Royce & Associates LP lessened its stake in JFrog Ltd. (NASDAQ:FROG - Free Report) by 11.5% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 400,803 shares of the company's stock after selling 52,000 shares during the period. Royce & Associates LP owned about 0.39% of JFrog worth $11,639,000 at the end of the most recent quarter.

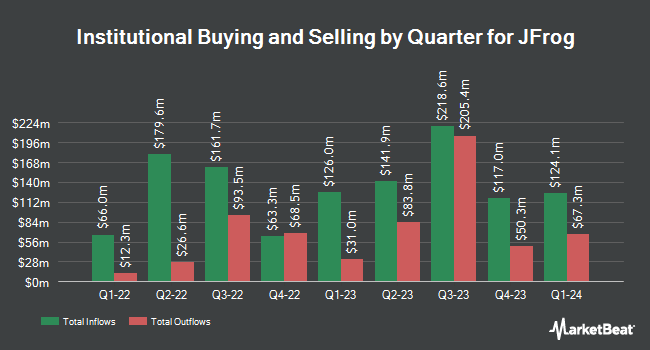

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in FROG. TimesSquare Capital Management LLC lifted its stake in JFrog by 114.1% in the third quarter. TimesSquare Capital Management LLC now owns 3,034,900 shares of the company's stock worth $88,133,000 after acquiring an additional 1,617,551 shares during the last quarter. 1832 Asset Management L.P. grew its stake in shares of JFrog by 285.1% during the first quarter. 1832 Asset Management L.P. now owns 1,422,100 shares of the company's stock worth $62,885,000 after purchasing an additional 1,052,800 shares in the last quarter. Meitav Investment House Ltd. increased its holdings in JFrog by 4,244.7% in the second quarter. Meitav Investment House Ltd. now owns 876,628 shares of the company's stock valued at $32,903,000 after buying an additional 856,451 shares during the last quarter. American Century Companies Inc. raised its stake in JFrog by 172.5% in the second quarter. American Century Companies Inc. now owns 1,330,034 shares of the company's stock valued at $49,943,000 after buying an additional 841,956 shares in the last quarter. Finally, Ensign Peak Advisors Inc purchased a new stake in JFrog during the 2nd quarter worth about $30,098,000. Hedge funds and other institutional investors own 85.02% of the company's stock.

JFrog Stock Down 2.4 %

NASDAQ FROG traded down $0.77 during trading hours on Friday, hitting $30.72. 1,172,513 shares of the stock were exchanged, compared to its average volume of 956,805. JFrog Ltd. has a 12-month low of $22.91 and a 12-month high of $48.81. The stock has a 50-day moving average of $29.47 and a 200 day moving average of $31.96. The company has a market cap of $3.13 billion, a price-to-earnings ratio of -57.96 and a beta of 0.93.

Wall Street Analyst Weigh In

Several research firms recently weighed in on FROG. Robert W. Baird boosted their target price on JFrog from $32.00 to $36.00 and gave the stock an "outperform" rating in a research note on Friday, November 8th. Cantor Fitzgerald restated an "overweight" rating and set a $35.00 price objective on shares of JFrog in a research report on Tuesday, October 29th. TD Cowen lifted their price target on shares of JFrog from $32.00 to $35.00 and gave the stock a "buy" rating in a research note on Monday, October 28th. KeyCorp raised their price objective on JFrog from $30.00 to $32.00 and gave the stock an "overweight" rating in a report on Thursday, September 12th. Finally, Scotiabank boosted their target price on JFrog from $25.00 to $30.00 and gave the company a "sector perform" rating in a report on Friday, November 8th. Three equities research analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $37.72.

Get Our Latest Analysis on JFrog

Insider Transactions at JFrog

In other news, CTO Yoav Landman sold 15,000 shares of JFrog stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $28.00, for a total transaction of $420,000.00. Following the completion of the sale, the chief technology officer now directly owns 6,627,242 shares in the company, valued at approximately $185,562,776. This trade represents a 0.23 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CRO Tali Notman sold 11,621 shares of the company's stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $27.06, for a total value of $314,464.26. Following the completion of the sale, the executive now owns 547,413 shares in the company, valued at approximately $14,812,995.78. This represents a 2.08 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 143,806 shares of company stock valued at $4,185,802. Corporate insiders own 15.70% of the company's stock.

JFrog Company Profile

(

Free Report)

JFrog Ltd. provides end-to-end hybrid software supply chain platform in the United States, Israel, India, and internationally. The company offers JFrog Artifactory, a package repository that allows teams and organizations to store, update, and manage their software packages; JFrog Curation that functions as a guardian outside the software development pipeline, controlling the admission of packages into an organization, primarily from open source or public repositories; JFrog Xray, which scans JFrog Artifactory to secure all software packages; JFrog Advanced Security, an optional add-on for select JFrog subscriptions; and JFrog Distribution that provides software package distribution.

Recommended Stories

Before you consider JFrog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JFrog wasn't on the list.

While JFrog currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.