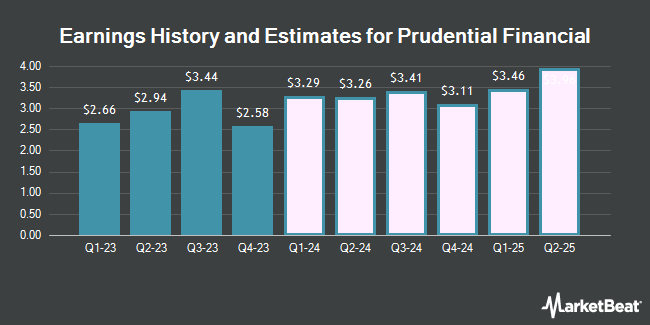

Prudential Financial, Inc. (NYSE:PRU - Free Report) - Research analysts at Zacks Research raised their FY2024 earnings per share (EPS) estimates for shares of Prudential Financial in a report released on Wednesday, November 20th. Zacks Research analyst T. De now forecasts that the financial services provider will post earnings per share of $13.33 for the year, up from their prior estimate of $13.31. The consensus estimate for Prudential Financial's current full-year earnings is $13.33 per share. Zacks Research also issued estimates for Prudential Financial's Q4 2024 earnings at $3.34 EPS, Q4 2025 earnings at $3.65 EPS, FY2025 earnings at $14.64 EPS, Q2 2026 earnings at $3.92 EPS and Q3 2026 earnings at $3.89 EPS.

PRU has been the topic of several other reports. TD Cowen began coverage on Prudential Financial in a research note on Wednesday, October 9th. They set a "hold" rating and a $130.00 target price on the stock. Bank of America boosted their price target on Prudential Financial from $109.00 to $118.00 and gave the company a "neutral" rating in a research note on Thursday, October 10th. Argus upgraded Prudential Financial to a "strong-buy" rating in a research note on Thursday, August 8th. UBS Group increased their price target on Prudential Financial from $112.00 to $119.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 13th. Finally, Keefe, Bruyette & Woods reiterated a "market perform" rating and set a $121.00 price target on shares of Prudential Financial in a research report on Wednesday, August 21st. Eleven equities research analysts have rated the stock with a hold rating, one has given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company has an average rating of "Hold" and an average price target of $125.69.

Get Our Latest Research Report on Prudential Financial

Prudential Financial Stock Up 1.4 %

PRU stock traded up $1.76 on Friday, hitting $128.02. 413,104 shares of the company's stock were exchanged, compared to its average volume of 1,497,109. Prudential Financial has a 12-month low of $94.92 and a 12-month high of $129.13. The firm has a 50 day moving average price of $123.06 and a two-hundred day moving average price of $119.61. The company has a debt-to-equity ratio of 0.60, a quick ratio of 0.14 and a current ratio of 0.14. The stock has a market cap of $45.58 billion, a P/E ratio of 11.22, a price-to-earnings-growth ratio of 0.89 and a beta of 1.29.

Prudential Financial (NYSE:PRU - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The financial services provider reported $3.48 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.47 by $0.01. Prudential Financial had a return on equity of 15.30% and a net margin of 6.03%. The business had revenue of $19.48 billion for the quarter, compared to the consensus estimate of $14.57 billion. During the same period last year, the business posted $3.44 EPS.

Prudential Financial Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, December 12th. Shareholders of record on Tuesday, November 19th will be issued a dividend of $1.30 per share. This represents a $5.20 dividend on an annualized basis and a yield of 4.06%. The ex-dividend date is Tuesday, November 19th. Prudential Financial's dividend payout ratio (DPR) is 46.22%.

Insider Transactions at Prudential Financial

In other news, major shareholder Insurance Co Of Ame Prudential bought 261,059 shares of the business's stock in a transaction dated Tuesday, October 8th. The shares were acquired at an average price of $27.58 per share, for a total transaction of $7,200,007.22. Following the completion of the transaction, the insider now owns 4,208,549 shares of the company's stock, valued at approximately $116,071,781.42. This trade represents a 6.61 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Caroline Feeney sold 1,110 shares of the business's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $119.97, for a total value of $133,166.70. Following the completion of the transaction, the executive vice president now owns 10,175 shares in the company, valued at $1,220,694.75. This trade represents a 9.84 % decrease in their position. The disclosure for this sale can be found here. Insiders own 0.31% of the company's stock.

Institutional Investors Weigh In On Prudential Financial

Several institutional investors have recently modified their holdings of PRU. Creekmur Asset Management LLC increased its holdings in shares of Prudential Financial by 78.8% during the 1st quarter. Creekmur Asset Management LLC now owns 245 shares of the financial services provider's stock worth $29,000 after buying an additional 108 shares during the last quarter. Lynx Investment Advisory acquired a new stake in Prudential Financial in the 2nd quarter valued at $29,000. Ashton Thomas Securities LLC acquired a new stake in Prudential Financial in the 3rd quarter valued at $31,000. Strategic Financial Concepts LLC increased its holdings in Prudential Financial by 1,312.4% in the 2nd quarter. Strategic Financial Concepts LLC now owns 26,934 shares of the financial services provider's stock valued at $32,000 after purchasing an additional 25,027 shares in the last quarter. Finally, Crewe Advisors LLC acquired a new stake in Prudential Financial in the 1st quarter valued at $33,000. Hedge funds and other institutional investors own 56.83% of the company's stock.

Prudential Financial Company Profile

(

Get Free Report)

Prudential Financial, Inc, together with its subsidiaries, provides insurance, investment management, and other financial products and services in the United States and internationally. It operates through PGIM, Retirement Strategies, Group Insurance, Individual Life, and International Businesses segments.

Read More

Before you consider Prudential Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prudential Financial wasn't on the list.

While Prudential Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.