GSA Capital Partners LLP purchased a new position in Symbotic Inc. (NASDAQ:SYM - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 24,681 shares of the company's stock, valued at approximately $602,000.

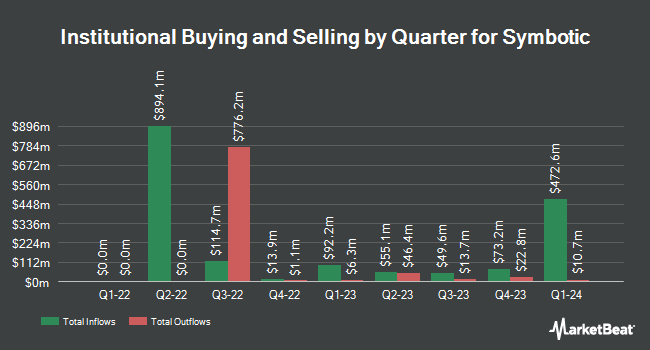

Several other large investors have also recently modified their holdings of the company. Baillie Gifford & Co. lifted its stake in shares of Symbotic by 12.4% during the second quarter. Baillie Gifford & Co. now owns 10,660,949 shares of the company's stock worth $374,839,000 after buying an additional 1,177,578 shares during the period. Canada Pension Plan Investment Board grew its stake in Symbotic by 191.5% during the 2nd quarter. Canada Pension Plan Investment Board now owns 775,900 shares of the company's stock valued at $27,281,000 after purchasing an additional 509,700 shares during the last quarter. Exchange Traded Concepts LLC increased its holdings in shares of Symbotic by 76.8% in the third quarter. Exchange Traded Concepts LLC now owns 873,987 shares of the company's stock valued at $21,317,000 after purchasing an additional 379,726 shares during the period. Vanguard Group Inc. raised its stake in shares of Symbotic by 16.6% in the first quarter. Vanguard Group Inc. now owns 2,426,420 shares of the company's stock worth $109,189,000 after purchasing an additional 345,386 shares during the last quarter. Finally, Millennium Management LLC lifted its holdings in shares of Symbotic by 6,694.5% during the second quarter. Millennium Management LLC now owns 335,649 shares of the company's stock worth $11,801,000 after purchasing an additional 330,709 shares during the period.

Insider Transactions at Symbotic

In other news, Director Todd Krasnow sold 2,000 shares of Symbotic stock in a transaction that occurred on Monday, November 4th. The shares were sold at an average price of $28.15, for a total transaction of $56,300.00. Following the sale, the director now owns 214,036 shares of the company's stock, valued at approximately $6,025,113.40. The trade was a 0.93 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, insider William M. Boyd III sold 8,826 shares of the firm's stock in a transaction dated Monday, October 28th. The stock was sold at an average price of $28.33, for a total value of $250,040.58. Following the sale, the insider now directly owns 23,012 shares of the company's stock, valued at $651,929.96. The trade was a 27.72 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 49,878 shares of company stock valued at $1,378,056 over the last 90 days. 38.30% of the stock is currently owned by corporate insiders.

Symbotic Stock Performance

Shares of SYM traded up $8.46 during mid-day trading on Tuesday, hitting $39.02. 10,101,506 shares of the company were exchanged, compared to its average volume of 1,609,922. The stock has a market cap of $22.85 billion, a price-to-earnings ratio of -205.37 and a beta of 1.81. Symbotic Inc. has a 1-year low of $17.11 and a 1-year high of $59.82. The company has a 50 day moving average of $27.00 and a 200-day moving average of $31.09.

Symbotic (NASDAQ:SYM - Get Free Report) last issued its quarterly earnings results on Monday, November 18th. The company reported $0.05 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.05. Symbotic had a positive return on equity of 4.08% and a negative net margin of 1.03%. The firm had revenue of $576.77 million for the quarter, compared to analyst estimates of $470.24 million. During the same period in the previous year, the company posted ($0.08) earnings per share. The business's revenue was up 47.2% on a year-over-year basis. Research analysts anticipate that Symbotic Inc. will post -0.08 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of research firms have issued reports on SYM. KeyCorp raised their price target on shares of Symbotic from $40.00 to $48.00 and gave the stock an "overweight" rating in a research report on Tuesday. Craig Hallum reduced their target price on shares of Symbotic from $54.00 to $45.00 and set a "buy" rating for the company in a report on Tuesday, July 30th. The Goldman Sachs Group lowered their price target on shares of Symbotic from $40.00 to $30.00 and set a "neutral" rating on the stock in a report on Wednesday, July 31st. BWS Financial reissued a "sell" rating and issued a $10.00 price objective on shares of Symbotic in a report on Tuesday. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating and set a $60.00 target price on shares of Symbotic in a report on Tuesday. One research analyst has rated the stock with a sell rating, three have issued a hold rating and ten have issued a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $44.31.

Get Our Latest Stock Analysis on SYM

Symbotic Profile

(

Free Report)

Symbotic Inc, an automation technology company, engages in developing technologies to improve operating efficiencies in modern warehouses. The company automates the processing of pallets and cases in large warehouses or distribution centers for retail companies. Its systems enhance operations at the front end of the supply chain.

Further Reading

Before you consider Symbotic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Symbotic wasn't on the list.

While Symbotic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.