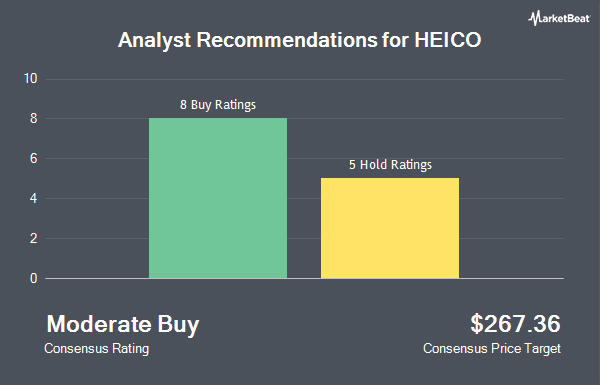

HEICO Co. (NYSE:HEI - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the eleven brokerages that are currently covering the company, Marketbeat.com reports. Three equities research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. The average 1 year target price among brokerages that have updated their coverage on the stock in the last year is $270.70.

A number of equities research analysts have issued reports on the stock. UBS Group started coverage on shares of HEICO in a research note on Tuesday, October 15th. They set a "neutral" rating and a $277.00 price objective on the stock. Bank of America lifted their price objective on shares of HEICO from $250.00 to $285.00 and gave the company a "buy" rating in a research note on Thursday, September 19th. Benchmark restated a "buy" rating and set a $245.00 target price on shares of HEICO in a research note on Tuesday, August 27th. Deutsche Bank Aktiengesellschaft raised their target price on HEICO from $235.00 to $271.00 and gave the company a "buy" rating in a report on Wednesday, September 4th. Finally, Stifel Nicolaus upped their price objective on HEICO from $250.00 to $280.00 and gave the stock a "buy" rating in a research report on Tuesday, August 27th.

Check Out Our Latest Report on HEICO

Insider Activity

In other HEICO news, CEO Laurans A. Mendelson purchased 725 shares of the firm's stock in a transaction on Friday, October 18th. The stock was purchased at an average cost of $262.94 per share, for a total transaction of $190,631.50. Following the transaction, the chief executive officer now owns 929,984 shares in the company, valued at $244,529,992.96. The trade was a 0.08 % increase in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, Director Alan Schriesheim sold 332 shares of the firm's stock in a transaction on Monday, October 7th. The shares were sold at an average price of $201.63, for a total transaction of $66,941.16. The disclosure for this sale can be found here. Over the last three months, insiders have bought 2,650 shares of company stock valued at $691,718. 8.10% of the stock is currently owned by corporate insiders.

Institutional Trading of HEICO

Institutional investors and hedge funds have recently bought and sold shares of the stock. Advisors Asset Management Inc. increased its stake in shares of HEICO by 3.6% in the first quarter. Advisors Asset Management Inc. now owns 15,926 shares of the aerospace company's stock valued at $3,042,000 after buying an additional 548 shares during the period. Quadrature Capital Ltd acquired a new stake in HEICO during the 1st quarter valued at approximately $2,796,000. Morse Asset Management Inc bought a new position in HEICO during the 1st quarter worth approximately $1,136,000. Silvercrest Asset Management Group LLC raised its holdings in HEICO by 13.0% during the 1st quarter. Silvercrest Asset Management Group LLC now owns 12,204 shares of the aerospace company's stock worth $2,331,000 after purchasing an additional 1,406 shares during the last quarter. Finally, Virtu Financial LLC lifted its position in shares of HEICO by 148.8% in the 1st quarter. Virtu Financial LLC now owns 5,449 shares of the aerospace company's stock worth $1,041,000 after purchasing an additional 3,259 shares during the period. 27.12% of the stock is currently owned by institutional investors and hedge funds.

HEICO Trading Up 0.6 %

Shares of HEI stock opened at $279.14 on Friday. The stock has a market cap of $38.69 billion, a P/E ratio of 81.86, a price-to-earnings-growth ratio of 3.31 and a beta of 1.23. HEICO has a 1 year low of $167.56 and a 1 year high of $282.82. The company has a current ratio of 3.30, a quick ratio of 1.47 and a debt-to-equity ratio of 0.63. The stock has a 50 day simple moving average of $261.57 and a 200 day simple moving average of $241.28.

HEICO (NYSE:HEI - Get Free Report) last released its earnings results on Monday, August 26th. The aerospace company reported $0.97 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.92 by $0.05. The company had revenue of $992.20 million for the quarter, compared to analyst estimates of $995.34 million. HEICO had a return on equity of 14.51% and a net margin of 12.64%. HEICO's quarterly revenue was up 37.3% on a year-over-year basis. During the same period in the prior year, the firm posted $0.77 EPS. On average, research analysts predict that HEICO will post 3.65 earnings per share for the current fiscal year.

About HEICO

(

Get Free ReportHEICO Corporation, through its subsidiaries, designs, manufactures, and sells aerospace, defense, and electronic related products and services in the United States and internationally. Its Flight Support Group segment provides jet engine and aircraft component replacement parts; thermal insulation blankets and parts; renewable/reusable insulation systems; and specialty components.

Recommended Stories

Before you consider HEICO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HEICO wasn't on the list.

While HEICO currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.