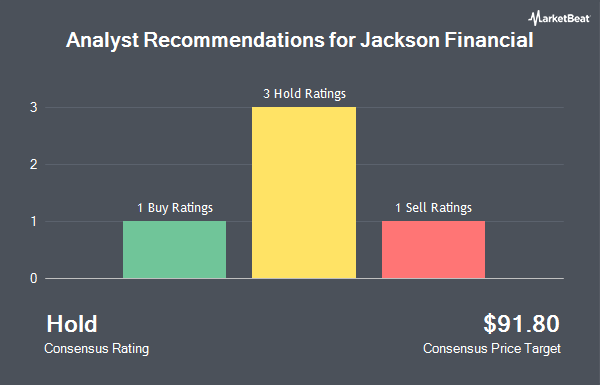

Shares of Jackson Financial Inc. (NYSE:JXN - Get Free Report) have earned a consensus rating of "Hold" from the six ratings firms that are covering the company, MarketBeat reports. One research analyst has rated the stock with a sell rating, four have issued a hold rating and one has given a buy rating to the company. The average 1-year price target among brokers that have covered the stock in the last year is $84.00.

Several brokerages recently issued reports on JXN. Barclays upped their price target on shares of Jackson Financial from $109.00 to $111.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 8th. Jefferies Financial Group upped their price target on shares of Jackson Financial from $73.00 to $80.00 and gave the stock a "hold" rating in a research report on Monday, July 29th. Morgan Stanley upped their price target on shares of Jackson Financial from $86.00 to $89.00 and gave the stock an "equal weight" rating in a research report on Monday, August 19th. Evercore ISI downgraded shares of Jackson Financial from an "in-line" rating to an "underperform" rating and upped their price target for the stock from $74.00 to $95.00 in a research report on Thursday, November 14th. Finally, Keefe, Bruyette & Woods upped their price target on shares of Jackson Financial from $80.00 to $82.00 and gave the stock a "market perform" rating in a research report on Wednesday, August 14th.

Get Our Latest Stock Report on Jackson Financial

Insider Buying and Selling at Jackson Financial

In other news, EVP Carrie Chelko sold 5,500 shares of Jackson Financial stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $91.31, for a total value of $502,205.00. Following the sale, the executive vice president now directly owns 61,829 shares in the company, valued at $5,645,605.99. This trade represents a 8.17 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 1.30% of the company's stock.

Institutional Trading of Jackson Financial

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. Asset Allocation Strategies LLC increased its holdings in Jackson Financial by 0.6% during the second quarter. Asset Allocation Strategies LLC now owns 18,926 shares of the company's stock worth $1,405,000 after buying an additional 119 shares during the last quarter. Mutual of America Capital Management LLC increased its holdings in shares of Jackson Financial by 1.4% in the third quarter. Mutual of America Capital Management LLC now owns 11,316 shares of the company's stock valued at $1,032,000 after purchasing an additional 159 shares during the last quarter. Private Advisor Group LLC increased its holdings in shares of Jackson Financial by 1.2% in the second quarter. Private Advisor Group LLC now owns 14,962 shares of the company's stock valued at $1,111,000 after purchasing an additional 178 shares during the last quarter. International Assets Investment Management LLC increased its holdings in shares of Jackson Financial by 2.0% in the second quarter. International Assets Investment Management LLC now owns 9,954 shares of the company's stock valued at $739,000 after purchasing an additional 199 shares during the last quarter. Finally, Blue Trust Inc. increased its holdings in shares of Jackson Financial by 232.1% in the third quarter. Blue Trust Inc. now owns 372 shares of the company's stock valued at $34,000 after purchasing an additional 260 shares during the last quarter. 89.96% of the stock is currently owned by institutional investors and hedge funds.

Jackson Financial Stock Performance

NYSE:JXN traded up $2.78 during trading hours on Friday, hitting $101.67. 350,166 shares of the company traded hands, compared to its average volume of 733,353. The stock has a market capitalization of $7.51 billion, a price-to-earnings ratio of -7.82 and a beta of 1.48. Jackson Financial has a twelve month low of $45.61 and a twelve month high of $115.22. The firm has a 50-day moving average of $97.66 and a 200 day moving average of $85.40. The company has a current ratio of 0.30, a quick ratio of 0.30 and a debt-to-equity ratio of 0.42.

Jackson Financial (NYSE:JXN - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $4.60 earnings per share (EPS) for the quarter, missing the consensus estimate of $4.67 by ($0.07). The business had revenue of $2.12 billion for the quarter, compared to analysts' expectations of $1.73 billion. During the same quarter in the previous year, the business earned $3.80 earnings per share. On average, analysts forecast that Jackson Financial will post 18.8 EPS for the current year.

Jackson Financial declared that its Board of Directors has authorized a share buyback plan on Wednesday, August 7th that authorizes the company to repurchase $750.00 million in outstanding shares. This repurchase authorization authorizes the company to buy up to 10.8% of its shares through open market purchases. Shares repurchase plans are usually an indication that the company's board believes its stock is undervalued.

Jackson Financial Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Thursday, December 5th will be paid a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a yield of 2.75%. The ex-dividend date of this dividend is Thursday, December 5th. Jackson Financial's payout ratio is currently -22.15%.

About Jackson Financial

(

Get Free ReportJackson Financial Inc, through its subsidiaries, provides suite of annuities to retail investors in the United States. The company operates through three segments: Retail Annuities, Institutional Products, and Closed Life and Annuity Blocks. The Retail Annuities segment offers various retirement income and savings products, including variable, fixed index, fixed, and payout annuities, as well as registered index-linked annuities and lifetime income solutions.

Recommended Stories

Before you consider Jackson Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jackson Financial wasn't on the list.

While Jackson Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.