Harbor Capital Advisors Inc. raised its stake in shares of Universal Technical Institute, Inc. (NYSE:UTI - Free Report) by 90.0% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 81,521 shares of the company's stock after purchasing an additional 38,624 shares during the quarter. Harbor Capital Advisors Inc. owned approximately 0.15% of Universal Technical Institute worth $1,326,000 at the end of the most recent reporting period.

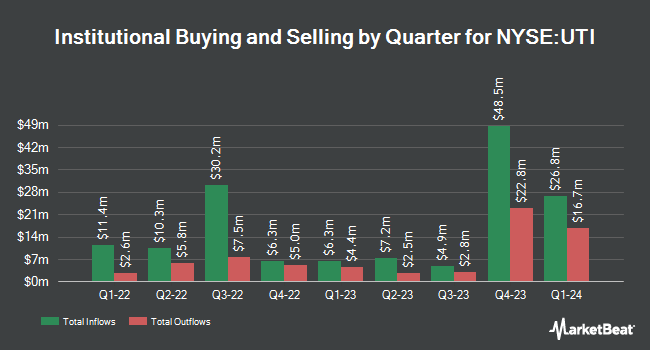

A number of other institutional investors also recently bought and sold shares of UTI. Pembroke Management LTD grew its position in Universal Technical Institute by 11.1% during the 3rd quarter. Pembroke Management LTD now owns 410,163 shares of the company's stock valued at $6,669,000 after purchasing an additional 40,855 shares during the last quarter. Conestoga Capital Advisors LLC grew its position in Universal Technical Institute by 9.4% during the third quarter. Conestoga Capital Advisors LLC now owns 85,110 shares of the company's stock valued at $1,384,000 after buying an additional 7,320 shares during the period. Pullen Investment Management LLC grew its position in Universal Technical Institute by 15.5% during the third quarter. Pullen Investment Management LLC now owns 65,160 shares of the company's stock valued at $1,060,000 after buying an additional 8,740 shares during the period. International Assets Investment Management LLC grew its position in Universal Technical Institute by 1,526.0% during the third quarter. International Assets Investment Management LLC now owns 4,065 shares of the company's stock valued at $66,000 after buying an additional 3,815 shares during the period. Finally, Inspire Investing LLC grew its position in Universal Technical Institute by 13.5% during the third quarter. Inspire Investing LLC now owns 25,556 shares of the company's stock valued at $416,000 after buying an additional 3,032 shares during the period. 75.67% of the stock is owned by institutional investors.

Insider Activity at Universal Technical Institute

In related news, CEO Jerome Alan Grant sold 68,000 shares of the company's stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $17.53, for a total transaction of $1,192,040.00. Following the sale, the chief executive officer now owns 136,443 shares of the company's stock, valued at $2,391,845.79. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 27.60% of the stock is owned by insiders.

Analyst Ratings Changes

A number of research firms have weighed in on UTI. Truist Financial began coverage on shares of Universal Technical Institute in a research report on Thursday, July 25th. They issued a "buy" rating and a $22.00 price target for the company. Rosenblatt Securities reiterated a "buy" rating and issued a $22.00 price target on shares of Universal Technical Institute in a research report on Wednesday, September 11th. Northland Securities upped their price target on shares of Universal Technical Institute from $18.00 to $20.00 and gave the stock an "outperform" rating in a research report on Wednesday, August 7th. Barrington Research reiterated an "outperform" rating and issued a $22.00 price target on shares of Universal Technical Institute in a research report on Wednesday, August 7th. Finally, StockNews.com upgraded shares of Universal Technical Institute from a "hold" rating to a "buy" rating in a research report on Wednesday, August 7th. Six investment analysts have rated the stock with a buy rating, According to MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $21.60.

Check Out Our Latest Research Report on UTI

Universal Technical Institute Price Performance

Shares of NYSE:UTI traded up $1.94 during midday trading on Wednesday, reaching $19.06. 864,554 shares of the company were exchanged, compared to its average volume of 527,564. The company has a current ratio of 1.02, a quick ratio of 1.02 and a debt-to-equity ratio of 0.56. The business's fifty day moving average is $16.38 and its two-hundred day moving average is $16.21. Universal Technical Institute, Inc. has a one year low of $9.18 and a one year high of $19.79. The stock has a market cap of $1.03 billion, a PE ratio of 34.24, a price-to-earnings-growth ratio of 1.21 and a beta of 1.34.

Universal Technical Institute (NYSE:UTI - Get Free Report) last released its quarterly earnings results on Tuesday, August 6th. The company reported $0.09 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.07 by $0.02. The company had revenue of $177.46 million for the quarter, compared to the consensus estimate of $172.33 million. Universal Technical Institute had a net margin of 3.82% and a return on equity of 12.66%. During the same quarter in the prior year, the firm earned ($0.05) earnings per share. As a group, analysts predict that Universal Technical Institute, Inc. will post 0.71 earnings per share for the current year.

About Universal Technical Institute

(

Free Report)

Universal Technical Institute, Inc provides transportation, skilled trades, and healthcare education programs in the United States. The company operates in two segments, UTI and Concorde. It offers certificate, diploma, or degree programs under various brands, such as Universal Technical Institute, Motorcycle Mechanics Institute, Marine Mechanics Institute, NASCAR Technical Institute, and MIAT College of Technology.

Read More

Before you consider Universal Technical Institute, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Technical Institute wasn't on the list.

While Universal Technical Institute currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.