Golar LNG (NASDAQ:GLNG - Get Free Report) was downgraded by analysts at Fearnley Fonds from a "strong-buy" rating to a "hold" rating in a report released on Wednesday,Zacks.com reports.

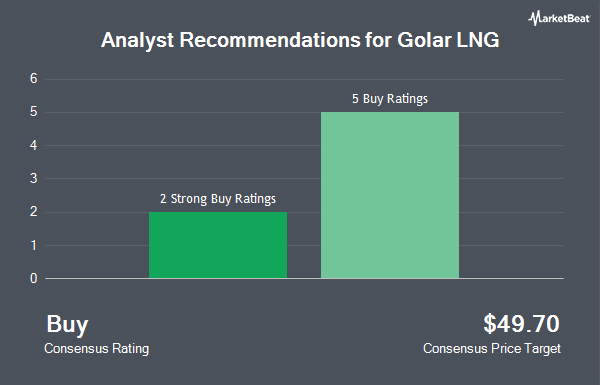

GLNG has been the subject of several other reports. Stifel Nicolaus cut their price objective on shares of Golar LNG from $55.00 to $53.00 and set a "buy" rating for the company in a research report on Friday, August 16th. B. Riley raised their target price on Golar LNG from $35.50 to $44.50 and gave the stock a "buy" rating in a research note on Friday, July 19th. Deutsche Bank Aktiengesellschaft boosted their price target on shares of Golar LNG from $43.00 to $56.00 and gave the company a "buy" rating in a research note on Friday, August 16th. Finally, StockNews.com raised Golar LNG to a "sell" rating in a research note on Wednesday. One equities research analyst has rated the stock with a sell rating, one has given a hold rating and four have given a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $49.63.

Read Our Latest Stock Analysis on Golar LNG

Golar LNG Price Performance

GLNG stock traded down $0.99 during mid-day trading on Wednesday, reaching $34.00. The company's stock had a trading volume of 1,094,824 shares, compared to its average volume of 1,192,914. The company has a current ratio of 1.24, a quick ratio of 1.28 and a debt-to-equity ratio of 0.31. The company's 50 day moving average is $36.19 and its two-hundred day moving average is $32.38. The stock has a market cap of $3.55 billion, a PE ratio of 25.37 and a beta of 0.58. Golar LNG has a fifty-two week low of $19.94 and a fifty-two week high of $39.40.

Golar LNG (NASDAQ:GLNG - Get Free Report) last released its quarterly earnings data on Thursday, August 15th. The shipping company reported $0.42 earnings per share for the quarter, missing analysts' consensus estimates of $0.44 by ($0.02). Golar LNG had a return on equity of 9.20% and a net margin of 50.89%. The company had revenue of $62.98 million for the quarter, compared to analyst estimates of $67.38 million. Equities research analysts expect that Golar LNG will post 1.53 EPS for the current year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in the business. State Street Corp lifted its stake in Golar LNG by 5.2% during the third quarter. State Street Corp now owns 1,920,590 shares of the shipping company's stock worth $70,601,000 after purchasing an additional 94,336 shares during the last quarter. Stifel Financial Corp raised its holdings in Golar LNG by 21.8% during the third quarter. Stifel Financial Corp now owns 639,813 shares of the shipping company's stock worth $23,520,000 after purchasing an additional 114,531 shares in the last quarter. Philadelphia Financial Management of San Francisco LLC lifted its position in shares of Golar LNG by 32.8% during the 3rd quarter. Philadelphia Financial Management of San Francisco LLC now owns 761,194 shares of the shipping company's stock worth $27,981,000 after buying an additional 187,924 shares during the last quarter. Clearline Capital LP purchased a new stake in shares of Golar LNG during the 3rd quarter worth approximately $36,865,000. Finally, Appian Way Asset Management LP acquired a new position in shares of Golar LNG in the 3rd quarter valued at $15,351,000. 92.21% of the stock is owned by institutional investors and hedge funds.

About Golar LNG

(

Get Free Report)

Golar LNG Limited designs, converts, owns, and operates marine infrastructure for the liquefaction of natural gas. The company operates through three segments: FLNG, Corporate and Other, and Shipping. It engages in the regasification, storage, and offloading of liquefied natural gas (LNG); operation of floating liquefaction natural gas (FLNG) vessels or projects; transportation of LNG carriers; and vessel management activities.

Further Reading

Before you consider Golar LNG, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golar LNG wasn't on the list.

While Golar LNG currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.