Van ECK Associates Corp increased its stake in shares of Insight Enterprises, Inc. (NASDAQ:NSIT - Free Report) by 40.0% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 16,294 shares of the software maker's stock after acquiring an additional 4,656 shares during the quarter. Van ECK Associates Corp's holdings in Insight Enterprises were worth $3,438,000 at the end of the most recent reporting period.

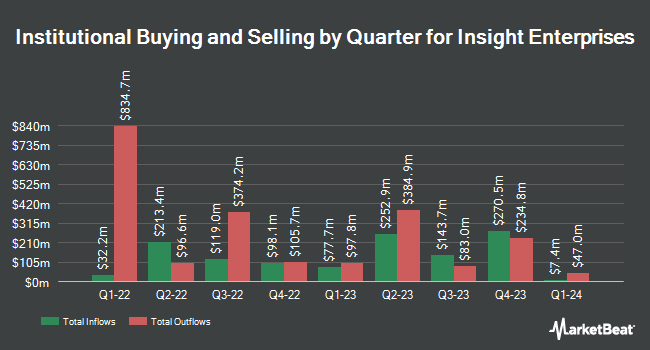

Other institutional investors and hedge funds have also bought and sold shares of the company. Opal Wealth Advisors LLC bought a new position in Insight Enterprises during the second quarter worth $38,000. GAMMA Investing LLC increased its position in Insight Enterprises by 56.9% during the second quarter. GAMMA Investing LLC now owns 452 shares of the software maker's stock worth $90,000 after acquiring an additional 164 shares during the period. EntryPoint Capital LLC bought a new position in Insight Enterprises during the first quarter worth $89,000. Blue Trust Inc. increased its holdings in Insight Enterprises by 40.8% in the 2nd quarter. Blue Trust Inc. now owns 531 shares of the software maker's stock valued at $99,000 after buying an additional 154 shares during the period. Finally, Ausbil Investment Management Ltd bought a new stake in Insight Enterprises in the 2nd quarter valued at $195,000.

Insight Enterprises Price Performance

Shares of NSIT traded down $1.29 during trading hours on Friday, hitting $170.79. The stock had a trading volume of 565,686 shares, compared to its average volume of 310,442. The company's fifty day moving average is $206.54 and its two-hundred day moving average is $203.53. The company has a debt-to-equity ratio of 0.43, a current ratio of 1.24 and a quick ratio of 1.20. Insight Enterprises, Inc. has a 52 week low of $141.73 and a 52 week high of $228.07. The stock has a market capitalization of $5.42 billion, a price-to-earnings ratio of 21.48, a P/E/G ratio of 1.52 and a beta of 1.48.

Insight Enterprises (NASDAQ:NSIT - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The software maker reported $2.19 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.37 by ($0.18). The company had revenue of $2.09 billion for the quarter, compared to analyst estimates of $2.34 billion. Insight Enterprises had a return on equity of 19.71% and a net margin of 3.42%. The firm's quarterly revenue was down 7.9% on a year-over-year basis. During the same quarter last year, the company earned $2.37 EPS. On average, analysts anticipate that Insight Enterprises, Inc. will post 9.55 EPS for the current year.

Insider Buying and Selling

In related news, insider Jennifer M. Vasin sold 739 shares of the company's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $206.03, for a total transaction of $152,256.17. Following the transaction, the insider now owns 5,460 shares in the company, valued at $1,124,923.80. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. 1.23% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

Several brokerages have issued reports on NSIT. JPMorgan Chase & Co. lowered their price target on shares of Insight Enterprises from $233.00 to $225.00 and set a "neutral" rating on the stock in a report on Friday, August 2nd. Stifel Nicolaus boosted their price target on shares of Insight Enterprises from $192.00 to $200.00 and gave the company a "hold" rating in a report on Wednesday, July 17th. Finally, Barrington Research lowered their price target on shares of Insight Enterprises from $225.00 to $205.00 and set an "outperform" rating on the stock in a report on Monday, November 4th.

View Our Latest Analysis on NSIT

Insight Enterprises Profile

(

Free Report)

Insight Enterprises, Inc, together with its subsidiaries, provides information technology, hardware, software, and services in the United States and internationally. The company offers modern platforms/infrastructure that manages and supports cloud and data platforms, modern networks, and edge technologies; cybersecurity solutions automates and connects modern platform securely; data and artificial intelligence modernizes data platforms and architectures, and build data analytics and AI solutions; modern workplace and apps; and intelligent edge solutions that gathers and utilizes data for real-time decision making.

Featured Articles

Before you consider Insight Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Insight Enterprises wasn't on the list.

While Insight Enterprises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.