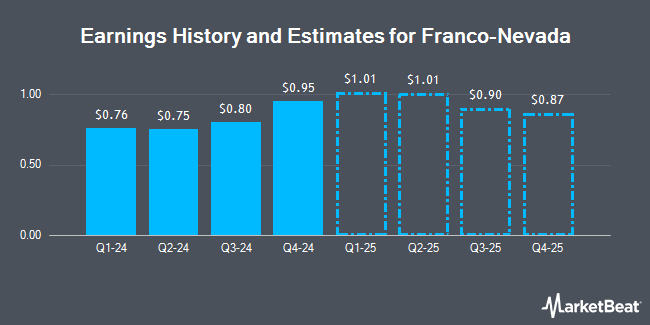

Franco-Nevada Co. (NYSE:FNV - Free Report) TSE: FNV - Stock analysts at HC Wainwright lifted their FY2024 earnings per share (EPS) estimates for shares of Franco-Nevada in a research note issued to investors on Thursday, November 7th. HC Wainwright analyst H. Ihle now anticipates that the basic materials company will earn $2.78 per share for the year, up from their prior estimate of $2.59. HC Wainwright currently has a "Buy" rating and a $200.00 target price on the stock. The consensus estimate for Franco-Nevada's current full-year earnings is $3.25 per share. HC Wainwright also issued estimates for Franco-Nevada's FY2025 earnings at $3.58 EPS.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last released its quarterly earnings results on Wednesday, November 6th. The basic materials company reported $0.80 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.83 by ($0.03). The firm had revenue of $275.70 million for the quarter, compared to analysts' expectations of $279.11 million. Franco-Nevada had a positive return on equity of 10.63% and a negative net margin of 55.28%. The company's quarterly revenue was down 10.9% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.91 EPS.

Other research analysts also recently issued research reports about the company. StockNews.com upgraded Franco-Nevada from a "sell" rating to a "hold" rating in a research note on Thursday, August 22nd. TD Securities upgraded Franco-Nevada from a "hold" rating to a "buy" rating in a research note on Thursday, August 15th. Scotiabank dropped their price target on Franco-Nevada from $142.00 to $141.00 and set a "sector perform" rating on the stock in a research note on Friday. Jefferies Financial Group lowered their target price on Franco-Nevada from $137.00 to $136.00 and set a "hold" rating on the stock in a research note on Thursday, October 17th. Finally, Bank of America downgraded Franco-Nevada from a "buy" rating to a "neutral" rating and lowered their target price for the company from $142.00 to $139.00 in a research note on Tuesday, October 1st. Four analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $156.57.

Read Our Latest Stock Analysis on FNV

Franco-Nevada Stock Down 3.8 %

NYSE:FNV traded down $4.61 during mid-day trading on Monday, reaching $117.83. 1,274,610 shares of the stock were exchanged, compared to its average volume of 658,750. The company has a 50 day simple moving average of $126.57 and a 200-day simple moving average of $124.18. The stock has a market capitalization of $22.68 billion, a P/E ratio of -37.29, a P/E/G ratio of 20.59 and a beta of 0.75. Franco-Nevada has a 1 year low of $102.29 and a 1 year high of $137.60.

Institutional Trading of Franco-Nevada

Several hedge funds have recently modified their holdings of FNV. Allspring Global Investments Holdings LLC acquired a new stake in shares of Franco-Nevada in the 2nd quarter valued at approximately $276,446,000. M&G Plc acquired a new stake in shares of Franco-Nevada in the 1st quarter valued at approximately $219,971,000. EdgePoint Investment Group Inc. lifted its holdings in shares of Franco-Nevada by 68.1% in the 1st quarter. EdgePoint Investment Group Inc. now owns 2,759,677 shares of the basic materials company's stock valued at $328,972,000 after buying an additional 1,117,523 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp lifted its holdings in shares of Franco-Nevada by 3,404.9% in the 2nd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 727,681 shares of the basic materials company's stock valued at $86,287,000 after buying an additional 706,919 shares during the period. Finally, Victory Capital Management Inc. lifted its holdings in shares of Franco-Nevada by 13.9% in the 3rd quarter. Victory Capital Management Inc. now owns 3,489,240 shares of the basic materials company's stock valued at $433,538,000 after buying an additional 424,810 shares during the period. 77.06% of the stock is owned by institutional investors and hedge funds.

Franco-Nevada Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, December 5th will be issued a $0.36 dividend. The ex-dividend date of this dividend is Thursday, December 5th. This represents a $1.44 annualized dividend and a dividend yield of 1.22%. Franco-Nevada's dividend payout ratio is currently -45.57%.

Franco-Nevada Company Profile

(

Get Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Further Reading

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.