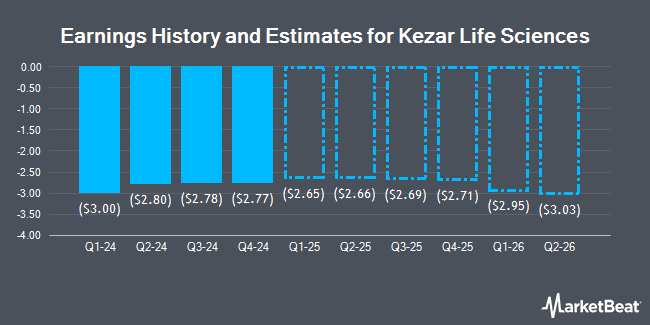

Kezar Life Sciences, Inc. (NASDAQ:KZR - Free Report) - Research analysts at William Blair lifted their FY2024 earnings per share estimates for Kezar Life Sciences in a research note issued on Wednesday, November 13th. William Blair analyst M. Phipps now anticipates that the company will post earnings per share of ($2.06) for the year, up from their previous estimate of ($12.50). William Blair has a "Market Perform" rating on the stock. The consensus estimate for Kezar Life Sciences' current full-year earnings is ($6.47) per share. William Blair also issued estimates for Kezar Life Sciences' Q4 2024 earnings at ($2.81) EPS, Q1 2025 earnings at ($2.73) EPS, Q2 2025 earnings at ($2.75) EPS, Q3 2025 earnings at ($2.78) EPS, Q4 2025 earnings at ($2.80) EPS, FY2025 earnings at ($11.06) EPS, FY2026 earnings at ($11.86) EPS and FY2027 earnings at ($12.84) EPS.

Kezar Life Sciences (NASDAQ:KZR - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($2.78) earnings per share (EPS) for the quarter, beating the consensus estimate of ($3.03) by $0.25.

A number of other brokerages have also issued reports on KZR. HC Wainwright reissued a "neutral" rating on shares of Kezar Life Sciences in a report on Monday, October 14th. Wells Fargo & Company dropped their target price on Kezar Life Sciences from $20.00 to $11.00 and set an "equal weight" rating for the company in a research report on Thursday.

View Our Latest Analysis on Kezar Life Sciences

Kezar Life Sciences Price Performance

KZR stock traded down $0.07 during trading on Monday, hitting $7.39. The stock had a trading volume of 59,129 shares, compared to its average volume of 73,697. The company's 50-day moving average price is $7.20 and its two-hundred day moving average price is $6.82. Kezar Life Sciences has a twelve month low of $5.20 and a twelve month high of $11.35. The stock has a market capitalization of $53.92 million, a P/E ratio of -0.56 and a beta of 0.22. The company has a debt-to-equity ratio of 0.05, a current ratio of 7.65 and a quick ratio of 9.58.

Institutional Trading of Kezar Life Sciences

Hedge funds have recently added to or reduced their stakes in the company. Affinity Asset Advisors LLC purchased a new stake in shares of Kezar Life Sciences in the 1st quarter valued at approximately $1,588,000. Stonepine Capital Management LLC acquired a new stake in Kezar Life Sciences in the second quarter valued at $630,000. Acadian Asset Management LLC lifted its holdings in Kezar Life Sciences by 42.5% during the 1st quarter. Acadian Asset Management LLC now owns 1,790,838 shares of the company's stock worth $1,613,000 after buying an additional 534,203 shares during the last quarter. Acuitas Investments LLC boosted its position in shares of Kezar Life Sciences by 42.8% during the 2nd quarter. Acuitas Investments LLC now owns 986,785 shares of the company's stock worth $592,000 after acquiring an additional 295,956 shares in the last quarter. Finally, Ikarian Capital LLC boosted its position in shares of Kezar Life Sciences by 23.0% during the 3rd quarter. Ikarian Capital LLC now owns 1,068,992 shares of the company's stock worth $827,000 after acquiring an additional 200,000 shares in the last quarter. Institutional investors and hedge funds own 67.90% of the company's stock.

About Kezar Life Sciences

(

Get Free Report)

Kezar Life Sciences, Inc, a clinical-stage biotechnology company, engages in the discovery and development of novel small molecule therapeutics to treat unmet needs in immune-mediated diseases and cancer in the United States. The company's lead product candidate is zetomipzomib (KZR-616), a selective immunoproteasome inhibitor that is in Phase 2b clinical trials for various indications, including lupus nephritis, dermatomyositis, and polymyositis; Phase 1b clinical trials in systemic lupus erythematosus; and completed Phase 2a clinical trials in lupus nephritis.

Further Reading

Before you consider Kezar Life Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kezar Life Sciences wasn't on the list.

While Kezar Life Sciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.