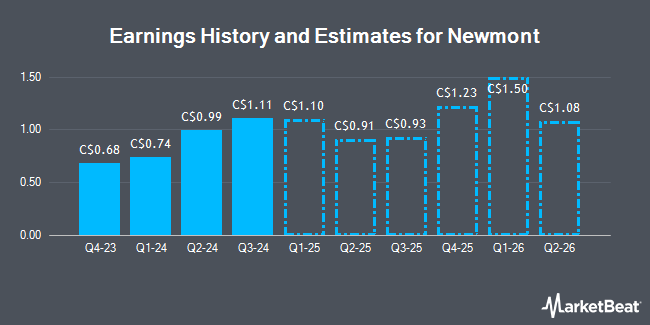

Newmont Co. (TSE:NGT - Free Report) - Research analysts at Raymond James cut their FY2025 earnings per share estimates for Newmont in a research report issued to clients and investors on Monday, December 9th. Raymond James analyst B. Macarthur now anticipates that the company will post earnings per share of $4.37 for the year, down from their previous forecast of $4.38. The consensus estimate for Newmont's current full-year earnings is $5.51 per share.

Other equities research analysts have also issued research reports about the stock. Argus upgraded shares of Newmont from a "hold" rating to a "strong-buy" rating in a report on Thursday, August 29th. Scotiabank downgraded shares of Newmont from a "strong-buy" rating to a "hold" rating in a research note on Friday, October 25th. UBS Group lowered Newmont from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, October 30th. Cibc World Mkts lowered shares of Newmont from a "strong-buy" rating to a "hold" rating in a research note on Monday, October 28th. Finally, CLSA raised shares of Newmont to a "hold" rating in a research note on Friday, November 29th. Five investment analysts have rated the stock with a hold rating and two have assigned a strong buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of C$68.00.

Check Out Our Latest Research Report on NGT

Newmont Trading Up 2.1 %

Shares of TSE:NGT traded up C$1.22 during trading on Wednesday, hitting C$60.00. The company had a trading volume of 308,555 shares, compared to its average volume of 210,682. The stock has a market cap of C$69 billion, a price-to-earnings ratio of -15.51, a price-to-earnings-growth ratio of 1.43 and a beta of 0.51. The company has a debt-to-equity ratio of 31.20, a current ratio of 2.11 and a quick ratio of 1.77. The company has a fifty day simple moving average of C$65.82 and a two-hundred day simple moving average of C$65.09. Newmont has a one year low of C$39.96 and a one year high of C$81.16.

Newmont (TSE:NGT - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The company reported C$1.11 earnings per share for the quarter, beating analysts' consensus estimates of C$1.07 by C$0.04. The firm had revenue of C$6.28 billion during the quarter, compared to analyst estimates of C$5.79 billion. Newmont had a negative return on equity of 8.09% and a negative net margin of 13.29%.

Newmont Cuts Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 23rd. Investors of record on Wednesday, November 27th will be issued a $0.338 dividend. The ex-dividend date is Wednesday, November 27th. This represents a $1.35 annualized dividend and a dividend yield of 2.25%. Newmont's payout ratio is currently -35.62%.

About Newmont

(

Get Free Report)

Newmont Corporation engages in the production and exploration of gold. It also explores for copper, silver, zinc, and lead. The company has operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, Papua New Guinea, Ecuador, Fiji, and Ghana.

Featured Articles

Before you consider Newmont, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newmont wasn't on the list.

While Newmont currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.