consensus price target of $324.00.

View Our Latest Stock Analysis on Acuity Brands

Acuity Brands Stock Down 1.1 %

NYSE AYI traded down $3.76 during mid-day trading on Friday, reaching $325.87. 251,252 shares of the company's stock traded hands, compared to its average volume of 255,958. Acuity Brands, Inc. has a 1-year low of $176.93 and a 1-year high of $337.99. The company has a fifty day simple moving average of $295.08 and a 200-day simple moving average of $264.84. The company has a current ratio of 2.72, a quick ratio of 2.16 and a debt-to-equity ratio of 0.21. The company has a market cap of $10.06 billion, a price-to-earnings ratio of 24.25, a P/E/G ratio of 2.13 and a beta of 1.40.

Acuity Brands (NYSE:AYI - Get Free Report) last issued its quarterly earnings data on Tuesday, October 1st. The electronics maker reported $4.30 earnings per share for the quarter, beating analysts' consensus estimates of $3.90 by $0.40. Acuity Brands had a return on equity of 20.49% and a net margin of 11.00%. The firm had revenue of $1.03 billion during the quarter, compared to analyst estimates of $1.02 billion. During the same quarter last year, the firm earned $3.74 EPS. Acuity Brands's quarterly revenue was up 2.2% on a year-over-year basis. As a group, equities research analysts expect that Acuity Brands, Inc. will post 15.55 EPS for the current year.

Acuity Brands Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, November 1st. Stockholders of record on Friday, October 18th were given a $0.15 dividend. The ex-dividend date of this dividend was Friday, October 18th. This represents a $0.60 annualized dividend and a dividend yield of 0.18%. Acuity Brands's payout ratio is 4.46%.

Insider Transactions at Acuity Brands

In other news, SVP Barry R. Goldman sold 5,120 shares of Acuity Brands stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $305.00, for a total value of $1,561,600.00. Following the completion of the transaction, the senior vice president now owns 8,438 shares in the company, valued at approximately $2,573,590. This trade represents a 37.76 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 1.50% of the company's stock.

About Acuity Brands

(

Free Report)

Acuity Brands, Inc provides lighting, lighting controls, building management system, location-aware applications in the United States and internationally. The company operates in two segments, Acuity Brands Lighting and Lighting Controls (ABL); and the Intelligent Spaces Group (ISG). The ABL segment provides commercial, architectural, and specialty lighting solutions, as well as lighting controls and components for various indoor and outdoor applications under the A-Light, Aculux, American Electric Lighting, Cyclone, Dark to Light, eldoLED, Eureka, Gotham, Healthcare Lighting, Holophane, Hydrel, Indy, IOTA, Juno, Lithonia Lighting, Luminaire LED, Luminis, Mark Architectural Lighting, nLight, OPTOTRONIC, Peerless, RELOCWiring Solutions, and Sensor Switch.

Further Reading

Before you consider Acuity Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acuity Brands wasn't on the list.

While Acuity Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report