JMP Securities reaffirmed their market outperform rating on shares of Kura Oncology (NASDAQ:KURA - Free Report) in a research note released on Tuesday,Benzinga reports. They currently have a $32.00 price target on the stock.

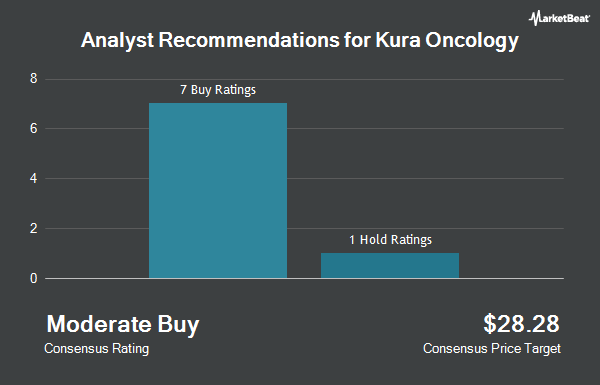

Several other research firms also recently weighed in on KURA. UBS Group began coverage on Kura Oncology in a research report on Thursday, October 24th. They set a "buy" rating and a $27.00 target price on the stock. Lifesci Capital upgraded shares of Kura Oncology to a "strong-buy" rating in a research report on Tuesday, October 22nd. StockNews.com upgraded shares of Kura Oncology from a "sell" rating to a "hold" rating in a report on Tuesday, November 12th. Cantor Fitzgerald reiterated an "overweight" rating on shares of Kura Oncology in a report on Wednesday, November 6th. Finally, Wedbush reissued an "outperform" rating and issued a $37.00 price objective on shares of Kura Oncology in a research report on Monday, November 4th. Two investment analysts have rated the stock with a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $28.83.

Get Our Latest Stock Report on Kura Oncology

Kura Oncology Price Performance

KURA stock traded down $0.08 during trading on Tuesday, hitting $15.96. 620,962 shares of the company's stock traded hands, compared to its average volume of 893,848. The stock has a market capitalization of $1.24 billion, a price-to-earnings ratio of -6.76 and a beta of 0.86. Kura Oncology has a 52 week low of $9.06 and a 52 week high of $24.17. The company has a debt-to-equity ratio of 0.02, a quick ratio of 11.47 and a current ratio of 11.47. The business has a fifty day simple moving average of $18.36 and a 200 day simple moving average of $19.85.

Institutional Investors Weigh In On Kura Oncology

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Suvretta Capital Management LLC raised its stake in shares of Kura Oncology by 8.2% during the third quarter. Suvretta Capital Management LLC now owns 7,652,782 shares of the company's stock valued at $149,535,000 after acquiring an additional 583,155 shares in the last quarter. Vanguard Group Inc. raised its position in Kura Oncology by 0.7% during the 1st quarter. Vanguard Group Inc. now owns 4,065,903 shares of the company's stock valued at $86,726,000 after purchasing an additional 28,212 shares in the last quarter. Avoro Capital Advisors LLC raised its position in Kura Oncology by 29.2% during the 1st quarter. Avoro Capital Advisors LLC now owns 3,850,000 shares of the company's stock valued at $82,120,000 after purchasing an additional 870,000 shares in the last quarter. Armistice Capital LLC lifted its holdings in shares of Kura Oncology by 14.7% in the 2nd quarter. Armistice Capital LLC now owns 2,350,000 shares of the company's stock worth $48,386,000 after buying an additional 302,000 shares during the period. Finally, Artal Group S.A. grew its position in shares of Kura Oncology by 8.6% during the 1st quarter. Artal Group S.A. now owns 1,919,884 shares of the company's stock worth $40,951,000 after buying an additional 151,828 shares in the last quarter.

Kura Oncology Company Profile

(

Get Free Report)

Kura Oncology, Inc, a clinical-stage biopharmaceutical company, develops medicines for the treatment of cancer. The company's pipeline consists of small molecule product candidates that target cancer. Its lead product candidates are ziftomenib, an orally bioavailable small molecule inhibitor of the menin-KMT2A interaction for the treatment of genetically defined subsets of acute leukemias, including acute myeloid leukemia and acute lymphoblastic leukemia; tipifarnib, an orally bioavailable farnesyl transferase inhibitor combination with alpelisib for patients with PIK3CA-dependent HNSCC; and KO-2806, a farnesyl transferase inhibitor for the treatment of solid tumors.

See Also

Before you consider Kura Oncology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kura Oncology wasn't on the list.

While Kura Oncology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.