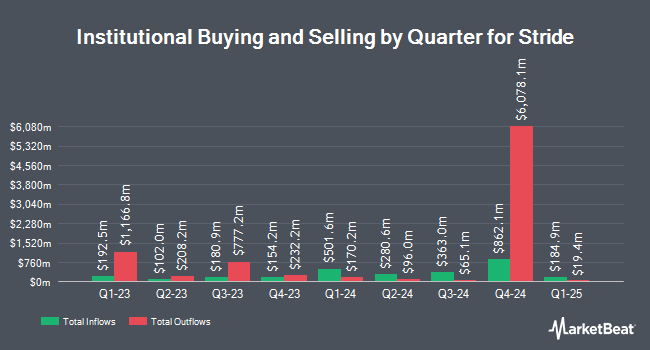

International Assets Investment Management LLC grew its holdings in shares of Stride, Inc. (NYSE:LRN - Free Report) by 8,431.7% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 5,119 shares of the company's stock after purchasing an additional 5,059 shares during the period. International Assets Investment Management LLC's holdings in Stride were worth $437,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Mirae Asset Global Investments Co. Ltd. increased its holdings in shares of Stride by 17.0% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 31,262 shares of the company's stock worth $1,971,000 after acquiring an additional 4,546 shares in the last quarter. Texas Permanent School Fund Corp increased its position in Stride by 1.4% in the 1st quarter. Texas Permanent School Fund Corp now owns 34,831 shares of the company's stock valued at $2,196,000 after buying an additional 496 shares in the last quarter. ClariVest Asset Management LLC boosted its stake in Stride by 67.3% during the 1st quarter. ClariVest Asset Management LLC now owns 30,794 shares of the company's stock valued at $1,942,000 after purchasing an additional 12,393 shares during the last quarter. Swiss National Bank lifted its stake in Stride by 1.0% in the first quarter. Swiss National Bank now owns 81,300 shares of the company's stock valued at $5,126,000 after purchasing an additional 800 shares during the last quarter. Finally, Inspire Advisors LLC bought a new stake in Stride during the 1st quarter valued at $264,000. Institutional investors and hedge funds own 98.24% of the company's stock.

Stride Price Performance

Shares of LRN stock traded down $0.57 on Thursday, hitting $98.89. 794,678 shares of the company's stock were exchanged, compared to its average volume of 846,353. The stock has a market cap of $4.31 billion, a P/E ratio of 18.08, a price-to-earnings-growth ratio of 0.70 and a beta of 0.27. The company has a 50 day moving average of $81.68 and a 200 day moving average of $75.07. The company has a debt-to-equity ratio of 0.38, a current ratio of 5.60 and a quick ratio of 5.50. Stride, Inc. has a 12 month low of $54.81 and a 12 month high of $99.61.

Stride (NYSE:LRN - Get Free Report) last released its earnings results on Tuesday, October 22nd. The company reported $0.94 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.22 by $0.72. Stride had a return on equity of 21.23% and a net margin of 11.38%. The business had revenue of $551.08 million during the quarter, compared to the consensus estimate of $504.29 million. During the same period last year, the business posted $0.11 earnings per share. The business's revenue for the quarter was up 14.8% on a year-over-year basis. On average, equities research analysts predict that Stride, Inc. will post 6.66 EPS for the current year.

Insider Buying and Selling at Stride

In other news, Director Todd Goldthwaite sold 8,028 shares of Stride stock in a transaction that occurred on Friday, October 25th. The shares were sold at an average price of $91.54, for a total transaction of $734,883.12. Following the completion of the sale, the director now owns 85,058 shares of the company's stock, valued at approximately $7,786,209.32. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Insiders own 3.00% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have weighed in on LRN shares. Citigroup lifted their price objective on Stride from $90.00 to $94.00 and gave the company a "neutral" rating in a research report on Tuesday, October 29th. Barrington Research increased their target price on shares of Stride from $90.00 to $100.00 and gave the company an "outperform" rating in a research report on Wednesday, October 23rd. BMO Capital Markets lifted their target price on shares of Stride from $84.00 to $88.00 and gave the company an "outperform" rating in a research report on Thursday, October 24th. Canaccord Genuity Group started coverage on shares of Stride in a research note on Thursday, August 8th. They issued a "buy" rating and a $94.00 price target on the stock. Finally, StockNews.com cut shares of Stride from a "buy" rating to a "hold" rating in a report on Wednesday, October 23rd. Three investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, Stride has an average rating of "Moderate Buy" and a consensus price target of $90.17.

Read Our Latest Report on LRN

About Stride

(

Free Report)

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

Recommended Stories

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.