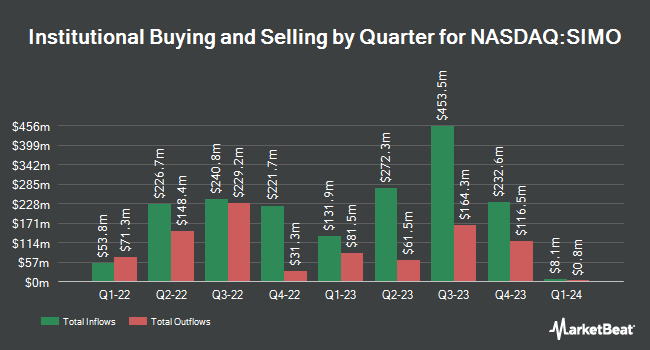

Erste Asset Management GmbH bought a new stake in Silicon Motion Technology Co. (NASDAQ:SIMO - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 664,000 shares of the semiconductor producer's stock, valued at approximately $40,331,000. Erste Asset Management GmbH owned about 1.97% of Silicon Motion Technology at the end of the most recent quarter.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Harbor Capital Advisors Inc. raised its position in shares of Silicon Motion Technology by 95.7% in the third quarter. Harbor Capital Advisors Inc. now owns 128,299 shares of the semiconductor producer's stock valued at $7,793,000 after buying an additional 62,733 shares during the last quarter. National Bank of Canada FI raised its holdings in Silicon Motion Technology by 6,186.7% in the 2nd quarter. National Bank of Canada FI now owns 47,150 shares of the semiconductor producer's stock valued at $3,766,000 after acquiring an additional 46,400 shares during the last quarter. Resolute Capital Asset Partners LLC lifted its stake in shares of Silicon Motion Technology by 44.4% during the 2nd quarter. Resolute Capital Asset Partners LLC now owns 65,000 shares of the semiconductor producer's stock worth $5,264,000 after purchasing an additional 20,000 shares during the period. Renaissance Technologies LLC boosted its holdings in shares of Silicon Motion Technology by 41.9% during the second quarter. Renaissance Technologies LLC now owns 113,879 shares of the semiconductor producer's stock worth $9,223,000 after purchasing an additional 33,600 shares during the last quarter. Finally, Blue Trust Inc. increased its stake in Silicon Motion Technology by 3,971.4% in the second quarter. Blue Trust Inc. now owns 570 shares of the semiconductor producer's stock valued at $44,000 after purchasing an additional 556 shares during the last quarter. 78.02% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

SIMO has been the topic of a number of research analyst reports. Roth Mkm decreased their price target on shares of Silicon Motion Technology from $90.00 to $80.00 and set a "buy" rating on the stock in a report on Tuesday, October 8th. Morgan Stanley reduced their target price on Silicon Motion Technology from $78.00 to $65.00 and set an "overweight" rating on the stock in a report on Monday, September 16th. StockNews.com lowered Silicon Motion Technology from a "buy" rating to a "hold" rating in a research note on Monday, November 4th. Needham & Company LLC reduced their price objective on Silicon Motion Technology from $94.00 to $75.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. Finally, Craig Hallum dropped their target price on shares of Silicon Motion Technology from $96.00 to $90.00 and set a "buy" rating for the company in a research report on Thursday, October 31st. One research analyst has rated the stock with a sell rating, one has issued a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat, Silicon Motion Technology currently has a consensus rating of "Moderate Buy" and an average target price of $81.67.

Get Our Latest Analysis on Silicon Motion Technology

Silicon Motion Technology Stock Up 1.2 %

NASDAQ:SIMO traded up $0.64 during trading hours on Friday, reaching $53.07. 218,814 shares of the stock were exchanged, compared to its average volume of 312,632. Silicon Motion Technology Co. has a 52 week low of $50.50 and a 52 week high of $85.87. The stock has a market capitalization of $1.79 billion, a P/E ratio of 20.10, a P/E/G ratio of 1.44 and a beta of 0.84. The firm has a 50 day simple moving average of $56.13 and a 200-day simple moving average of $66.21.

Silicon Motion Technology (NASDAQ:SIMO - Get Free Report) last issued its earnings results on Wednesday, October 30th. The semiconductor producer reported $0.92 EPS for the quarter, beating analysts' consensus estimates of $0.85 by $0.07. The company had revenue of $212.40 million during the quarter, compared to the consensus estimate of $209.49 million. Silicon Motion Technology had a return on equity of 11.52% and a net margin of 10.90%. Silicon Motion Technology's quarterly revenue was up 23.3% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.32 earnings per share. As a group, analysts expect that Silicon Motion Technology Co. will post 2.59 earnings per share for the current year.

Silicon Motion Technology Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, November 27th. Shareholders of record on Thursday, November 14th were given a $0.50 dividend. This represents a $2.00 annualized dividend and a yield of 3.77%. The ex-dividend date of this dividend was Thursday, November 14th. Silicon Motion Technology's dividend payout ratio is presently 75.38%.

Silicon Motion Technology Profile

(

Free Report)

Silicon Motion Technology Corporation, together with its subsidiaries, designs, develops, and markets NAND flash controllers for solid-state storage devices. The company offers controllers for computing-grade solid state drives (SSDs), which are used in PCs and other client devices; enterprise-grade SSDs used in data centers; eMMC and UFS mobile embedded storage for use in smartphones and IoT devices; flash memory cards and flash drives for use in expandable storage; and specialized SSDs that are used in industrial, commercial, and automotive applications.

Featured Stories

Before you consider Silicon Motion Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicon Motion Technology wasn't on the list.

While Silicon Motion Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.