Kura Sushi USA (NASDAQ:KRUS - Get Free Report) had its target price boosted by research analysts at Craig Hallum from $85.00 to $120.00 in a research report issued to clients and investors on Thursday,Benzinga reports. The firm currently has a "buy" rating on the stock. Craig Hallum's price objective suggests a potential upside of 26.08% from the stock's current price.

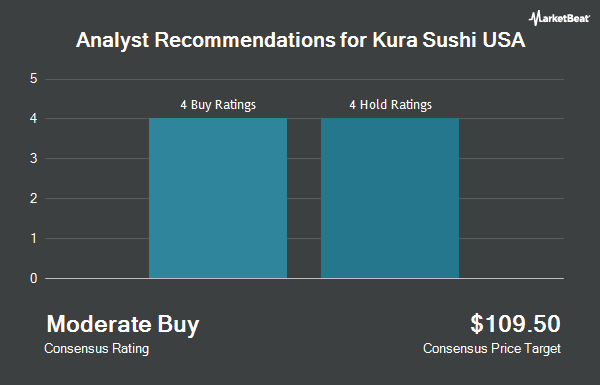

Other equities research analysts have also recently issued research reports about the company. Northcoast Research began coverage on Kura Sushi USA in a report on Tuesday, September 10th. They set a "buy" rating and a $79.00 price objective on the stock. Roth Mkm reaffirmed a "buy" rating and set a $70.00 price target (down from $90.00) on shares of Kura Sushi USA in a research report on Wednesday, July 10th. Piper Sandler increased their price target on Kura Sushi USA from $63.00 to $98.00 and gave the company a "neutral" rating in a report on Thursday. Barclays boosted their target price on shares of Kura Sushi USA from $60.00 to $70.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 22nd. Finally, Benchmark reissued a "buy" rating and issued a $90.00 target price on shares of Kura Sushi USA in a research report on Wednesday, July 10th. Four research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, Kura Sushi USA presently has an average rating of "Moderate Buy" and a consensus price target of $82.38.

Get Our Latest Stock Analysis on KRUS

Kura Sushi USA Stock Down 8.0 %

Kura Sushi USA stock traded down $8.30 during mid-day trading on Thursday, hitting $95.18. The company had a trading volume of 289,113 shares, compared to its average volume of 160,747. The business has a fifty day moving average of $82.44 and a 200 day moving average of $80.41. Kura Sushi USA has a 1 year low of $48.66 and a 1 year high of $122.81. The stock has a market cap of $1.07 billion, a price-to-earnings ratio of -1,371.43 and a beta of 1.86.

Kura Sushi USA (NASDAQ:KRUS - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported $0.09 earnings per share for the quarter, beating the consensus estimate of $0.02 by $0.07. Kura Sushi USA had a negative net margin of 0.30% and a negative return on equity of 0.07%. The business had revenue of $66.01 million for the quarter, compared to the consensus estimate of $64.13 million. Equities analysts anticipate that Kura Sushi USA will post -0.26 earnings per share for the current year.

Institutional Trading of Kura Sushi USA

Several institutional investors and hedge funds have recently made changes to their positions in KRUS. Lazard Asset Management LLC increased its stake in shares of Kura Sushi USA by 144.0% in the 1st quarter. Lazard Asset Management LLC now owns 62,031 shares of the company's stock valued at $7,143,000 after acquiring an additional 36,609 shares during the last quarter. Russell Investments Group Ltd. grew its holdings in shares of Kura Sushi USA by 42.6% in the 1st quarter. Russell Investments Group Ltd. now owns 103,290 shares of the company's stock valued at $11,895,000 after buying an additional 30,836 shares during the period. Roubaix Capital LLC increased its position in shares of Kura Sushi USA by 104.8% in the 3rd quarter. Roubaix Capital LLC now owns 56,979 shares of the company's stock valued at $4,590,000 after buying an additional 29,158 shares in the last quarter. Castleark Management LLC acquired a new stake in Kura Sushi USA during the 1st quarter worth $3,326,000. Finally, Lord Abbett & CO. LLC lifted its holdings in Kura Sushi USA by 28.1% during the first quarter. Lord Abbett & CO. LLC now owns 103,916 shares of the company's stock worth $11,967,000 after acquiring an additional 22,823 shares in the last quarter. Institutional investors own 65.49% of the company's stock.

About Kura Sushi USA

(

Get Free Report)

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kura Sushi USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kura Sushi USA wasn't on the list.

While Kura Sushi USA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.