Five Below (NASDAQ:FIVE - Free Report) had its price objective raised by Truist Financial from $87.00 to $88.00 in a report published on Thursday morning,Benzinga reports. Truist Financial currently has a hold rating on the specialty retailer's stock.

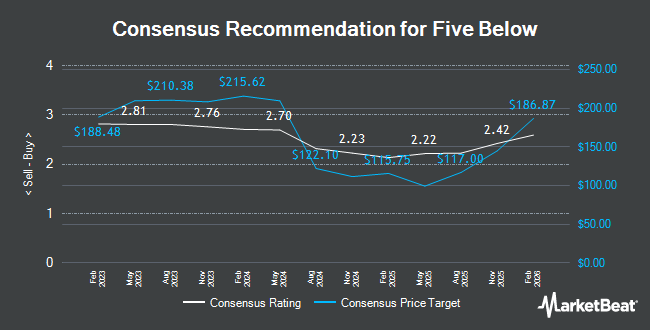

A number of other research analysts also recently commented on the stock. Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating and issued a $79.00 target price (down from $155.00) on shares of Five Below in a research report on Thursday, July 18th. JPMorgan Chase & Co. lowered Five Below from a "neutral" rating to an "underweight" rating and upped their target price for the company from $89.00 to $95.00 in a report on Thursday, September 19th. Wells Fargo & Company reduced their target price on shares of Five Below from $145.00 to $115.00 and set an "overweight" rating on the stock in a report on Wednesday, July 17th. Citigroup lowered their price objective on Five Below from $92.00 to $85.00 and set a "neutral" rating for the company in a research report on Wednesday, August 21st. Finally, Gordon Haskett lowered shares of Five Below from an "accumulate" rating to a "hold" rating in a research report on Wednesday, July 24th. Three equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating and seven have issued a buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $106.40.

Get Our Latest Report on FIVE

Five Below Stock Performance

Shares of Five Below stock traded up $7.10 on Thursday, reaching $91.52. The company had a trading volume of 3,617,221 shares, compared to its average volume of 1,453,757. Five Below has a 52-week low of $64.87 and a 52-week high of $216.18. The firm's 50 day moving average price is $90.22 and its two-hundred day moving average price is $102.27. The firm has a market cap of $5.03 billion, a PE ratio of 18.00, a PEG ratio of 1.05 and a beta of 1.20.

Five Below (NASDAQ:FIVE - Get Free Report) last released its earnings results on Wednesday, August 28th. The specialty retailer reported $0.54 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.54. Five Below had a return on equity of 18.16% and a net margin of 7.57%. The firm had revenue of $830.07 million during the quarter, compared to analyst estimates of $821.95 million. As a group, sell-side analysts predict that Five Below will post 4.55 EPS for the current year.

Hedge Funds Weigh In On Five Below

A number of large investors have recently made changes to their positions in the business. Janus Henderson Group PLC grew its holdings in shares of Five Below by 0.4% during the 1st quarter. Janus Henderson Group PLC now owns 30,164 shares of the specialty retailer's stock valued at $5,473,000 after acquiring an additional 115 shares in the last quarter. Fifth Third Bancorp grew its stake in shares of Five Below by 12.0% in the 2nd quarter. Fifth Third Bancorp now owns 1,375 shares of the specialty retailer's stock valued at $150,000 after buying an additional 147 shares in the last quarter. Parkside Financial Bank & Trust grew its stake in shares of Five Below by 9.3% in the 2nd quarter. Parkside Financial Bank & Trust now owns 2,122 shares of the specialty retailer's stock valued at $231,000 after buying an additional 180 shares in the last quarter. Texas Permanent School Fund Corp grew its stake in shares of Five Below by 0.4% in the 1st quarter. Texas Permanent School Fund Corp now owns 48,304 shares of the specialty retailer's stock valued at $8,761,000 after buying an additional 200 shares in the last quarter. Finally, Peloton Wealth Strategists grew its stake in shares of Five Below by 3.0% in the 2nd quarter. Peloton Wealth Strategists now owns 6,820 shares of the specialty retailer's stock valued at $743,000 after buying an additional 200 shares in the last quarter.

Five Below Company Profile

(

Get Free Report)

Five Below, Inc operates as a specialty value retailer in the United States. The company offers range of accessories, which includes novelty socks, sunglasses, jewelry, scarves, gloves, hair accessories, athletic tops and bottoms, and t-shirts, as well as nail polish, lip gloss, fragrance, and branded cosmetics; and personalized living space products, such as lamps, posters, frames, fleece blankets, plush items, pillows, candles, incense, lighting, novelty décor, accent furniture, and related items, as well as provides storage options.

See Also

Before you consider Five Below, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Below wasn't on the list.

While Five Below currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.