GSA Capital Partners LLP lowered its stake in MINISO Group Holding Limited (NYSE:MNSO - Free Report) by 79.5% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 19,974 shares of the company's stock after selling 77,629 shares during the quarter. GSA Capital Partners LLP's holdings in MINISO Group were worth $350,000 as of its most recent filing with the Securities and Exchange Commission.

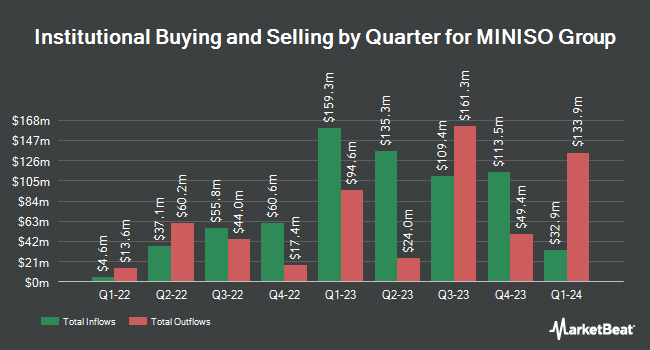

Other institutional investors and hedge funds have also recently bought and sold shares of the company. DekaBank Deutsche Girozentrale boosted its position in shares of MINISO Group by 3.7% in the third quarter. DekaBank Deutsche Girozentrale now owns 19,573 shares of the company's stock worth $378,000 after buying an additional 690 shares during the period. Cubist Systematic Strategies LLC lifted its stake in MINISO Group by 9.1% in the 2nd quarter. Cubist Systematic Strategies LLC now owns 11,249 shares of the company's stock worth $215,000 after acquiring an additional 942 shares in the last quarter. XTX Topco Ltd boosted its position in MINISO Group by 10.6% during the 2nd quarter. XTX Topco Ltd now owns 13,861 shares of the company's stock worth $264,000 after acquiring an additional 1,326 shares during the period. Point72 Asia Singapore Pte. Ltd. purchased a new position in MINISO Group during the 2nd quarter valued at about $26,000. Finally, Blue Trust Inc. increased its holdings in shares of MINISO Group by 3,098.4% in the 2nd quarter. Blue Trust Inc. now owns 1,951 shares of the company's stock valued at $40,000 after purchasing an additional 1,890 shares during the period. Institutional investors and hedge funds own 17.16% of the company's stock.

MINISO Group Stock Down 1.9 %

MINISO Group stock opened at $16.67 on Friday. The company has a current ratio of 2.38, a quick ratio of 1.93 and a debt-to-equity ratio of 0.15. MINISO Group Holding Limited has a 1-year low of $12.51 and a 1-year high of $26.54. The firm's fifty day simple moving average is $17.64 and its 200-day simple moving average is $18.51. The company has a market capitalization of $5.25 billion, a P/E ratio of 15.44, a P/E/G ratio of 0.70 and a beta of 0.15.

MINISO Group (NYSE:MNSO - Get Free Report) last posted its earnings results on Friday, August 30th. The company reported $0.26 earnings per share for the quarter. MINISO Group had a return on equity of 26.41% and a net margin of 15.72%. The company had revenue of $555.26 million for the quarter, compared to analyst estimates of $557.54 million. Sell-side analysts forecast that MINISO Group Holding Limited will post 1.23 earnings per share for the current fiscal year.

MINISO Group Announces Dividend

The business also recently announced a Semi-Annual dividend, which was paid on Thursday, September 26th. Investors of record on Friday, September 13th were issued a $0.274 dividend. The ex-dividend date of this dividend was Friday, September 13th. This represents a yield of 1.6%. MINISO Group's dividend payout ratio (DPR) is currently 49.07%.

Wall Street Analyst Weigh In

MNSO has been the subject of several research reports. JPMorgan Chase & Co. restated a "neutral" rating and set a $15.00 price target (down from $27.00) on shares of MINISO Group in a report on Tuesday, September 24th. Citigroup started coverage on shares of MINISO Group in a research note on Friday, October 4th. They set a "buy" rating and a $26.80 target price for the company. Dbs Bank raised shares of MINISO Group to a "strong-buy" rating in a research note on Tuesday, September 24th. Bank of America lowered MINISO Group from a "buy" rating to an "underperform" rating in a report on Monday, September 23rd. Finally, Jefferies Financial Group restated a "hold" rating on shares of MINISO Group in a research note on Monday, September 23rd. One investment analyst has rated the stock with a sell rating, two have given a hold rating, one has given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $20.90.

Get Our Latest Stock Analysis on MNSO

MINISO Group Company Profile

(

Free Report)

MINISO Group Holding Limited, an investment holding company, engages in the retail and wholesale of lifestyle products and pop toy products in China, Asia, the United States, and Europe. The company offers products in various categories, including home decor products, small electronics, textiles, accessories, beauty tools, toys, cosmetics, personal care products, snacks, fragrances and perfumes, and stationeries and gifts under the MINISO and WonderLife brand names; and blind boxes, toy bricks, model figures, model kits, collectible dolls, Ichiban Kuji, sculptures, and other popular toys under the TOP TOY brand.

Further Reading

Before you consider MINISO Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MINISO Group wasn't on the list.

While MINISO Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.