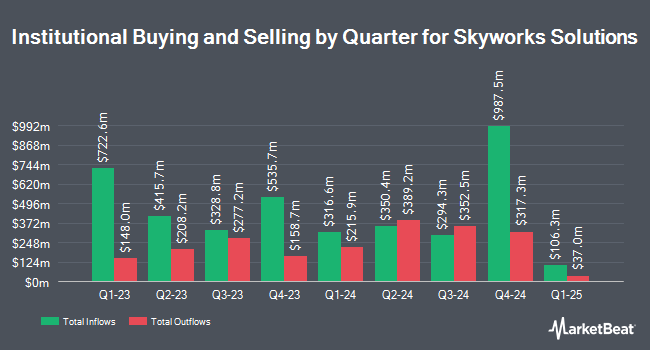

Lifeworks Advisors LLC lowered its stake in shares of Skyworks Solutions, Inc. (NASDAQ:SWKS - Free Report) by 73.8% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 4,546 shares of the semiconductor manufacturer's stock after selling 12,795 shares during the period. Lifeworks Advisors LLC's holdings in Skyworks Solutions were worth $449,000 at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in SWKS. Tokio Marine Asset Management Co. Ltd. raised its position in shares of Skyworks Solutions by 30.4% in the third quarter. Tokio Marine Asset Management Co. Ltd. now owns 4,388 shares of the semiconductor manufacturer's stock worth $433,000 after buying an additional 1,022 shares in the last quarter. Simmons Bank raised its position in shares of Skyworks Solutions by 34.8% in the third quarter. Simmons Bank now owns 4,833 shares of the semiconductor manufacturer's stock worth $477,000 after buying an additional 1,249 shares in the last quarter. Winslow Asset Management Inc. raised its position in shares of Skyworks Solutions by 1.1% in the third quarter. Winslow Asset Management Inc. now owns 87,937 shares of the semiconductor manufacturer's stock worth $8,686,000 after buying an additional 969 shares in the last quarter. Sumitomo Mitsui Trust Group Inc. raised its position in shares of Skyworks Solutions by 2.6% in the third quarter. Sumitomo Mitsui Trust Group Inc. now owns 440,559 shares of the semiconductor manufacturer's stock worth $43,514,000 after buying an additional 11,182 shares in the last quarter. Finally, GSA Capital Partners LLP purchased a new stake in shares of Skyworks Solutions in the third quarter worth $380,000. Hedge funds and other institutional investors own 85.43% of the company's stock.

Skyworks Solutions Stock Down 0.4 %

SWKS traded down $0.31 on Friday, hitting $83.69. The company had a trading volume of 3,278,401 shares, compared to its average volume of 2,382,870. The company has a debt-to-equity ratio of 0.16, a current ratio of 3.01 and a quick ratio of 4.29. Skyworks Solutions, Inc. has a 52-week low of $82.13 and a 52-week high of $120.86. The stock has a fifty day simple moving average of $95.14 and a 200-day simple moving average of $100.20. The firm has a market capitalization of $13.37 billion, a P/E ratio of 22.62, a P/E/G ratio of 3.77 and a beta of 1.21.

Skyworks Solutions (NASDAQ:SWKS - Get Free Report) last released its earnings results on Tuesday, November 12th. The semiconductor manufacturer reported $1.55 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.52 by $0.03. The firm had revenue of $1.03 billion during the quarter, compared to analyst estimates of $1.02 billion. Skyworks Solutions had a net margin of 14.27% and a return on equity of 13.71%. The business's revenue was down 15.9% on a year-over-year basis. During the same period last year, the business earned $1.95 earnings per share. As a group, equities analysts expect that Skyworks Solutions, Inc. will post 5.39 EPS for the current fiscal year.

Skyworks Solutions Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 24th. Shareholders of record on Tuesday, December 3rd will be given a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a yield of 3.35%. The ex-dividend date is Tuesday, December 3rd. Skyworks Solutions's dividend payout ratio (DPR) is presently 75.68%.

Insiders Place Their Bets

In other news, SVP Carlos S. Bori sold 9,321 shares of the business's stock in a transaction on Friday, September 13th. The shares were sold at an average price of $101.97, for a total transaction of $950,462.37. Following the completion of the sale, the senior vice president now owns 37,203 shares of the company's stock, valued at $3,793,589.91. The trade was a 20.03 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, SVP Robert John Terry sold 10,522 shares of Skyworks Solutions stock in a transaction on Monday, November 11th. The shares were sold at an average price of $88.01, for a total transaction of $926,041.22. Following the transaction, the senior vice president now owns 15,960 shares in the company, valued at approximately $1,404,639.60. This trade represents a 39.73 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 31,841 shares of company stock valued at $3,034,265. Company insiders own 0.34% of the company's stock.

Analysts Set New Price Targets

A number of brokerages recently issued reports on SWKS. JPMorgan Chase & Co. lowered their price objective on Skyworks Solutions from $120.00 to $100.00 and set a "neutral" rating on the stock in a research report on Wednesday. Stifel Nicolaus increased their target price on Skyworks Solutions from $112.00 to $125.00 and gave the company a "buy" rating in a research note on Wednesday, July 31st. Piper Sandler reduced their target price on Skyworks Solutions from $95.00 to $85.00 and set a "neutral" rating on the stock in a research note on Wednesday. Benchmark reissued a "hold" rating on shares of Skyworks Solutions in a research note on Wednesday. Finally, Rosenblatt Securities increased their target price on Skyworks Solutions from $120.00 to $130.00 and gave the company a "buy" rating in a research note on Wednesday, July 31st. Three investment analysts have rated the stock with a sell rating, fifteen have given a hold rating and five have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $101.00.

Read Our Latest Report on Skyworks Solutions

Skyworks Solutions Company Profile

(

Free Report)

Skyworks Solutions, Inc, together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific. Its product portfolio includes amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, DC/DC converters, demodulators, detectors, diodes, wireless analog system on chip products, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, power over ethernet, power isolators, receivers, switches, synthesizers, timing devices, voltage controlled oscillators/synthesizers, and voltage regulators.

Recommended Stories

Before you consider Skyworks Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyworks Solutions wasn't on the list.

While Skyworks Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report