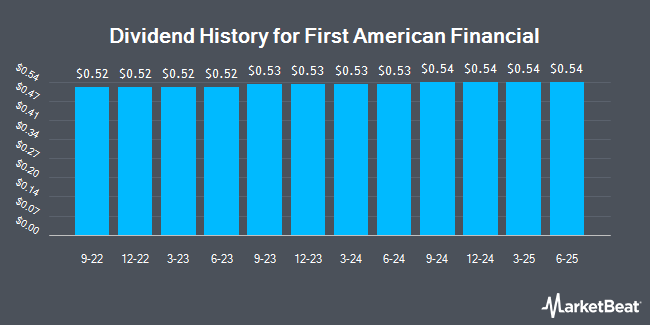

First American Financial Co. (NYSE:FAF - Get Free Report) declared a quarterly dividend on Tuesday, November 5th, RTT News reports. Stockholders of record on Monday, December 9th will be paid a dividend of 0.54 per share by the insurance provider on Monday, December 16th. This represents a $2.16 annualized dividend and a dividend yield of 3.43%.

First American Financial has increased its dividend payment by an average of 5.7% per year over the last three years and has raised its dividend annually for the last 15 consecutive years. First American Financial has a payout ratio of 38.6% meaning its dividend is sufficiently covered by earnings. Equities research analysts expect First American Financial to earn $5.14 per share next year, which means the company should continue to be able to cover its $2.16 annual dividend with an expected future payout ratio of 42.0%.

First American Financial Trading Up 0.7 %

Shares of NYSE FAF traded up $0.44 during mid-day trading on Tuesday, hitting $62.99. The company had a trading volume of 463,800 shares, compared to its average volume of 671,451. The company has a market capitalization of $6.49 billion, a price-to-earnings ratio of 70.28 and a beta of 1.29. First American Financial has a 1 year low of $51.60 and a 1 year high of $67.88. The stock's 50-day moving average price is $64.83 and its 200-day moving average price is $59.42.

First American Financial (NYSE:FAF - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The insurance provider reported $1.34 earnings per share for the quarter, beating the consensus estimate of $1.15 by $0.19. The company had revenue of $1.41 billion during the quarter, compared to analysts' expectations of $1.66 billion. First American Financial had a return on equity of 7.95% and a net margin of 1.58%. The firm's quarterly revenue was down 5.1% compared to the same quarter last year. During the same period in the previous year, the business earned $1.22 earnings per share. As a group, equities research analysts forecast that First American Financial will post 3.94 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on FAF shares. Truist Financial lifted their price objective on First American Financial from $68.00 to $73.00 and gave the company a "buy" rating in a research note on Friday, October 25th. Barclays lifted their price objective on First American Financial from $70.00 to $72.00 and gave the stock an "equal weight" rating in a report on Friday, October 25th. Keefe, Bruyette & Woods lifted their price objective on First American Financial from $66.00 to $72.00 and gave the stock an "outperform" rating in a report on Wednesday, September 4th. Finally, Stephens lifted their price objective on First American Financial from $66.00 to $73.00 and gave the stock an "overweight" rating in a report on Friday, October 25th. One analyst has rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $72.50.

Check Out Our Latest Research Report on First American Financial

About First American Financial

(

Get Free Report)

First American Financial Corporation, through its subsidiaries, provides financial services. It operates through Title Insurance and Services, and Home Warranty segments. The Title Insurance and Services segment issues title insurance policies on residential and commercial property, as well as offers related products and services internationally.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider First American Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First American Financial wasn't on the list.

While First American Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.