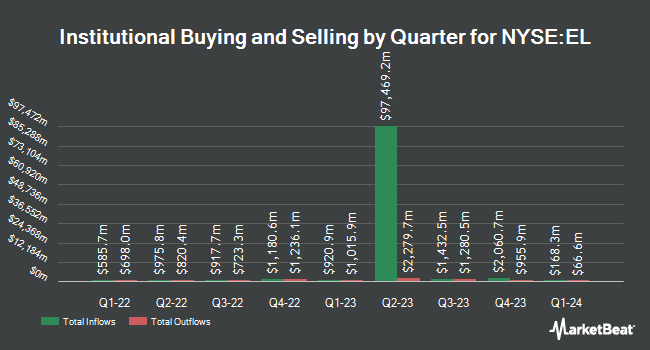

Janney Montgomery Scott LLC acquired a new stake in The Estée Lauder Companies Inc. (NYSE:EL - Free Report) during the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor acquired 16,043 shares of the company's stock, valued at approximately $1,599,000.

Other large investors have also recently added to or reduced their stakes in the company. Empowered Funds LLC increased its stake in shares of Estée Lauder Companies by 26.5% during the 1st quarter. Empowered Funds LLC now owns 2,775 shares of the company's stock worth $428,000 after purchasing an additional 582 shares during the last quarter. Atomi Financial Group Inc. acquired a new position in shares of Estée Lauder Companies during the 1st quarter worth $203,000. Sei Investments Co. boosted its holdings in shares of Estée Lauder Companies by 20.3% during the 1st quarter. Sei Investments Co. now owns 90,931 shares of the company's stock worth $14,017,000 after buying an additional 15,348 shares during the period. QRG Capital Management Inc. boosted its holdings in shares of Estée Lauder Companies by 9.8% during the 1st quarter. QRG Capital Management Inc. now owns 12,909 shares of the company's stock worth $1,990,000 after buying an additional 1,155 shares during the period. Finally, Avantax Advisory Services Inc. boosted its holdings in shares of Estée Lauder Companies by 4.6% during the 1st quarter. Avantax Advisory Services Inc. now owns 3,643 shares of the company's stock worth $562,000 after buying an additional 160 shares during the period. Institutional investors and hedge funds own 55.15% of the company's stock.

Analyst Ratings Changes

Several research firms recently issued reports on EL. JPMorgan Chase & Co. downgraded shares of Estée Lauder Companies from an "overweight" rating to a "neutral" rating and decreased their price objective for the stock from $113.00 to $74.00 in a report on Friday, November 1st. UBS Group reduced their price target on shares of Estée Lauder Companies from $115.00 to $104.00 and set a "neutral" rating for the company in a report on Tuesday, August 20th. Evercore ISI reduced their price target on shares of Estée Lauder Companies from $180.00 to $130.00 and set an "outperform" rating for the company in a report on Tuesday, August 20th. DA Davidson reissued a "buy" rating and issued a $130.00 price target on shares of Estée Lauder Companies in a report on Tuesday, October 29th. Finally, Hsbc Global Res downgraded shares of Estée Lauder Companies from a "strong-buy" rating to a "hold" rating in a report on Wednesday, October 16th. Nineteen equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $100.90.

View Our Latest Research Report on Estée Lauder Companies

Insider Buying and Selling

In other Estée Lauder Companies news, CEO Fabrizio Freda sold 10,969 shares of the company's stock in a transaction on Friday, November 1st. The shares were sold at an average price of $67.76, for a total value of $743,259.44. Following the transaction, the chief executive officer now directly owns 295,838 shares in the company, valued at $20,045,982.88. The trade was a 3.58 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Charlene Barshefsky sold 3,437 shares of the company's stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of $91.93, for a total transaction of $315,963.41. Following the completion of the transaction, the director now owns 49,800 shares in the company, valued at approximately $4,578,114. This represents a 6.46 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 18,296 shares of company stock worth $1,423,366. Insiders own 12.78% of the company's stock.

Estée Lauder Companies Price Performance

EL traded up $1.96 during midday trading on Thursday, hitting $64.82. The company had a trading volume of 4,008,916 shares, compared to its average volume of 3,461,326. The company has a debt-to-equity ratio of 1.44, a quick ratio of 0.90 and a current ratio of 1.32. The company has a market capitalization of $23.27 billion, a PE ratio of 115.77, a P/E/G ratio of 3.79 and a beta of 1.05. The Estée Lauder Companies Inc. has a twelve month low of $62.29 and a twelve month high of $159.75. The firm's 50-day simple moving average is $85.64 and its 200-day simple moving average is $101.68.

Estée Lauder Companies (NYSE:EL - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The company reported $0.14 EPS for the quarter, topping the consensus estimate of $0.09 by $0.05. Estée Lauder Companies had a net margin of 1.31% and a return on equity of 17.31%. The company had revenue of $3.36 billion during the quarter, compared to analysts' expectations of $3.37 billion. During the same quarter in the previous year, the company earned $0.11 EPS. Estée Lauder Companies's revenue was down 4.5% on a year-over-year basis. Equities research analysts predict that The Estée Lauder Companies Inc. will post 1.59 EPS for the current fiscal year.

Estée Lauder Companies Cuts Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 29th will be issued a $0.35 dividend. The ex-dividend date is Friday, November 29th. This represents a $1.40 dividend on an annualized basis and a dividend yield of 2.16%. Estée Lauder Companies's dividend payout ratio (DPR) is presently 250.00%.

Estée Lauder Companies Profile

(

Free Report)

The Estée Lauder Companies Inc manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide. It offers skin care products, including moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, and sun care products; and makeup products, such as lipsticks, lip glosses, mascaras, foundations, eyeshadows, and powders, as well as compacts, brushes, and other makeup tools.

Recommended Stories

Before you consider Estée Lauder Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Estée Lauder Companies wasn't on the list.

While Estée Lauder Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report