Kornitzer Capital Management Inc. KS raised its position in shares of QuidelOrtho Co. (NASDAQ:QDEL - Free Report) by 46.7% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 207,685 shares of the company's stock after purchasing an additional 66,080 shares during the period. Kornitzer Capital Management Inc. KS owned 0.31% of QuidelOrtho worth $9,470,000 at the end of the most recent quarter.

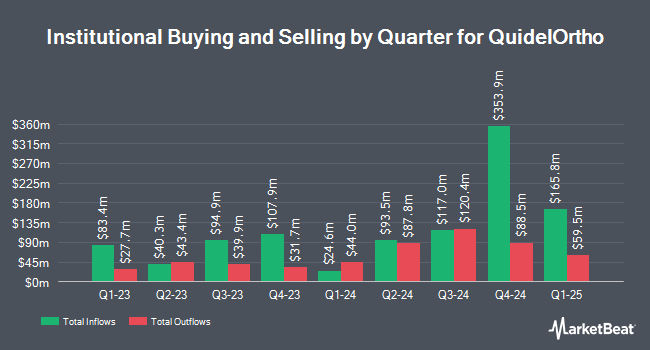

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the company. Texas Permanent School Fund Corp lifted its stake in shares of QuidelOrtho by 1.3% in the 1st quarter. Texas Permanent School Fund Corp now owns 43,275 shares of the company's stock worth $2,075,000 after acquiring an additional 560 shares during the period. Quantbot Technologies LP acquired a new stake in shares of QuidelOrtho in the 1st quarter worth approximately $689,000. SG Americas Securities LLC lifted its stake in shares of QuidelOrtho by 55.4% in the 1st quarter. SG Americas Securities LLC now owns 6,930 shares of the company's stock worth $332,000 after acquiring an additional 2,470 shares during the period. Susquehanna Fundamental Investments LLC acquired a new stake in shares of QuidelOrtho in the 1st quarter worth approximately $1,178,000. Finally, Headlands Technologies LLC acquired a new stake in shares of QuidelOrtho in the 1st quarter worth approximately $86,000. 99.00% of the stock is owned by institutional investors and hedge funds.

QuidelOrtho Stock Up 12.7 %

Shares of QDEL stock traded up $4.94 during trading hours on Friday, reaching $43.79. 2,488,349 shares of the stock traded hands, compared to its average volume of 970,354. QuidelOrtho Co. has a 1-year low of $29.74 and a 1-year high of $75.86. The business has a fifty day moving average price of $42.24 and a 200 day moving average price of $40.42. The company has a quick ratio of 0.79, a current ratio of 1.44 and a debt-to-equity ratio of 0.70.

QuidelOrtho (NASDAQ:QDEL - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The company reported $0.85 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.30 by $0.55. QuidelOrtho had a negative net margin of 65.60% and a positive return on equity of 3.87%. The business had revenue of $727.00 million for the quarter, compared to analyst estimates of $642.16 million. During the same quarter in the previous year, the business earned $0.90 earnings per share. The firm's revenue was down 2.3% compared to the same quarter last year. As a group, equities research analysts predict that QuidelOrtho Co. will post 1.72 earnings per share for the current year.

Analysts Set New Price Targets

A number of analysts recently commented on QDEL shares. UBS Group started coverage on shares of QuidelOrtho in a report on Thursday, September 19th. They issued a "neutral" rating and a $50.00 target price on the stock. Royal Bank of Canada reiterated an "outperform" rating and issued a $61.00 target price on shares of QuidelOrtho in a report on Friday, August 16th. Finally, Craig Hallum upgraded shares of QuidelOrtho from a "hold" rating to a "buy" rating and boosted their target price for the stock from $40.00 to $57.00 in a report on Thursday, September 5th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $58.83.

View Our Latest Analysis on QDEL

QuidelOrtho Profile

(

Free Report)

QuidelOrtho Corporation provides diagnostic testing solutions. The company operates through Labs, Transfusion Medicine, Point-of-Care, and Molecular Diagnostics business units. The Labs business unit provides clinical chemistry laboratory instruments and tests that measure target chemicals in bodily fluids for the evaluation of health and the clinical management of patients; immunoassay laboratory instruments and tests, which measure proteins as they act as antigens in the spread of disease, antibodies in the immune response spurred by disease, or markers of proper organ function and health; testing products to detect and monitor disease progression across a spectrum of therapeutic areas; and specialized diagnostic solutions.

Recommended Stories

Before you consider QuidelOrtho, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuidelOrtho wasn't on the list.

While QuidelOrtho currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.