Fomento Económico Mexicano (NYSE:FMX - Get Free Report) was upgraded by investment analysts at StockNews.com from a "hold" rating to a "buy" rating in a research report issued to clients and investors on Wednesday.

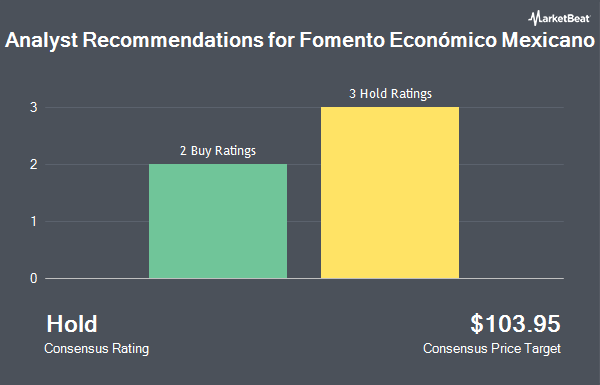

Several other brokerages have also recently issued reports on FMX. Barclays dropped their target price on Fomento Económico Mexicano from $125.00 to $118.00 and set an "overweight" rating on the stock in a research report on Wednesday, October 30th. JPMorgan Chase & Co. cut Fomento Económico Mexicano from an "overweight" rating to a "neutral" rating and lifted their price objective for the company from $104.00 to $109.00 in a research report on Monday, September 23rd. Five research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $128.00.

Get Our Latest Stock Analysis on FMX

Fomento Económico Mexicano Stock Performance

NYSE FMX traded up $0.43 during trading hours on Wednesday, hitting $96.66. The company's stock had a trading volume of 789,549 shares, compared to its average volume of 687,398. Fomento Económico Mexicano has a 12 month low of $93.32 and a 12 month high of $143.43. The company's 50 day simple moving average is $99.61 and its two-hundred day simple moving average is $108.16. The company has a market cap of $34.58 billion, a P/E ratio of 24.78, a price-to-earnings-growth ratio of 5.47 and a beta of 0.94. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.72 and a quick ratio of 1.44.

Hedge Funds Weigh In On Fomento Económico Mexicano

Hedge funds have recently bought and sold shares of the business. Baillie Gifford & Co. increased its stake in Fomento Económico Mexicano by 10.8% during the third quarter. Baillie Gifford & Co. now owns 4,306,739 shares of the company's stock worth $425,118,000 after acquiring an additional 421,057 shares during the last quarter. Healthcare of Ontario Pension Plan Trust Fund grew its stake in shares of Fomento Económico Mexicano by 740.2% in the second quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 472,200 shares of the company's stock valued at $50,832,000 after buying an additional 416,000 shares in the last quarter. Sustainable Growth Advisers LP grew its stake in shares of Fomento Económico Mexicano by 122.8% in the first quarter. Sustainable Growth Advisers LP now owns 435,906 shares of the company's stock valued at $56,785,000 after buying an additional 240,256 shares in the last quarter. Millennium Management LLC grew its stake in shares of Fomento Económico Mexicano by 577.6% in the second quarter. Millennium Management LLC now owns 222,464 shares of the company's stock valued at $23,948,000 after buying an additional 189,632 shares in the last quarter. Finally, Employees Retirement System of Texas grew its stake in shares of Fomento Económico Mexicano by 64.1% in the second quarter. Employees Retirement System of Texas now owns 471,096 shares of the company's stock valued at $50,713,000 after buying an additional 184,000 shares in the last quarter.

Fomento Económico Mexicano Company Profile

(

Get Free Report)

Fomento Económico Mexicano, SAB. de C.V., through its subsidiaries, operates as a bottler of Coca-Cola trademark beverages. The company produces, markets, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and Uruguay.

See Also

Before you consider Fomento Económico Mexicano, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fomento Económico Mexicano wasn't on the list.

While Fomento Económico Mexicano currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.