LMR Partners LLP decreased its stake in shares of Elanco Animal Health Incorporated (NYSE:ELAN - Free Report) by 49.5% during the third quarter, according to its most recent filing with the SEC. The institutional investor owned 334,529 shares of the company's stock after selling 327,805 shares during the period. LMR Partners LLP owned 0.07% of Elanco Animal Health worth $4,914,000 as of its most recent SEC filing.

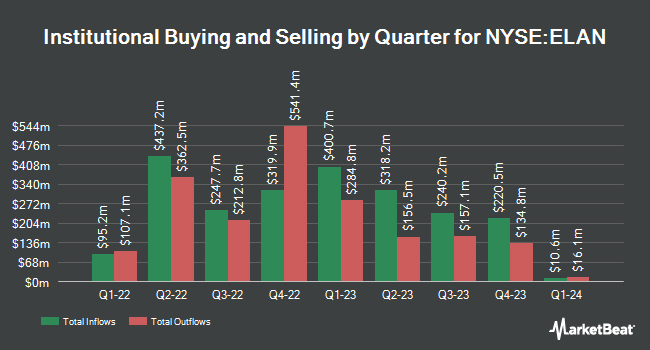

Other large investors have also added to or reduced their stakes in the company. 180 Wealth Advisors LLC increased its holdings in shares of Elanco Animal Health by 3.6% in the 2nd quarter. 180 Wealth Advisors LLC now owns 25,716 shares of the company's stock worth $352,000 after buying an additional 893 shares during the last quarter. HBK Sorce Advisory LLC lifted its stake in Elanco Animal Health by 9.4% during the second quarter. HBK Sorce Advisory LLC now owns 12,920 shares of the company's stock worth $186,000 after purchasing an additional 1,107 shares during the last quarter. Atomi Financial Group Inc. increased its position in shares of Elanco Animal Health by 11.1% during the 2nd quarter. Atomi Financial Group Inc. now owns 12,260 shares of the company's stock valued at $177,000 after purchasing an additional 1,221 shares during the last quarter. Keene & Associates Inc. raised its holdings in shares of Elanco Animal Health by 5.7% during the 3rd quarter. Keene & Associates Inc. now owns 22,945 shares of the company's stock valued at $337,000 after buying an additional 1,240 shares in the last quarter. Finally, Resonant Capital Advisors LLC lifted its position in Elanco Animal Health by 5.0% in the 2nd quarter. Resonant Capital Advisors LLC now owns 27,325 shares of the company's stock worth $394,000 after buying an additional 1,306 shares during the last quarter. Institutional investors own 97.48% of the company's stock.

Insider Buying and Selling

In other news, Director Michael J. Harrington acquired 3,500 shares of the stock in a transaction on Thursday, August 22nd. The stock was acquired at an average price of $14.85 per share, with a total value of $51,975.00. Following the completion of the transaction, the director now owns 81,094 shares of the company's stock, valued at $1,204,245.90. This represents a 4.51 % increase in their position. The purchase was disclosed in a filing with the SEC, which can be accessed through this hyperlink. 0.57% of the stock is owned by insiders.

Analyst Ratings Changes

Several research firms have commented on ELAN. Stifel Nicolaus reissued a "buy" rating and set a $20.00 price target on shares of Elanco Animal Health in a research note on Thursday, September 19th. Barclays boosted their price target on shares of Elanco Animal Health from $19.00 to $20.00 and gave the stock an "overweight" rating in a research note on Friday, November 8th. Finally, Morgan Stanley cut Elanco Animal Health from an "overweight" rating to an "equal weight" rating and reduced their price objective for the company from $17.00 to $15.00 in a research note on Thursday, September 19th. One research analyst has rated the stock with a sell rating, two have issued a hold rating and four have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $17.14.

Read Our Latest Analysis on ELAN

Elanco Animal Health Trading Down 1.0 %

Shares of NYSE ELAN traded down $0.14 during trading hours on Tuesday, hitting $13.31. The company's stock had a trading volume of 2,960,681 shares, compared to its average volume of 4,767,413. The business has a 50-day simple moving average of $13.79 and a 200-day simple moving average of $14.77. The stock has a market cap of $6.58 billion, a price-to-earnings ratio of 33.63, a P/E/G ratio of 1.46 and a beta of 1.41. The company has a debt-to-equity ratio of 0.66, a quick ratio of 1.31 and a current ratio of 2.55. Elanco Animal Health Incorporated has a 12 month low of $11.40 and a 12 month high of $18.80.

Elanco Animal Health (NYSE:ELAN - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported $0.13 EPS for the quarter, beating analysts' consensus estimates of $0.12 by $0.01. The company had revenue of $1.03 billion during the quarter, compared to the consensus estimate of $1.04 billion. Elanco Animal Health had a return on equity of 6.78% and a net margin of 4.60%. The firm's revenue for the quarter was down 3.6% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.18 earnings per share. On average, analysts anticipate that Elanco Animal Health Incorporated will post 0.91 earnings per share for the current fiscal year.

Elanco Animal Health Company Profile

(

Free Report)

Elanco Animal Health Incorporated, an animal health company, innovates, develops, manufactures, and markets products for pets and farm animals. It offers pet health disease prevention products, such as parasiticide and vaccine products that protect pets from worms, fleas, and ticks under the Seresto, Advantage, Advantix, and Advocate brands; pet health therapeutics for pain, osteoarthritis, ear infections, cardiovascular, and dermatology indications in canines and felines under the Galliprant and Claro brands; vaccines, antibiotics, parasiticides, and other products for use in poultry and aquaculture production, as well as nutritional health products, including enzymes, probiotics, and prebiotics; and a range of vaccines, antibiotics, implants, parasiticides, and other products used in ruminant and swine production under the Rumensin and Baytril brands.

Featured Stories

Before you consider Elanco Animal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elanco Animal Health wasn't on the list.

While Elanco Animal Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.