Landscape Capital Management L.L.C. cut its stake in Life Time Group Holdings, Inc. (NYSE:LTH - Free Report) by 38.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 60,390 shares of the company's stock after selling 37,775 shares during the period. Landscape Capital Management L.L.C.'s holdings in Life Time Group were worth $1,475,000 at the end of the most recent quarter.

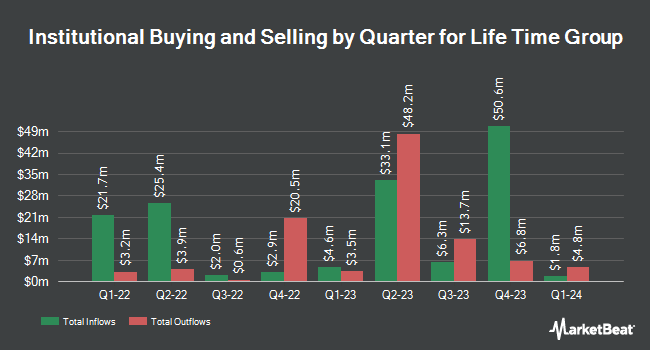

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Hood River Capital Management LLC boosted its position in shares of Life Time Group by 3,657.9% during the 1st quarter. Hood River Capital Management LLC now owns 1,257,960 shares of the company's stock worth $19,524,000 after purchasing an additional 1,224,485 shares in the last quarter. Dimensional Fund Advisors LP boosted its holdings in Life Time Group by 19.8% in the second quarter. Dimensional Fund Advisors LP now owns 4,658,902 shares of the company's stock worth $87,728,000 after acquiring an additional 770,766 shares in the last quarter. Braun Stacey Associates Inc. grew its stake in Life Time Group by 113.7% in the third quarter. Braun Stacey Associates Inc. now owns 849,792 shares of the company's stock valued at $20,752,000 after acquiring an additional 452,197 shares during the period. Millennium Management LLC increased its holdings in shares of Life Time Group by 66.7% during the second quarter. Millennium Management LLC now owns 1,076,386 shares of the company's stock valued at $20,268,000 after acquiring an additional 430,779 shares in the last quarter. Finally, Sona Asset Management US LLC acquired a new position in shares of Life Time Group during the first quarter worth approximately $5,044,000. Institutional investors and hedge funds own 79.40% of the company's stock.

Insider Buying and Selling at Life Time Group

In related news, CFO Erik Weaver sold 4,662 shares of Life Time Group stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $25.88, for a total value of $120,652.56. Following the completion of the transaction, the chief financial officer now directly owns 75,866 shares in the company, valued at approximately $1,963,412.08. The trade was a 5.79 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 12.50% of the company's stock.

Life Time Group Stock Performance

Shares of NYSE LTH traded up $0.15 during mid-day trading on Friday, reaching $24.53. 1,204,387 shares of the company's stock were exchanged, compared to its average volume of 1,115,194. The firm has a market capitalization of $5.08 billion, a price-to-earnings ratio of 35.55, a price-to-earnings-growth ratio of 1.58 and a beta of 1.89. The firm has a 50-day moving average price of $24.42 and a two-hundred day moving average price of $21.44. The company has a debt-to-equity ratio of 0.64, a current ratio of 0.59 and a quick ratio of 0.46. Life Time Group Holdings, Inc. has a 52 week low of $11.89 and a 52 week high of $27.11.

Life Time Group (NYSE:LTH - Get Free Report) last released its earnings results on Thursday, October 24th. The company reported $0.19 earnings per share for the quarter, missing analysts' consensus estimates of $0.20 by ($0.01). The company had revenue of $693.20 million for the quarter, compared to the consensus estimate of $684.13 million. Life Time Group had a net margin of 5.67% and a return on equity of 6.42%. The firm's revenue was up 18.5% on a year-over-year basis. During the same period in the prior year, the company earned $0.09 earnings per share. Analysts predict that Life Time Group Holdings, Inc. will post 0.56 EPS for the current year.

Wall Street Analysts Forecast Growth

LTH has been the topic of a number of recent research reports. Morgan Stanley raised their price objective on shares of Life Time Group from $21.00 to $29.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 16th. Northland Securities increased their price objective on Life Time Group from $28.50 to $29.00 and gave the stock an "outperform" rating in a research note on Friday, October 25th. Bank of America lifted their target price on Life Time Group from $29.00 to $30.00 and gave the company a "buy" rating in a research report on Friday, September 6th. Wells Fargo & Company increased their price target on Life Time Group from $21.00 to $25.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 16th. Finally, The Goldman Sachs Group raised their price objective on Life Time Group from $15.00 to $22.00 and gave the company a "neutral" rating in a research note on Friday, August 2nd. Three analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat, Life Time Group has a consensus rating of "Moderate Buy" and an average target price of $27.78.

View Our Latest Stock Analysis on LTH

Life Time Group Profile

(

Free Report)

Life Time Group Holdings, Inc provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada. It primarily engages in designing, building, and operating of sports and athletic, professional fitness, family recreation, and spa centers in a resort-like environment, principally in suburban and urban locations of metropolitan areas.

Further Reading

Before you consider Life Time Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Life Time Group wasn't on the list.

While Life Time Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.