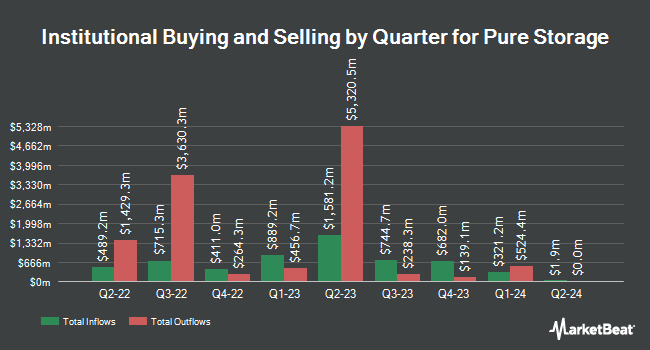

Janney Montgomery Scott LLC bought a new stake in Pure Storage, Inc. (NYSE:PSTG - Free Report) in the 3rd quarter, according to its most recent filing with the SEC. The fund bought 40,460 shares of the technology company's stock, valued at approximately $2,033,000.

Several other large investors have also recently made changes to their positions in PSTG. Massmutual Trust Co. FSB ADV increased its holdings in Pure Storage by 61.2% in the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 424 shares of the technology company's stock worth $27,000 after acquiring an additional 161 shares in the last quarter. Larson Financial Group LLC increased its holdings in Pure Storage by 242.9% in the 2nd quarter. Larson Financial Group LLC now owns 432 shares of the technology company's stock worth $28,000 after acquiring an additional 306 shares in the last quarter. ORG Wealth Partners LLC purchased a new stake in Pure Storage in the 3rd quarter worth $31,000. FSC Wealth Advisors LLC purchased a new stake in Pure Storage in the 2nd quarter worth $33,000. Finally, City State Bank increased its holdings in Pure Storage by 175.0% in the 2nd quarter. City State Bank now owns 550 shares of the technology company's stock worth $35,000 after acquiring an additional 350 shares in the last quarter. 83.42% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several brokerages recently commented on PSTG. Northland Securities reissued a "market perform" rating and issued a $59.00 price target (down previously from $68.00) on shares of Pure Storage in a report on Thursday, August 29th. Needham & Company LLC dropped their target price on shares of Pure Storage from $80.00 to $62.00 and set a "buy" rating for the company in a report on Thursday, August 29th. Evercore ISI dropped their target price on shares of Pure Storage from $75.00 to $70.00 and set an "outperform" rating for the company in a report on Thursday, August 29th. UBS Group dropped their target price on shares of Pure Storage from $47.00 to $45.00 and set a "sell" rating for the company in a report on Thursday, August 29th. Finally, Raymond James dropped their target price on shares of Pure Storage from $73.00 to $70.00 and set an "outperform" rating for the company in a report on Thursday, August 29th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating and fourteen have issued a buy rating to the company. Based on data from MarketBeat, Pure Storage has a consensus rating of "Moderate Buy" and an average target price of $68.15.

Get Our Latest Analysis on Pure Storage

Insider Buying and Selling at Pure Storage

In other Pure Storage news, insider John Colgrove sold 100,000 shares of the company's stock in a transaction dated Tuesday, August 20th. The shares were sold at an average price of $61.76, for a total value of $6,176,000.00. Following the transaction, the insider now owns 700,000 shares of the company's stock, valued at $43,232,000. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. In other news, CAO Mona Chu sold 20,647 shares of the stock in a transaction dated Monday, October 7th. The shares were sold at an average price of $51.50, for a total transaction of $1,063,320.50. Following the sale, the chief accounting officer now owns 75,992 shares of the company's stock, valued at approximately $3,913,588. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider John Colgrove sold 100,000 shares of the stock in a transaction dated Tuesday, August 20th. The stock was sold at an average price of $61.76, for a total transaction of $6,176,000.00. Following the sale, the insider now directly owns 700,000 shares in the company, valued at $43,232,000. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 454,542 shares of company stock valued at $24,775,030 over the last 90 days. 6.00% of the stock is owned by insiders.

Pure Storage Trading Down 0.6 %

NYSE PSTG traded down $0.28 during trading hours on Wednesday, reaching $49.87. The company had a trading volume of 9,649,489 shares, compared to its average volume of 3,691,199. The stock has a 50-day moving average of $51.26 and a 200 day moving average of $57.00. Pure Storage, Inc. has a 1-year low of $31.00 and a 1-year high of $70.41. The company has a current ratio of 1.99, a quick ratio of 1.96 and a debt-to-equity ratio of 0.07. The stock has a market capitalization of $16.34 billion, a P/E ratio of 131.43, a price-to-earnings-growth ratio of 7.86 and a beta of 1.10.

Pure Storage (NYSE:PSTG - Get Free Report) last posted its earnings results on Wednesday, August 28th. The technology company reported $0.20 EPS for the quarter, beating analysts' consensus estimates of $0.10 by $0.10. Pure Storage had a net margin of 4.53% and a return on equity of 17.41%. The company had revenue of $763.77 million for the quarter, compared to analysts' expectations of $756.59 million. As a group, research analysts anticipate that Pure Storage, Inc. will post 0.43 earnings per share for the current fiscal year.

Pure Storage Company Profile

(

Free Report)

Pure Storage, Inc engages in the provision of data storage and management technologies, products, and services in the United States and internationally. Its Purity software is shared across its products and provides enterprise-class data services, such as always-on data reduction, data protection, and encryption, as well as storage protocols, including block, file, and object.

See Also

Before you consider Pure Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pure Storage wasn't on the list.

While Pure Storage currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.