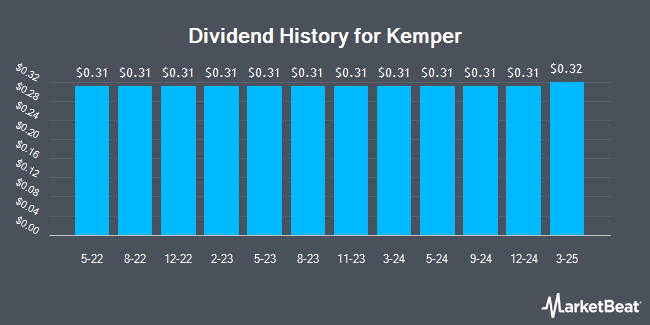

Kemper Co. (NYSE:KMPR - Get Free Report) declared a quarterly dividend on Thursday, November 7th,Wall Street Journal reports. Shareholders of record on Monday, November 18th will be paid a dividend of 0.31 per share by the insurance provider on Wednesday, December 4th. This represents a $1.24 annualized dividend and a yield of 1.83%. The ex-dividend date of this dividend is Monday, November 18th.

Kemper has increased its dividend by an average of 1.1% per year over the last three years. Kemper has a dividend payout ratio of 20.9% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect Kemper to earn $5.98 per share next year, which means the company should continue to be able to cover its $1.24 annual dividend with an expected future payout ratio of 20.7%.

Kemper Trading Up 3.2 %

Shares of KMPR traded up $2.09 during mid-day trading on Friday, reaching $67.82. 488,505 shares of the company were exchanged, compared to its average volume of 376,376. The business has a 50 day simple moving average of $61.92 and a two-hundred day simple moving average of $60.91. The company has a debt-to-equity ratio of 0.50, a quick ratio of 0.22 and a current ratio of 0.22. The stock has a market capitalization of $4.34 billion, a PE ratio of 16.15 and a beta of 0.85. Kemper has a 52 week low of $38.52 and a 52 week high of $68.12.

Kemper (NYSE:KMPR - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The insurance provider reported $1.62 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.34 by $0.28. Kemper had a net margin of 5.86% and a return on equity of 12.03%. The firm had revenue of $1.18 billion during the quarter, compared to analyst estimates of $1.07 billion. During the same quarter last year, the business earned ($0.44) EPS. The company's revenue was down 1.7% compared to the same quarter last year. On average, analysts predict that Kemper will post 5.17 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on the company. JMP Securities reissued a "market outperform" rating and issued a $85.00 price objective on shares of Kemper in a research report on Tuesday, October 15th. StockNews.com raised Kemper from a "hold" rating to a "buy" rating in a research note on Monday, November 4th. Raymond James increased their price target on Kemper from $70.00 to $75.00 and gave the stock a "strong-buy" rating in a report on Thursday, August 8th. UBS Group lifted their price objective on shares of Kemper from $67.00 to $71.00 and gave the company a "buy" rating in a research note on Tuesday, August 13th. Finally, Piper Sandler increased their target price on shares of Kemper from $77.00 to $80.00 and gave the stock an "overweight" rating in a research note on Tuesday, August 6th. Five analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus price target of $76.20.

View Our Latest Research Report on KMPR

Kemper Company Profile

(

Get Free Report)

Kemper Corporation, a diversified insurance holding company, engages in the provision of insurance products to individuals and businesses in the United States. The company operates through three segments: Specialty Property & Casualty Insurance, Preferred Property & Casualty Insurance, and Life & Health Insurance.

Recommended Stories

Before you consider Kemper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kemper wasn't on the list.

While Kemper currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.