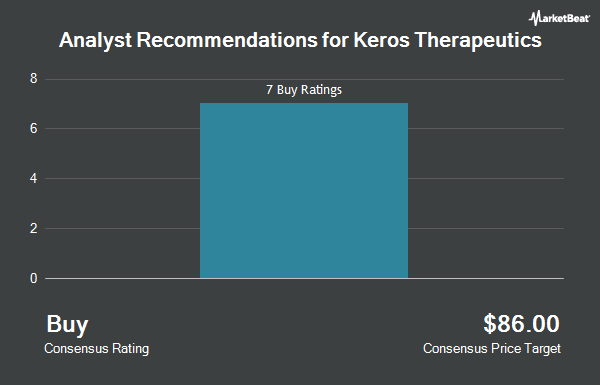

Shares of Keros Therapeutics, Inc. (NASDAQ:KROS - Get Free Report) have been assigned a consensus rating of "Buy" from the twelve analysts that are presently covering the company, Marketbeat reports. Twelve investment analysts have rated the stock with a buy recommendation. The average 1 year price target among brokers that have covered the stock in the last year is $88.89.

KROS has been the topic of several research analyst reports. Cantor Fitzgerald restated an "overweight" rating on shares of Keros Therapeutics in a research report on Friday. Guggenheim started coverage on shares of Keros Therapeutics in a research report on Monday, September 23rd. They set a "buy" rating and a $96.00 target price on the stock. Wedbush reissued an "outperform" rating and set a $84.00 price target on shares of Keros Therapeutics in a research note on Thursday, November 7th. Scotiabank initiated coverage on Keros Therapeutics in a report on Wednesday, October 16th. They issued a "sector outperform" rating and a $77.00 price target on the stock. Finally, Jefferies Financial Group began coverage on Keros Therapeutics in a report on Tuesday, November 5th. They set a "buy" rating for the company.

Get Our Latest Stock Report on Keros Therapeutics

Keros Therapeutics Stock Up 3.9 %

Shares of NASDAQ KROS opened at $55.92 on Friday. The stock has a fifty day moving average price of $59.30 and a 200 day moving average price of $52.26. Keros Therapeutics has a 1-year low of $27.31 and a 1-year high of $73.00.

Keros Therapeutics (NASDAQ:KROS - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported ($1.41) earnings per share for the quarter, missing analysts' consensus estimates of ($1.28) by ($0.13). Keros Therapeutics had a negative net margin of 27,890.94% and a negative return on equity of 41.74%. The business had revenue of $0.39 million during the quarter. During the same quarter in the previous year, the company earned ($1.33) earnings per share. The company's quarterly revenue was up 4750.0% compared to the same quarter last year. As a group, sell-side analysts expect that Keros Therapeutics will post -5.28 EPS for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Point72 Asset Management L.P. boosted its holdings in shares of Keros Therapeutics by 155.9% during the third quarter. Point72 Asset Management L.P. now owns 947,570 shares of the company's stock worth $55,025,000 after purchasing an additional 577,220 shares during the last quarter. Redmile Group LLC acquired a new stake in shares of Keros Therapeutics during the 1st quarter worth $36,576,000. Darwin Global Management Ltd. raised its position in shares of Keros Therapeutics by 35.4% in the 1st quarter. Darwin Global Management Ltd. now owns 1,435,950 shares of the company's stock worth $95,060,000 after buying an additional 375,523 shares during the period. Alkeon Capital Management LLC boosted its holdings in Keros Therapeutics by 18.7% in the third quarter. Alkeon Capital Management LLC now owns 1,897,601 shares of the company's stock valued at $110,194,000 after acquiring an additional 298,694 shares during the last quarter. Finally, Parkman Healthcare Partners LLC grew its position in Keros Therapeutics by 112.3% during the third quarter. Parkman Healthcare Partners LLC now owns 421,782 shares of the company's stock valued at $24,493,000 after acquiring an additional 223,155 shares during the period. 71.56% of the stock is currently owned by hedge funds and other institutional investors.

Keros Therapeutics Company Profile

(

Get Free ReportKeros Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops and commercializes novel therapeutics for patients with disorders that are linked to dysfunctional signaling of the transforming growth factor-beta family of proteins in the United States. The company's lead product candidate is KER-050, which is being developed for the treatment of low blood cell counts, or cytopenias, including anemia and thrombocytopenia in patients with myelodysplastic syndromes, as well as in patients with myelofibrosis.

See Also

Before you consider Keros Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keros Therapeutics wasn't on the list.

While Keros Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.