Empowered Funds LLC lifted its stake in Golden Ocean Group Limited (NASDAQ:GOGL - Free Report) by 5.4% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 929,764 shares of the shipping company's stock after purchasing an additional 47,302 shares during the period. Empowered Funds LLC owned 0.46% of Golden Ocean Group worth $12,440,000 at the end of the most recent reporting period.

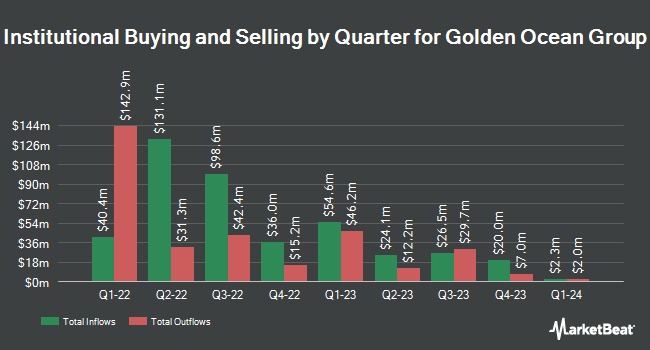

A number of other institutional investors also recently bought and sold shares of the stock. SG Americas Securities LLC boosted its position in shares of Golden Ocean Group by 165.8% in the first quarter. SG Americas Securities LLC now owns 66,090 shares of the shipping company's stock worth $857,000 after purchasing an additional 41,225 shares during the period. Swiss National Bank increased its stake in Golden Ocean Group by 1.6% in the 1st quarter. Swiss National Bank now owns 261,158 shares of the shipping company's stock worth $3,298,000 after buying an additional 4,124 shares in the last quarter. Sei Investments Co. bought a new stake in Golden Ocean Group during the first quarter valued at about $677,000. Russell Investments Group Ltd. lifted its position in shares of Golden Ocean Group by 463.6% in the first quarter. Russell Investments Group Ltd. now owns 610,850 shares of the shipping company's stock valued at $7,916,000 after acquiring an additional 502,476 shares in the last quarter. Finally, ProShare Advisors LLC boosted its stake in shares of Golden Ocean Group by 8.5% in the first quarter. ProShare Advisors LLC now owns 22,128 shares of the shipping company's stock worth $287,000 after acquiring an additional 1,742 shares during the period. 22.00% of the stock is owned by institutional investors.

Analysts Set New Price Targets

GOGL has been the subject of several recent analyst reports. StockNews.com downgraded Golden Ocean Group from a "buy" rating to a "hold" rating in a research note on Saturday, October 5th. Jefferies Financial Group dropped their target price on shares of Golden Ocean Group from $15.50 to $14.50 and set a "hold" rating for the company in a research report on Wednesday, August 28th.

Check Out Our Latest Stock Report on Golden Ocean Group

Golden Ocean Group Price Performance

NASDAQ GOGL traded up $0.08 during trading on Friday, hitting $12.05. 1,231,535 shares of the stock traded hands, compared to its average volume of 1,574,763. The company has a quick ratio of 1.00, a current ratio of 1.17 and a debt-to-equity ratio of 0.66. Golden Ocean Group Limited has a 12-month low of $7.51 and a 12-month high of $15.77. The firm has a 50-day simple moving average of $11.81 and a 200-day simple moving average of $12.79. The company has a market capitalization of $2.41 billion, a P/E ratio of 11.34 and a beta of 1.20.

Golden Ocean Group (NASDAQ:GOGL - Get Free Report) last released its quarterly earnings results on Wednesday, August 28th. The shipping company reported $0.32 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.28 by $0.04. Golden Ocean Group had a net margin of 22.01% and a return on equity of 10.57%. The company had revenue of $197.35 million for the quarter, compared to the consensus estimate of $187.74 million. As a group, analysts predict that Golden Ocean Group Limited will post 1.18 EPS for the current year.

Golden Ocean Group Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, September 20th. Investors of record on Wednesday, September 11th were given a $0.30 dividend. The ex-dividend date was Wednesday, September 11th. This represents a $1.20 annualized dividend and a yield of 9.96%. Golden Ocean Group's dividend payout ratio is currently 112.15%.

Golden Ocean Group Company Profile

(

Free Report)

Golden Ocean Group Limited, a shipping company, owns and operates a fleet of dry bulk vessels worldwide. The company's dry bulk vessels comprise Newcastlemax, Capesize, and Panamax vessels operating in the spot and time charter markets. It also transports a range of bulk commodities, including ores, coal, grains, and fertilizers.

Further Reading

Before you consider Golden Ocean Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golden Ocean Group wasn't on the list.

While Golden Ocean Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.