Hillenbrand (NYSE:HI - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Wednesday, November 13th. Analysts expect the company to announce earnings of $0.93 per share for the quarter. Investors that wish to register for the company's conference call can do so using this link.

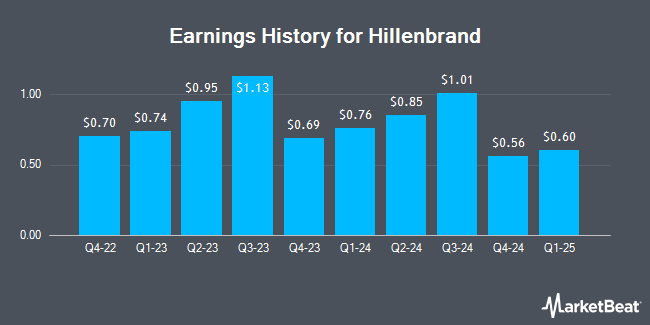

Hillenbrand (NYSE:HI - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The company reported $0.85 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.82 by $0.03. Hillenbrand had a positive return on equity of 14.89% and a negative net margin of 6.67%. The company had revenue of $786.60 million for the quarter, compared to the consensus estimate of $818.16 million. During the same period in the previous year, the business earned $0.95 EPS. Hillenbrand's revenue for the quarter was up 9.8% compared to the same quarter last year. On average, analysts expect Hillenbrand to post $3 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Hillenbrand Stock Up 10.2 %

Shares of HI stock traded up $2.95 during mid-day trading on Wednesday, reaching $31.95. 522,814 shares of the company were exchanged, compared to its average volume of 386,726. The company has a debt-to-equity ratio of 1.44, a quick ratio of 0.88 and a current ratio of 1.35. The business's 50 day simple moving average is $27.98 and its 200 day simple moving average is $36.92. The company has a market capitalization of $2.24 billion, a P/E ratio of -9.87 and a beta of 1.38. Hillenbrand has a fifty-two week low of $25.11 and a fifty-two week high of $50.58.

Hillenbrand Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Monday, September 16th were issued a dividend of $0.2225 per share. This is a positive change from Hillenbrand's previous quarterly dividend of $0.22. This represents a $0.89 annualized dividend and a yield of 2.79%. The ex-dividend date of this dividend was Monday, September 16th. Hillenbrand's dividend payout ratio (DPR) is currently -30.27%.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on HI shares. DA Davidson cut shares of Hillenbrand from a "buy" rating to a "neutral" rating and reduced their price target for the stock from $54.00 to $33.00 in a research report on Monday, August 12th. KeyCorp assumed coverage on Hillenbrand in a research report on Wednesday, July 10th. They issued an "overweight" rating and a $50.00 target price for the company. Finally, StockNews.com raised Hillenbrand from a "sell" rating to a "hold" rating in a research report on Friday, September 6th. Two equities research analysts have rated the stock with a hold rating, one has given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $48.00.

Check Out Our Latest Research Report on Hillenbrand

Hillenbrand Company Profile

(

Get Free Report)

Hillenbrand, Inc operates as an industrial company in the United States and internationally. The company operates through two segments, Advanced Process Solutions and Molding Technology Solutions. The Advanced Process Solutions segment designs, engineers, manufactures, markets, and services process and material handling equipment and systems comprising compounding, extrusion, and material handling equipment, equipment system design services, as well as offers mixing technology, ingredient automation, and portion process; and provides screening and separating equipment for various industries, including plastics, food and pharmaceuticals, chemicals, fertilizers, minerals, energy, wastewater treatment, forest products, and other general industrials.

See Also

Before you consider Hillenbrand, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hillenbrand wasn't on the list.

While Hillenbrand currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.