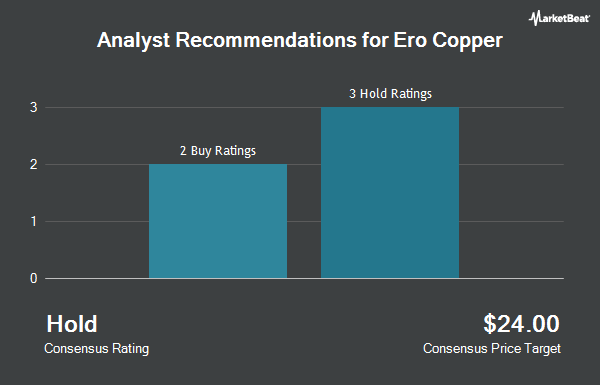

Ero Copper Corp. (NYSE:ERO - Get Free Report) has earned a consensus recommendation of "Buy" from the seven research firms that are currently covering the company, MarketBeat reports. Six research analysts have rated the stock with a buy recommendation and one has issued a strong buy recommendation on the company. The average 1-year price objective among analysts that have issued a report on the stock in the last year is $30.00.

Several analysts recently weighed in on ERO shares. Raymond James upgraded Ero Copper from a "market perform" rating to an "outperform" rating in a research note on Tuesday, September 3rd. StockNews.com raised Ero Copper from a "sell" rating to a "hold" rating in a research note on Friday, October 25th. Jefferies Financial Group raised Ero Copper from a "hold" rating to a "buy" rating in a research report on Monday, August 5th. Ventum Cap Mkts upgraded shares of Ero Copper from a "hold" rating to a "strong-buy" rating in a research note on Monday, July 22nd. Finally, Bank of America began coverage on shares of Ero Copper in a research note on Tuesday, September 3rd. They set a "buy" rating and a $28.00 price objective for the company.

Get Our Latest Research Report on ERO

Ero Copper Stock Down 1.0 %

Shares of NYSE:ERO traded down $0.15 during midday trading on Friday, reaching $15.28. The company's stock had a trading volume of 255,576 shares, compared to its average volume of 405,465. The company has a quick ratio of 0.60, a current ratio of 0.82 and a debt-to-equity ratio of 0.59. The firm has a 50 day moving average of $19.75 and a 200-day moving average of $20.40. The firm has a market capitalization of $1.58 billion, a P/E ratio of 89.88 and a beta of 1.23. Ero Copper has a 12-month low of $11.44 and a 12-month high of $24.34.

Institutional Investors Weigh In On Ero Copper

Several large investors have recently bought and sold shares of the business. FMR LLC grew its holdings in shares of Ero Copper by 1.8% in the third quarter. FMR LLC now owns 11,869,851 shares of the company's stock worth $264,262,000 after acquiring an additional 206,405 shares during the period. Jennison Associates LLC grew its stake in shares of Ero Copper by 4.3% during the 3rd quarter. Jennison Associates LLC now owns 5,710,827 shares of the company's stock valued at $127,149,000 after purchasing an additional 237,345 shares during the period. Impala Asset Management LLC increased its position in shares of Ero Copper by 12.7% during the 3rd quarter. Impala Asset Management LLC now owns 2,209,610 shares of the company's stock valued at $49,208,000 after purchasing an additional 248,390 shares during the last quarter. Montrusco Bolton Investments Inc. increased its position in shares of Ero Copper by 17.2% during the 3rd quarter. Montrusco Bolton Investments Inc. now owns 746,357 shares of the company's stock valued at $16,635,000 after purchasing an additional 109,633 shares during the last quarter. Finally, Boston Partners lifted its stake in shares of Ero Copper by 226.9% in the 1st quarter. Boston Partners now owns 726,068 shares of the company's stock worth $14,010,000 after purchasing an additional 503,972 shares during the period. 71.30% of the stock is currently owned by institutional investors.

Ero Copper Company Profile

(

Get Free ReportEro Copper Corp. engages in the exploration, development, and production of mining projects in Brazil. The company is involved in the production and sale of copper concentrate from the Caraíba operations located in the Curaçá Valley, northeastern Bahia state, Brazil, as well as gold and silver by-products.

Featured Stories

Before you consider Ero Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ero Copper wasn't on the list.

While Ero Copper currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.