GSA Capital Partners LLP reduced its stake in shares of Ennis, Inc. (NYSE:EBF - Free Report) by 33.7% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 61,029 shares of the industrial products company's stock after selling 31,024 shares during the quarter. GSA Capital Partners LLP owned about 0.23% of Ennis worth $1,484,000 at the end of the most recent quarter.

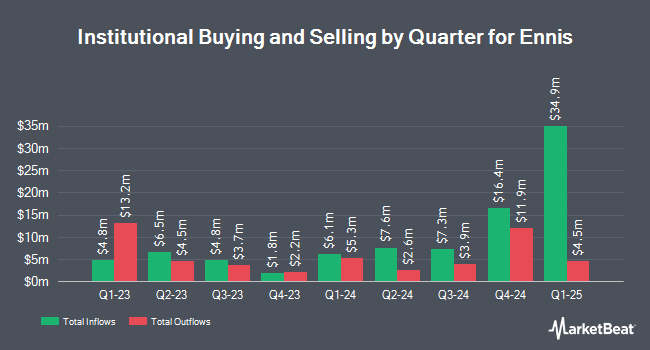

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Renaissance Technologies LLC raised its stake in Ennis by 0.7% during the 2nd quarter. Renaissance Technologies LLC now owns 1,537,746 shares of the industrial products company's stock worth $33,661,000 after acquiring an additional 11,000 shares in the last quarter. Bank of New York Mellon Corp increased its stake in Ennis by 0.4% in the second quarter. Bank of New York Mellon Corp now owns 339,928 shares of the industrial products company's stock valued at $7,441,000 after purchasing an additional 1,254 shares during the period. American Century Companies Inc. increased its stake in Ennis by 47.1% in the second quarter. American Century Companies Inc. now owns 274,947 shares of the industrial products company's stock valued at $6,019,000 after purchasing an additional 88,042 shares during the period. AQR Capital Management LLC increased its stake in Ennis by 74.5% in the second quarter. AQR Capital Management LLC now owns 268,172 shares of the industrial products company's stock valued at $5,870,000 after purchasing an additional 114,516 shares during the period. Finally, Price T Rowe Associates Inc. MD increased its stake in Ennis by 74.1% in the first quarter. Price T Rowe Associates Inc. MD now owns 65,588 shares of the industrial products company's stock valued at $1,346,000 after purchasing an additional 27,921 shares during the period. 74.33% of the stock is currently owned by institutional investors and hedge funds.

Ennis Trading Down 1.6 %

Shares of Ennis stock traded down $0.34 on Thursday, reaching $21.37. 38,410 shares of the stock were exchanged, compared to its average volume of 127,833. Ennis, Inc. has a 1-year low of $18.88 and a 1-year high of $25.75. The business has a fifty day moving average price of $22.45 and a two-hundred day moving average price of $22.13. The firm has a market capitalization of $555.71 million, a PE ratio of 13.58 and a beta of 0.41.

Ennis (NYSE:EBF - Get Free Report) last released its quarterly earnings data on Monday, September 23rd. The industrial products company reported $0.40 EPS for the quarter. The firm had revenue of $99.04 million for the quarter. Ennis had a net margin of 10.15% and a return on equity of 11.64%.

Ennis Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, November 8th. Shareholders of record on Friday, October 11th were issued a $0.25 dividend. This represents a $1.00 annualized dividend and a dividend yield of 4.68%. The ex-dividend date was Friday, October 11th. Ennis's dividend payout ratio (DPR) is presently 63.29%.

Analyst Upgrades and Downgrades

Separately, StockNews.com lowered shares of Ennis from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, October 29th.

Get Our Latest Report on EBF

About Ennis

(

Free Report)

Ennis, Inc manufactures and sells business forms and other business products in the United States. The company offers snap sets, continuous forms, laser cut sheets, tags, labels, envelopes, integrated products, jumbo rolls, and pressure sensitive products under the Ennis, Royal Business Forms, Block Graphics, 360º Custom Labels, ColorWorx, Enfusion, Uncompromised Check Solutions, VersaSeal, Ad Concepts, FormSource Limited, Star Award Ribbon Company, Witt Printing, B&D Litho, Genforms, PrintGraphics, Calibrated Forms, PrintXcel, Printegra, Forms Manufacturers, Mutual Graphics, TRI-C Business Forms, Major Business Systems, Independent Printing, Hoosier Data Forms, Hayes Graphics, Wright Business Graphics, Wright 360, Integrated Print & Graphics, the Flesh Company, Impressions Direct, and AmeriPrint brands.

Read More

Before you consider Ennis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ennis wasn't on the list.

While Ennis currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.