Entropy Technologies LP lowered its position in Warner Bros. Discovery, Inc. (NASDAQ:WBD - Free Report) by 41.9% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 280,088 shares of the company's stock after selling 202,383 shares during the quarter. Entropy Technologies LP's holdings in Warner Bros. Discovery were worth $2,311,000 as of its most recent filing with the Securities and Exchange Commission.

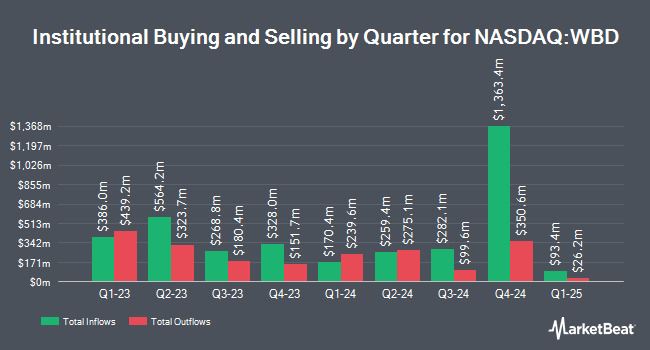

Several other large investors have also modified their holdings of the company. Family Firm Inc. acquired a new position in Warner Bros. Discovery in the 2nd quarter valued at $26,000. Crewe Advisors LLC purchased a new stake in Warner Bros. Discovery in the 1st quarter valued at approximately $27,000. OFI Invest Asset Management raised its stake in shares of Warner Bros. Discovery by 45.9% during the 2nd quarter. OFI Invest Asset Management now owns 3,879 shares of the company's stock worth $27,000 after buying an additional 1,221 shares in the last quarter. Transcendent Capital Group LLC boosted its stake in shares of Warner Bros. Discovery by 665.4% in the first quarter. Transcendent Capital Group LLC now owns 4,003 shares of the company's stock valued at $35,000 after buying an additional 3,480 shares in the last quarter. Finally, LRI Investments LLC acquired a new position in Warner Bros. Discovery during the first quarter worth $39,000. 59.95% of the stock is owned by institutional investors and hedge funds.

Warner Bros. Discovery Stock Performance

Shares of NASDAQ WBD traded up $0.63 during midday trading on Wednesday, reaching $9.85. 27,598,316 shares of the company traded hands, compared to its average volume of 29,247,740. The company has a market cap of $24.15 billion, a price-to-earnings ratio of -2.16 and a beta of 1.48. The company has a debt-to-equity ratio of 1.03, a current ratio of 0.80 and a quick ratio of 0.80. The stock has a 50-day moving average price of $7.97 and a 200 day moving average price of $7.84. Warner Bros. Discovery, Inc. has a 52 week low of $6.64 and a 52 week high of $12.70.

Warner Bros. Discovery (NASDAQ:WBD - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The company reported $0.05 earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.07) by $0.12. Warner Bros. Discovery had a negative return on equity of 27.56% and a negative net margin of 28.34%. The company had revenue of $9.62 billion for the quarter, compared to analysts' expectations of $9.79 billion. During the same period last year, the firm earned ($0.17) EPS. The firm's revenue for the quarter was down 3.6% on a year-over-year basis. Sell-side analysts anticipate that Warner Bros. Discovery, Inc. will post -4.41 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on WBD. Wolfe Research upgraded shares of Warner Bros. Discovery from an "underperform" rating to a "peer perform" rating in a report on Monday. Moffett Nathanson reduced their price objective on Warner Bros. Discovery from $10.00 to $9.00 and set a "neutral" rating for the company in a report on Thursday, August 8th. Morgan Stanley lowered their target price on Warner Bros. Discovery from $10.00 to $9.00 and set an "equal weight" rating on the stock in a report on Monday, July 29th. The Goldman Sachs Group increased their price objective on shares of Warner Bros. Discovery from $7.50 to $8.50 and gave the company a "neutral" rating in a research note on Monday, October 7th. Finally, Evercore ISI cut their target price on shares of Warner Bros. Discovery from $10.00 to $9.00 and set an "outperform" rating for the company in a research report on Thursday, August 8th. Twelve investment analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Hold" and a consensus target price of $10.55.

View Our Latest Research Report on WBD

Warner Bros. Discovery Company Profile

(

Free Report)

Warner Bros. Discovery, Inc operates as a media and entertainment company worldwide. It operates through three segments: Studios, Network, and DTC. The Studios segment produces and releases feature films for initial exhibition in theaters; produces and licenses television programs to its networks and third parties and direct-to-consumer services; distributes films and television programs to various third parties and internal television; and offers streaming services and distribution through the home entertainment market, themed experience licensing, and interactive gaming.

See Also

Before you consider Warner Bros. Discovery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warner Bros. Discovery wasn't on the list.

While Warner Bros. Discovery currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.