Leeward Investments LLC MA lowered its position in First Horizon Co. (NYSE:FHN - Free Report) by 9.0% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 2,022,145 shares of the financial services provider's stock after selling 199,919 shares during the period. First Horizon comprises approximately 1.5% of Leeward Investments LLC MA's holdings, making the stock its 7th largest position. Leeward Investments LLC MA owned about 0.38% of First Horizon worth $31,404,000 at the end of the most recent quarter.

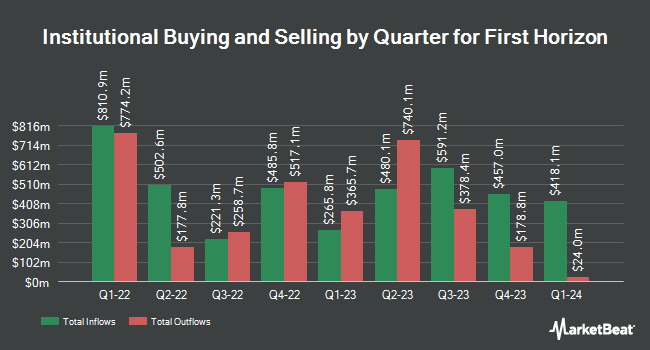

Other hedge funds have also recently added to or reduced their stakes in the company. M&G PLC increased its stake in shares of First Horizon by 2.9% during the 3rd quarter. M&G PLC now owns 618,728 shares of the financial services provider's stock worth $9,900,000 after purchasing an additional 17,711 shares in the last quarter. Concurrent Investment Advisors LLC acquired a new position in shares of First Horizon in the 3rd quarter valued at $174,000. Radnor Capital Management LLC acquired a new position in shares of First Horizon in the 3rd quarter valued at $587,000. Greenwood Capital Associates LLC boosted its holdings in shares of First Horizon by 10.1% in the 3rd quarter. Greenwood Capital Associates LLC now owns 465,513 shares of the financial services provider's stock valued at $7,229,000 after purchasing an additional 42,793 shares during the last quarter. Finally, Harbor Capital Advisors Inc. lifted its holdings in shares of First Horizon by 127.1% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 105,866 shares of the financial services provider's stock valued at $1,644,000 after acquiring an additional 59,258 shares in the last quarter. Institutional investors and hedge funds own 80.28% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts have weighed in on the stock. Raymond James cut shares of First Horizon from a "strong-buy" rating to an "outperform" rating and set a $18.00 price objective for the company. in a research report on Thursday, July 18th. Evercore ISI increased their price objective on shares of First Horizon from $18.00 to $20.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 30th. Stephens increased their price objective on shares of First Horizon from $18.00 to $20.00 and gave the stock an "overweight" rating in a research note on Thursday, October 17th. JPMorgan Chase & Co. dropped their price target on shares of First Horizon from $19.00 to $18.00 and set a "neutral" rating on the stock in a research note on Wednesday, October 9th. Finally, Keefe, Bruyette & Woods reiterated a "market perform" rating and issued a $18.00 price objective on shares of First Horizon in a report on Wednesday, July 17th. Six research analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. According to MarketBeat, First Horizon currently has a consensus rating of "Moderate Buy" and a consensus price target of $17.92.

Get Our Latest Report on FHN

First Horizon Stock Down 2.5 %

Shares of First Horizon stock traded down $0.50 on Thursday, hitting $19.60. The company had a trading volume of 11,401,452 shares, compared to its average volume of 6,624,266. The firm has a market capitalization of $10.50 billion, a P/E ratio of 14.56, a P/E/G ratio of 1.27 and a beta of 0.86. First Horizon Co. has a twelve month low of $10.96 and a twelve month high of $20.11. The company has a debt-to-equity ratio of 0.14, a current ratio of 1.84 and a quick ratio of 0.95. The stock has a 50-day moving average of $16.31 and a 200-day moving average of $15.85.

First Horizon (NYSE:FHN - Get Free Report) last posted its quarterly earnings results on Wednesday, October 16th. The financial services provider reported $0.42 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.38 by $0.04. First Horizon had a net margin of 15.43% and a return on equity of 9.51%. The firm had revenue of $1.32 billion for the quarter, compared to analyst estimates of $821.63 million. During the same period in the prior year, the firm posted $0.27 earnings per share. Research analysts predict that First Horizon Co. will post 1.48 earnings per share for the current year.

First Horizon Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, December 13th will be paid a dividend of $0.15 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.60 dividend on an annualized basis and a yield of 3.06%. First Horizon's payout ratio is 43.48%.

First Horizon declared that its Board of Directors has initiated a share repurchase plan on Tuesday, October 29th that allows the company to repurchase $1.00 billion in shares. This repurchase authorization allows the financial services provider to buy up to 10.6% of its stock through open market purchases. Stock repurchase plans are generally an indication that the company's board of directors believes its shares are undervalued.

First Horizon Profile

(

Free Report)

First Horizon Corporation operates as the bank holding company for First Horizon Bank that provides various financial services. The company operates through Regional Banking and Specialty Banking segments. It offers general banking services for consumers, businesses, financial institutions, and governments.

See Also

Before you consider First Horizon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Horizon wasn't on the list.

While First Horizon currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.