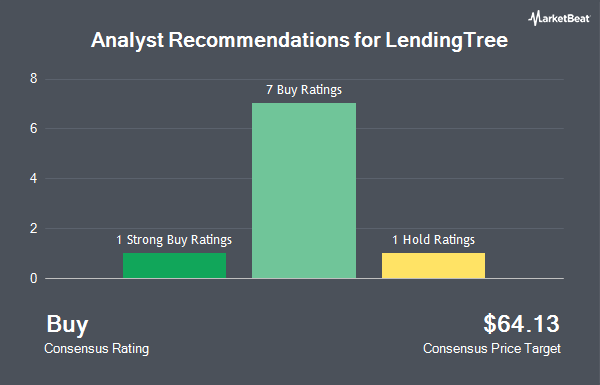

LendingTree, Inc. (NASDAQ:TREE - Get Free Report) has been given a consensus rating of "Moderate Buy" by the eight analysts that are covering the firm, Marketbeat reports. Two analysts have rated the stock with a hold recommendation and six have given a buy recommendation to the company. The average 1-year target price among brokerages that have issued a report on the stock in the last year is $64.00.

A number of brokerages have issued reports on TREE. Susquehanna increased their price target on LendingTree from $50.00 to $58.00 and gave the company a "neutral" rating in a research note on Friday, November 1st. Stephens increased their target price on shares of LendingTree from $55.00 to $65.00 and gave the company an "overweight" rating in a research note on Monday, July 29th. StockNews.com upgraded shares of LendingTree from a "hold" rating to a "buy" rating in a research report on Sunday. Keefe, Bruyette & Woods lifted their target price on LendingTree from $71.00 to $73.00 and gave the stock an "outperform" rating in a report on Friday, November 1st. Finally, Needham & Company LLC upped their target price on LendingTree from $67.00 to $78.00 and gave the company a "buy" rating in a report on Friday, November 1st.

Check Out Our Latest Report on LendingTree

Insider Activity at LendingTree

In related news, General Counsel Heather Enlow-Novitsky sold 564 shares of LendingTree stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $52.54, for a total transaction of $29,632.56. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 23.40% of the stock is currently owned by company insiders.

Institutional Trading of LendingTree

Large investors have recently bought and sold shares of the business. CWM LLC grew its holdings in LendingTree by 230.8% in the 2nd quarter. CWM LLC now owns 602 shares of the financial services provider's stock valued at $25,000 after buying an additional 420 shares in the last quarter. nVerses Capital LLC grew its holdings in shares of LendingTree by 200.0% during the third quarter. nVerses Capital LLC now owns 1,200 shares of the financial services provider's stock worth $70,000 after purchasing an additional 800 shares during the last quarter. Headlands Technologies LLC increased its position in LendingTree by 16.8% in the 1st quarter. Headlands Technologies LLC now owns 1,881 shares of the financial services provider's stock valued at $80,000 after acquiring an additional 270 shares during the period. Quest Partners LLC bought a new position in LendingTree during the 2nd quarter worth $132,000. Finally, Meeder Asset Management Inc. acquired a new position in shares of LendingTree in the second quarter worth approximately $139,000. 68.26% of the stock is owned by institutional investors.

LendingTree Stock Performance

Shares of TREE traded down $1.37 during mid-day trading on Thursday, reaching $48.45. 216,626 shares of the company's stock traded hands, compared to its average volume of 238,125. The company has a debt-to-equity ratio of 3.67, a quick ratio of 0.92 and a current ratio of 0.92. The business's 50-day moving average price is $55.09 and its 200-day moving average price is $49.93. The stock has a market capitalization of $647.39 million, a P/E ratio of -17.93 and a beta of 2.11. LendingTree has a 12 month low of $15.10 and a 12 month high of $62.49.

About LendingTree

(

Get Free ReportLendingTree, Inc, through its subsidiary, operates online consumer platform in the United States. It operates through three segments: Home, Consumer, and Insurance. The Home segment offers purchase mortgage, refinance mortgage, and home equity loans and lines of credit; and real estate brokerage services.

Recommended Stories

Before you consider LendingTree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingTree wasn't on the list.

While LendingTree currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.