GDS Wealth Management bought a new position in HealthEquity, Inc. (NASDAQ:HQY - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 28,638 shares of the company's stock, valued at approximately $2,344,000.

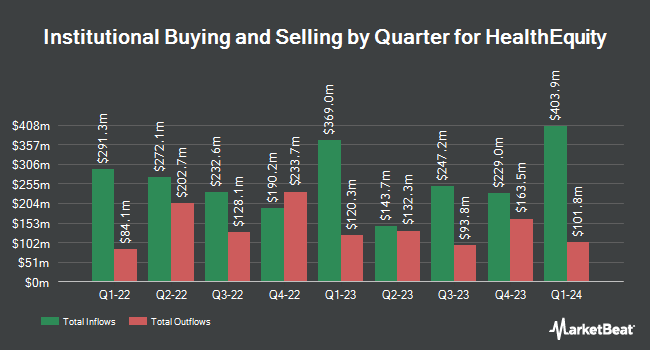

Several other hedge funds have also recently modified their holdings of HQY. Motley Fool Asset Management LLC raised its holdings in shares of HealthEquity by 3,001.0% during the 1st quarter. Motley Fool Asset Management LLC now owns 3,762,064 shares of the company's stock worth $307,097,000 after acquiring an additional 3,640,748 shares in the last quarter. Mackenzie Financial Corp lifted its position in HealthEquity by 16.0% during the second quarter. Mackenzie Financial Corp now owns 2,364,521 shares of the company's stock valued at $203,822,000 after purchasing an additional 325,906 shares during the last quarter. Generate Investment Management Ltd bought a new position in HealthEquity during the second quarter valued at $24,184,000. Thrivent Financial for Lutherans grew its stake in shares of HealthEquity by 924.2% in the 2nd quarter. Thrivent Financial for Lutherans now owns 220,220 shares of the company's stock worth $18,983,000 after buying an additional 198,718 shares in the last quarter. Finally, Vanguard Group Inc. increased its holdings in shares of HealthEquity by 1.7% in the 1st quarter. Vanguard Group Inc. now owns 8,768,632 shares of the company's stock worth $715,783,000 after buying an additional 149,133 shares during the last quarter. Hedge funds and other institutional investors own 99.55% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently commented on the stock. Barrington Research reaffirmed an "outperform" rating and issued a $105.00 price target on shares of HealthEquity in a report on Friday, September 20th. Bank of America cut their target price on HealthEquity from $105.00 to $100.00 and set a "buy" rating on the stock in a research report on Wednesday, September 4th. Royal Bank of Canada reaffirmed an "outperform" rating and set a $92.00 price objective on shares of HealthEquity in a research note on Wednesday, September 4th. JMP Securities reissued a "market outperform" rating and issued a $105.00 target price on shares of HealthEquity in a research note on Wednesday, September 4th. Finally, Deutsche Bank Aktiengesellschaft lifted their price target on shares of HealthEquity from $102.00 to $103.00 and gave the stock a "buy" rating in a research note on Wednesday, September 4th. Twelve investment analysts have rated the stock with a buy rating, According to data from MarketBeat, the company has a consensus rating of "Buy" and an average price target of $103.83.

Check Out Our Latest Stock Report on HQY

Insider Transactions at HealthEquity

In related news, Director Frank Corvino sold 1,039 shares of the stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $96.10, for a total transaction of $99,847.90. Following the completion of the sale, the director now owns 3,784 shares of the company's stock, valued at $363,642.40. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In related news, Director Frank Corvino sold 1,039 shares of the stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $96.10, for a total value of $99,847.90. Following the completion of the transaction, the director now directly owns 3,784 shares of the company's stock, valued at $363,642.40. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Robert W. Selander sold 8,250 shares of the business's stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $82.98, for a total transaction of $684,585.00. Following the sale, the director now directly owns 54,719 shares in the company, valued at approximately $4,540,582.62. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 10,536 shares of company stock valued at $884,517. Corporate insiders own 2.20% of the company's stock.

HealthEquity Stock Up 1.4 %

Shares of HealthEquity stock traded up $1.40 during trading on Monday, hitting $100.22. 275,306 shares of the stock traded hands, compared to its average volume of 614,448. The company has a current ratio of 4.10, a quick ratio of 4.10 and a debt-to-equity ratio of 0.51. The stock's fifty day simple moving average is $83.15 and its 200 day simple moving average is $80.45. The firm has a market cap of $8.75 billion, a P/E ratio of 82.35, a price-to-earnings-growth ratio of 1.55 and a beta of 0.52. HealthEquity, Inc. has a 52-week low of $62.10 and a 52-week high of $100.97.

HealthEquity (NASDAQ:HQY - Get Free Report) last posted its quarterly earnings results on Tuesday, September 3rd. The company reported $0.66 EPS for the quarter, beating the consensus estimate of $0.50 by $0.16. The business had revenue of $299.93 million during the quarter, compared to analyst estimates of $284.48 million. HealthEquity had a net margin of 9.61% and a return on equity of 9.01%. On average, equities analysts predict that HealthEquity, Inc. will post 2.27 earnings per share for the current fiscal year.

HealthEquity Company Profile

(

Free Report)

HealthEquity, Inc provides technology-enabled services platforms to consumers and employers in the United States. The company offers cloud-based platforms for individuals to make health saving and spending decisions, pay healthcare bills, receive personalized benefit information, earn wellness incentives, grow their savings, and make investment choices; and health savings accounts.

Recommended Stories

Before you consider HealthEquity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HealthEquity wasn't on the list.

While HealthEquity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.