Gartner (NYSE:IT - Free Report) had its price target upped by Robert W. Baird from $565.00 to $590.00 in a research note issued to investors on Wednesday, Benzinga reports. Robert W. Baird currently has an outperform rating on the information technology services provider's stock.

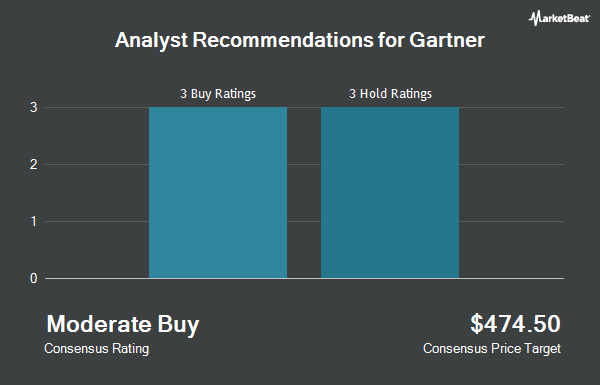

A number of other equities analysts have also recently issued reports on the company. Wells Fargo & Company increased their target price on Gartner from $435.00 to $460.00 and gave the stock an "underweight" rating in a report on Monday, October 14th. UBS Group raised their price target on shares of Gartner from $510.00 to $580.00 and gave the company a "buy" rating in a research report on Wednesday, July 31st. Bank of America increased their price objective on Gartner from $525.00 to $580.00 and gave the stock a "buy" rating in a research note on Wednesday, July 31st. Morgan Stanley upped their price target on Gartner from $490.00 to $528.00 and gave the stock an "equal weight" rating in a report on Thursday, October 10th. Finally, StockNews.com cut Gartner from a "buy" rating to a "hold" rating in a research note on Wednesday, July 17th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $539.25.

Check Out Our Latest Research Report on IT

Gartner Price Performance

Shares of Gartner stock traded up $18.38 during midday trading on Wednesday, hitting $531.86. 253,565 shares of the company traded hands, compared to its average volume of 367,554. The stock has a market cap of $40.99 billion, a price-to-earnings ratio of 50.55, a PEG ratio of 3.13 and a beta of 1.32. The company has a debt-to-equity ratio of 3.80, a quick ratio of 0.90 and a current ratio of 0.90. The firm's fifty day moving average price is $509.34 and its 200-day moving average price is $472.61. Gartner has a 12 month low of $392.49 and a 12 month high of $542.13.

Gartner (NYSE:IT - Get Free Report) last issued its earnings results on Tuesday, November 5th. The information technology services provider reported $2.50 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.45 by $0.05. Gartner had a net margin of 13.67% and a return on equity of 142.05%. The business had revenue of $1.48 billion for the quarter, compared to analyst estimates of $1.48 billion. During the same period in the prior year, the firm earned $2.56 earnings per share. Gartner's revenue was up 5.4% on a year-over-year basis. As a group, sell-side analysts forecast that Gartner will post 11.65 earnings per share for the current year.

Insider Activity at Gartner

In other Gartner news, CEO Eugene A. Hall sold 34,060 shares of the stock in a transaction on Thursday, September 12th. The shares were sold at an average price of $505.40, for a total transaction of $17,213,924.00. Following the completion of the sale, the chief executive officer now owns 1,143,401 shares of the company's stock, valued at $577,874,865.40. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In other Gartner news, CFO Craig Safian sold 6,310 shares of Gartner stock in a transaction that occurred on Thursday, August 15th. The stock was sold at an average price of $483.57, for a total transaction of $3,051,326.70. Following the sale, the chief financial officer now directly owns 71,544 shares of the company's stock, valued at approximately $34,596,532.08. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO Eugene A. Hall sold 34,060 shares of the firm's stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $505.40, for a total value of $17,213,924.00. Following the completion of the transaction, the chief executive officer now owns 1,143,401 shares of the company's stock, valued at approximately $577,874,865.40. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 49,899 shares of company stock valued at $24,959,886. Company insiders own 3.60% of the company's stock.

Hedge Funds Weigh In On Gartner

Several institutional investors and hedge funds have recently added to or reduced their stakes in IT. Janney Montgomery Scott LLC boosted its position in shares of Gartner by 0.5% in the 1st quarter. Janney Montgomery Scott LLC now owns 11,273 shares of the information technology services provider's stock worth $5,374,000 after purchasing an additional 59 shares in the last quarter. Nordea Investment Management AB increased its holdings in shares of Gartner by 4.3% during the first quarter. Nordea Investment Management AB now owns 6,370 shares of the information technology services provider's stock valued at $3,075,000 after acquiring an additional 260 shares in the last quarter. Whittier Trust Co. lifted its stake in shares of Gartner by 43.5% in the first quarter. Whittier Trust Co. now owns 432 shares of the information technology services provider's stock worth $206,000 after buying an additional 131 shares in the last quarter. Central Pacific Bank Trust Division purchased a new stake in shares of Gartner during the 1st quarter valued at about $36,000. Finally, GSA Capital Partners LLP purchased a new stake in Gartner in the 1st quarter worth approximately $1,121,000. Hedge funds and other institutional investors own 91.51% of the company's stock.

About Gartner

(

Get Free Report)

Gartner, Inc operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally. It operates through three segments: Research, Conferences, and Consulting. The Research segment delivers its research primarily through a subscription service that include on-demand access to published research content, data and benchmarks, and direct access to a network of research experts.

Featured Articles

Before you consider Gartner, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gartner wasn't on the list.

While Gartner currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.