Jennison Associates LLC increased its stake in shares of Urban Edge Properties (NYSE:UE - Free Report) by 7.8% during the third quarter, according to the company in its most recent filing with the SEC. The fund owned 2,966,029 shares of the real estate investment trust's stock after acquiring an additional 215,879 shares during the period. Jennison Associates LLC owned 2.38% of Urban Edge Properties worth $63,443,000 as of its most recent filing with the SEC.

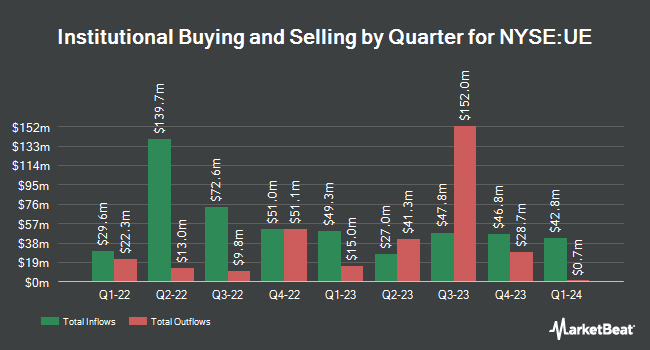

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Vanguard Group Inc. raised its position in Urban Edge Properties by 1.0% in the 1st quarter. Vanguard Group Inc. now owns 18,546,753 shares of the real estate investment trust's stock valued at $320,302,000 after purchasing an additional 191,258 shares during the last quarter. Dimensional Fund Advisors LP lifted its holdings in Urban Edge Properties by 7.1% during the second quarter. Dimensional Fund Advisors LP now owns 1,757,044 shares of the real estate investment trust's stock worth $32,452,000 after acquiring an additional 117,152 shares in the last quarter. American Century Companies Inc. lifted its holdings in Urban Edge Properties by 48.4% during the second quarter. American Century Companies Inc. now owns 1,406,251 shares of the real estate investment trust's stock worth $25,973,000 after acquiring an additional 458,951 shares in the last quarter. Marshall Wace LLP bought a new position in Urban Edge Properties during the second quarter worth about $19,326,000. Finally, Sei Investments Co. lifted its holdings in Urban Edge Properties by 32.0% during the second quarter. Sei Investments Co. now owns 909,459 shares of the real estate investment trust's stock worth $16,798,000 after acquiring an additional 220,715 shares in the last quarter. Institutional investors and hedge funds own 94.94% of the company's stock.

Urban Edge Properties Trading Down 0.2 %

NYSE UE traded down $0.04 on Thursday, reaching $22.95. The company had a trading volume of 1,007,989 shares, compared to its average volume of 880,553. The firm has a market cap of $2.87 billion, a price-to-earnings ratio of 10.29 and a beta of 1.54. Urban Edge Properties has a fifty-two week low of $15.81 and a fifty-two week high of $23.85. The business has a 50 day moving average of $21.95 and a two-hundred day moving average of $19.94. The company has a debt-to-equity ratio of 1.13, a current ratio of 1.30 and a quick ratio of 1.30.

Urban Edge Properties (NYSE:UE - Get Free Report) last issued its earnings results on Wednesday, October 30th. The real estate investment trust reported $0.07 EPS for the quarter. The company had revenue of $112.26 million during the quarter. Urban Edge Properties had a return on equity of 20.89% and a net margin of 59.23%. Analysts forecast that Urban Edge Properties will post 1.32 EPS for the current year.

Urban Edge Properties Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 13th will be issued a dividend of $0.17 per share. The ex-dividend date is Friday, December 13th. This represents a $0.68 dividend on an annualized basis and a yield of 2.96%. Urban Edge Properties's payout ratio is 30.49%.

Insider Transactions at Urban Edge Properties

In related news, CFO Mark Langer sold 93,962 shares of the stock in a transaction on Monday, November 11th. The stock was sold at an average price of $23.57, for a total value of $2,214,684.34. Following the transaction, the chief financial officer now owns 35,816 shares of the company's stock, valued at $844,183.12. This represents a 72.40 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders own 3.10% of the company's stock.

Wall Street Analysts Forecast Growth

UE has been the topic of a number of research reports. Evercore ISI boosted their price target on Urban Edge Properties from $21.00 to $22.00 and gave the company an "in-line" rating in a report on Monday, September 16th. StockNews.com raised Urban Edge Properties from a "sell" rating to a "hold" rating in a research report on Friday, August 2nd.

Read Our Latest Report on Urban Edge Properties

About Urban Edge Properties

(

Free Report)

Urban Edge Properties is a NYSE listed real estate investment trust focused on owning, managing, acquiring, developing, and redeveloping retail real estate in urban communities, primarily in the Washington, DC to Boston corridor. Urban Edge owns 76 properties totaling 17.1 million square feet of gross leasable area.

Read More

Before you consider Urban Edge Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Urban Edge Properties wasn't on the list.

While Urban Edge Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.