Los Angeles Capital Management LLC acquired a new stake in Pitney Bowes Inc. (NYSE:PBI - Free Report) during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor acquired 195,598 shares of the technology company's stock, valued at approximately $1,395,000. Los Angeles Capital Management LLC owned approximately 0.11% of Pitney Bowes at the end of the most recent quarter.

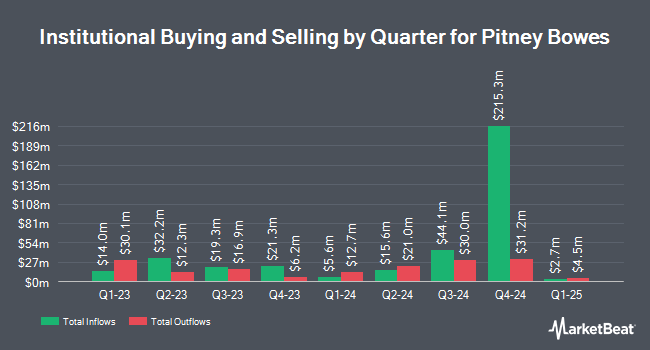

Other institutional investors have also added to or reduced their stakes in the company. James J. Burns & Company LLC bought a new position in shares of Pitney Bowes during the third quarter valued at $121,000. Fiducient Advisors LLC bought a new position in Pitney Bowes during the 3rd quarter valued at about $143,000. New York State Teachers Retirement System lifted its stake in Pitney Bowes by 5.9% during the 3rd quarter. New York State Teachers Retirement System now owns 257,279 shares of the technology company's stock valued at $1,834,000 after acquiring an additional 14,428 shares during the period. Assenagon Asset Management S.A. grew its stake in shares of Pitney Bowes by 2,894.2% in the third quarter. Assenagon Asset Management S.A. now owns 1,228,562 shares of the technology company's stock worth $8,760,000 after acquiring an additional 1,187,531 shares during the period. Finally, Redmont Wealth Advisors LLC purchased a new position in shares of Pitney Bowes during the third quarter valued at approximately $519,000. 67.88% of the stock is currently owned by hedge funds and other institutional investors.

Pitney Bowes Trading Down 0.4 %

Shares of Pitney Bowes stock traded down $0.03 during trading hours on Friday, reaching $7.23. 812,147 shares of the stock traded hands, compared to its average volume of 1,755,525. The company has a 50 day moving average price of $7.08 and a 200 day moving average price of $6.32. Pitney Bowes Inc. has a one year low of $3.68 and a one year high of $8.80.

Pitney Bowes (NYSE:PBI - Get Free Report) last announced its earnings results on Friday, November 8th. The technology company reported $0.21 EPS for the quarter, beating analysts' consensus estimates of $0.13 by $0.08. Pitney Bowes had a negative net margin of 13.02% and a negative return on equity of 12.85%. The business had revenue of $499.46 million during the quarter, compared to analysts' expectations of $467.80 million. Analysts predict that Pitney Bowes Inc. will post 0.38 EPS for the current year.

Pitney Bowes Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Monday, November 18th will be given a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a yield of 2.77%. The ex-dividend date of this dividend is Monday, November 18th. Pitney Bowes's payout ratio is -9.17%.

Analyst Ratings Changes

Separately, StockNews.com downgraded shares of Pitney Bowes from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, August 21st.

View Our Latest Analysis on PBI

About Pitney Bowes

(

Free Report)

Pitney Bowes Inc, a shipping and mailing company, provides technology, logistics, and financial services to small and medium-sized businesses, large enterprises, retailers, and government clients in the United States and internationally. It operates through Global Ecommerce, Presort Services, and SendTech Solutions segments.

Further Reading

Before you consider Pitney Bowes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pitney Bowes wasn't on the list.

While Pitney Bowes currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.