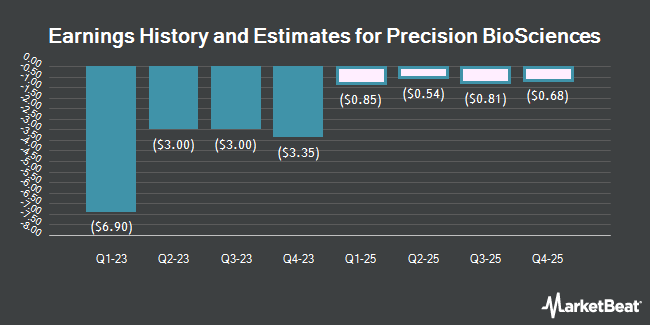

Precision BioSciences, Inc. (NASDAQ:DTIL - Free Report) - Equities research analysts at HC Wainwright cut their FY2024 earnings estimates for shares of Precision BioSciences in a note issued to investors on Tuesday, November 5th. HC Wainwright analyst P. Trucchio now expects that the company will post earnings of ($1.23) per share for the year, down from their previous forecast of $0.82. HC Wainwright currently has a "Buy" rating and a $60.00 target price on the stock. The consensus estimate for Precision BioSciences' current full-year earnings is $0.82 per share. HC Wainwright also issued estimates for Precision BioSciences' Q4 2024 earnings at ($0.42) EPS, Q1 2025 earnings at ($0.38) EPS and FY2025 earnings at ($1.05) EPS.

Precision BioSciences Stock Up 0.2 %

DTIL stock traded up $0.02 during midday trading on Thursday, reaching $8.42. The company's stock had a trading volume of 36,012 shares, compared to its average volume of 77,274. The business's 50-day simple moving average is $9.27 and its 200-day simple moving average is $10.04. Precision BioSciences has a 52 week low of $7.97 and a 52 week high of $19.43. The stock has a market cap of $60.88 million, a PE ratio of 140.36 and a beta of 1.71.

Hedge Funds Weigh In On Precision BioSciences

A hedge fund recently bought a new stake in Precision BioSciences stock. Janus Henderson Group PLC purchased a new stake in Precision BioSciences, Inc. (NASDAQ:DTIL - Free Report) during the first quarter, according to its most recent filing with the SEC. The firm purchased 573,052 shares of the company's stock, valued at approximately $7,739,000. Janus Henderson Group PLC owned 8.29% of Precision BioSciences at the end of the most recent reporting period. Institutional investors own 37.99% of the company's stock.

Precision BioSciences Company Profile

(

Get Free Report)

Precision BioSciences, Inc, an advanced gene editing company, develops in vivo gene editing therapies for gene edits, including gene elimination, insertion, and excision in the United States. The company offers ARCUS, a genome editing platform to DNA genome insertion, deletion, and repair. It also provides PBGENE-HBV for the treatment of chronic hepatitis B virus (HBV) to eliminate covalently closed circular DNA with direct cuts and edits as well as to inactivate integrated HBV DNA with the goal of long-lasting reductions in hepatitis B surface antigen; PBGENE-PMM for the treatment of m.3243 associated primary mitochondrial myopathy (PMM) which is expected to submit an IND and/or CTA.

Featured Stories

Before you consider Precision BioSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Precision BioSciences wasn't on the list.

While Precision BioSciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.