Foundry Partners LLC lessened its holdings in shares of Helix Energy Solutions Group, Inc. (NYSE:HLX - Free Report) by 13.1% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 507,730 shares of the oil and gas company's stock after selling 76,640 shares during the period. Foundry Partners LLC owned approximately 0.33% of Helix Energy Solutions Group worth $5,636,000 at the end of the most recent quarter.

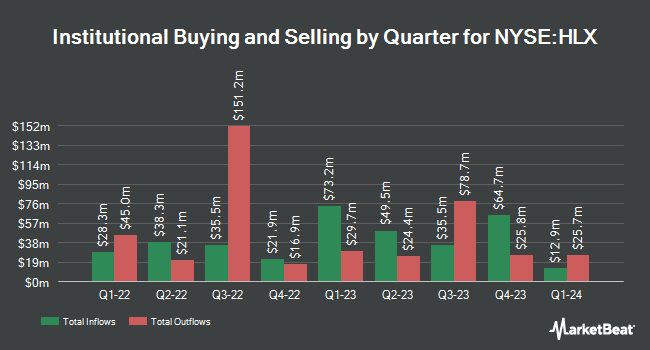

A number of other institutional investors have also recently made changes to their positions in HLX. Russell Investments Group Ltd. grew its position in Helix Energy Solutions Group by 95.2% during the 1st quarter. Russell Investments Group Ltd. now owns 308,892 shares of the oil and gas company's stock worth $3,348,000 after purchasing an additional 150,657 shares during the last quarter. ProShare Advisors LLC raised its stake in Helix Energy Solutions Group by 7.4% in the 1st quarter. ProShare Advisors LLC now owns 28,967 shares of the oil and gas company's stock worth $314,000 after acquiring an additional 1,997 shares during the last quarter. Vanguard Group Inc. lifted its position in Helix Energy Solutions Group by 1.2% during the 1st quarter. Vanguard Group Inc. now owns 13,366,874 shares of the oil and gas company's stock worth $144,897,000 after acquiring an additional 152,413 shares during the period. CANADA LIFE ASSURANCE Co grew its stake in Helix Energy Solutions Group by 35.6% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 236,168 shares of the oil and gas company's stock valued at $2,560,000 after purchasing an additional 61,963 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD raised its stake in shares of Helix Energy Solutions Group by 4.1% in the first quarter. Price T Rowe Associates Inc. MD now owns 175,075 shares of the oil and gas company's stock worth $1,899,000 after purchasing an additional 6,871 shares during the last quarter. Institutional investors and hedge funds own 91.33% of the company's stock.

Insider Buying and Selling

In other news, CEO Owen E. Kratz sold 298,419 shares of Helix Energy Solutions Group stock in a transaction that occurred on Thursday, October 3rd. The stock was sold at an average price of $11.92, for a total value of $3,557,154.48. Following the sale, the chief executive officer now directly owns 7,171,860 shares of the company's stock, valued at $85,488,571.20. The trade was a 3.99 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. 6.37% of the stock is owned by insiders.

Helix Energy Solutions Group Stock Performance

Shares of NYSE:HLX traded up $0.17 during trading on Friday, hitting $11.36. 1,607,629 shares of the stock traded hands, compared to its average volume of 1,819,483. The company has a fifty day moving average price of $10.20 and a two-hundred day moving average price of $10.83. Helix Energy Solutions Group, Inc. has a 52-week low of $8.82 and a 52-week high of $13.05. The company has a market cap of $1.73 billion, a price-to-earnings ratio of 285.32 and a beta of 2.43. The company has a quick ratio of 2.29, a current ratio of 2.29 and a debt-to-equity ratio of 0.19.

Helix Energy Solutions Group (NYSE:HLX - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The oil and gas company reported $0.19 EPS for the quarter, beating analysts' consensus estimates of $0.17 by $0.02. The firm had revenue of $342.42 million for the quarter, compared to analysts' expectations of $354.74 million. Helix Energy Solutions Group had a return on equity of 4.39% and a net margin of 0.54%. During the same period last year, the firm earned $0.19 EPS. As a group, equities analysts predict that Helix Energy Solutions Group, Inc. will post 0.29 EPS for the current year.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on HLX. StockNews.com upgraded Helix Energy Solutions Group from a "sell" rating to a "hold" rating in a research report on Saturday, November 2nd. BTIG Research lowered shares of Helix Energy Solutions Group from a "buy" rating to a "neutral" rating in a research note on Thursday, October 24th. TD Cowen decreased their target price on shares of Helix Energy Solutions Group from $16.00 to $15.00 and set a "buy" rating for the company in a research report on Friday, October 25th. Finally, Raymond James started coverage on shares of Helix Energy Solutions Group in a report on Thursday, September 19th. They issued a "strong-buy" rating and a $14.00 price target on the stock.

Check Out Our Latest Stock Report on HLX

Helix Energy Solutions Group Company Profile

(

Free Report)

Helix Energy Solutions Group, Inc, together with its subsidiaries, an offshore energy services company, provides specialty services to the offshore energy industry in Brazil, the Gulf of Mexico, the East Coast of the United States, North Sea, the Asia Pacific, and West Africa regions. The company operates through four segments: Well Intervention, Robotics, Production Facilities, and Shallow Water Abandonment segments.

Featured Articles

Before you consider Helix Energy Solutions Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helix Energy Solutions Group wasn't on the list.

While Helix Energy Solutions Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.