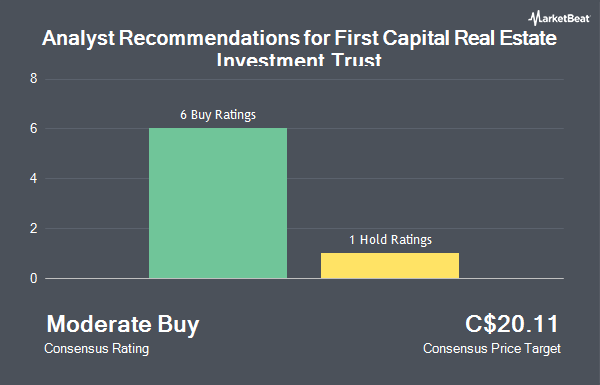

First Capital Real Estate Investment Trust (TSE:FCR.UN - Get Free Report) has earned a consensus rating of "Moderate Buy" from the nine ratings firms that are covering the firm, Marketbeat.com reports. One analyst has rated the stock with a hold recommendation and eight have given a buy recommendation to the company. The average 1-year target price among brokerages that have updated their coverage on the stock in the last year is C$20.11.

A number of equities analysts recently issued reports on FCR.UN shares. National Bankshares boosted their target price on shares of First Capital Real Estate Investment Trust from C$19.00 to C$20.75 in a research report on Wednesday, October 9th. BMO Capital Markets lifted their price objective on First Capital Real Estate Investment Trust from C$18.50 to C$20.00 in a report on Monday, October 28th. Canaccord Genuity Group upped their target price on First Capital Real Estate Investment Trust from C$17.50 to C$20.00 and gave the company a "buy" rating in a research note on Monday, September 16th. Scotiabank increased their price objective on shares of First Capital Real Estate Investment Trust from C$17.50 to C$18.75 and gave the company a "sector perform" rating in a research note on Wednesday, October 30th. Finally, TD Securities raised their target price on First Capital Real Estate Investment Trust from C$20.00 to C$21.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th.

Read Our Latest Analysis on FCR.UN

First Capital Real Estate Investment Trust Stock Down 0.3 %

Shares of TSE:FCR.UN traded down C$0.05 during trading on Thursday, reaching C$17.66. 179,392 shares of the company traded hands, compared to its average volume of 346,824. The firm has a market cap of C$3.75 billion, a P/E ratio of -60.90, a price-to-earnings-growth ratio of -2.77 and a beta of 1.28. The firm has a fifty day simple moving average of C$18.11 and a 200 day simple moving average of C$16.50. First Capital Real Estate Investment Trust has a 1-year low of C$13.61 and a 1-year high of C$18.98. The company has a quick ratio of 0.07, a current ratio of 1.22 and a debt-to-equity ratio of 112.41.

First Capital Real Estate Investment Trust Company Profile

(

Get Free ReportFirst Capital Real Estate Investment Trust (First Capital, RCF or the Fund) is an unincorporated open-end mutual fund governed by the laws of the Province of Ontario, Canada, and established pursuant to a declaration of trust dated October 16, 2019, which may be amended from time to time (the Declaration of Trust).

See Also

Before you consider First Capital Real Estate Investment Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Capital Real Estate Investment Trust wasn't on the list.

While First Capital Real Estate Investment Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.