Los Angeles Capital Management LLC purchased a new position in shares of BioMarin Pharmaceutical Inc. (NASDAQ:BMRN - Free Report) during the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 10,098 shares of the biotechnology company's stock, valued at approximately $710,000.

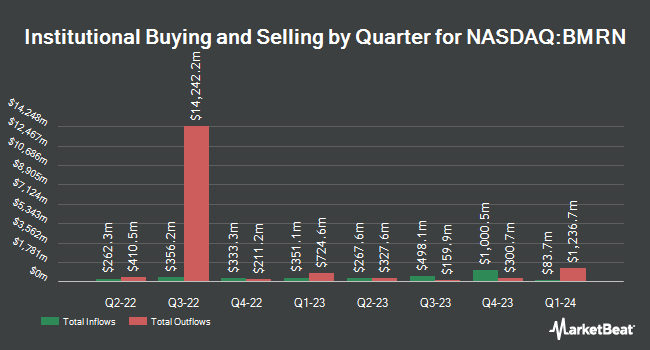

A number of other hedge funds have also recently added to or reduced their stakes in BMRN. Crossmark Global Holdings Inc. grew its stake in shares of BioMarin Pharmaceutical by 20.6% during the third quarter. Crossmark Global Holdings Inc. now owns 13,322 shares of the biotechnology company's stock valued at $937,000 after purchasing an additional 2,277 shares during the last quarter. Covestor Ltd raised its position in shares of BioMarin Pharmaceutical by 336.4% during the third quarter. Covestor Ltd now owns 1,030 shares of the biotechnology company's stock worth $72,000 after acquiring an additional 794 shares during the last quarter. AIA Group Ltd boosted its holdings in BioMarin Pharmaceutical by 15.4% in the third quarter. AIA Group Ltd now owns 3,435 shares of the biotechnology company's stock valued at $241,000 after acquiring an additional 458 shares during the last quarter. Stoneridge Investment Partners LLC acquired a new stake in BioMarin Pharmaceutical in the third quarter worth about $295,000. Finally, AlphaCentric Advisors LLC raised its holdings in BioMarin Pharmaceutical by 97.0% during the 3rd quarter. AlphaCentric Advisors LLC now owns 32,500 shares of the biotechnology company's stock worth $2,284,000 after purchasing an additional 16,000 shares during the last quarter. Institutional investors own 98.71% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have commented on BMRN shares. JPMorgan Chase & Co. lowered their target price on shares of BioMarin Pharmaceutical from $110.00 to $109.00 and set an "overweight" rating for the company in a research note on Wednesday, October 30th. Citigroup dropped their price objective on BioMarin Pharmaceutical from $93.00 to $81.00 and set a "neutral" rating on the stock in a research note on Wednesday, October 30th. TD Cowen decreased their target price on BioMarin Pharmaceutical from $125.00 to $120.00 and set a "buy" rating for the company in a research note on Tuesday, August 6th. Bank of America dropped their price target on BioMarin Pharmaceutical from $130.00 to $115.00 and set a "buy" rating on the stock in a research report on Tuesday, September 17th. Finally, Cantor Fitzgerald dropped their target price on shares of BioMarin Pharmaceutical from $110.00 to $90.00 and set an "overweight" rating on the stock in a report on Wednesday, October 30th. Seven analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $94.20.

Get Our Latest Research Report on BMRN

BioMarin Pharmaceutical Stock Performance

Shares of NASDAQ BMRN traded down $2.18 during midday trading on Friday, hitting $63.42. 1,687,439 shares of the company's stock were exchanged, compared to its average volume of 1,830,490. The company has a quick ratio of 2.62, a current ratio of 4.27 and a debt-to-equity ratio of 0.11. The company's 50 day moving average price is $70.43 and its 200 day moving average price is $79.15. BioMarin Pharmaceutical Inc. has a 12 month low of $63.22 and a 12 month high of $99.56. The firm has a market capitalization of $12.09 billion, a PE ratio of 37.98, a price-to-earnings-growth ratio of 0.66 and a beta of 0.31.

BioMarin Pharmaceutical (NASDAQ:BMRN - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The biotechnology company reported $0.55 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.78 by ($0.23). BioMarin Pharmaceutical had a net margin of 11.71% and a return on equity of 8.53%. The firm had revenue of $746.00 million during the quarter, compared to the consensus estimate of $703.37 million. During the same quarter last year, the firm earned $0.26 earnings per share. The business's revenue for the quarter was up 28.4% compared to the same quarter last year. As a group, analysts predict that BioMarin Pharmaceutical Inc. will post 2.47 earnings per share for the current fiscal year.

Insider Buying and Selling at BioMarin Pharmaceutical

In other BioMarin Pharmaceutical news, EVP Charles Greg Guyer sold 5,278 shares of the firm's stock in a transaction on Tuesday, November 12th. The stock was sold at an average price of $66.37, for a total value of $350,300.86. Following the sale, the executive vice president now owns 68,909 shares of the company's stock, valued at approximately $4,573,490.33. This trade represents a 7.11 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Insiders own 1.85% of the company's stock.

About BioMarin Pharmaceutical

(

Free Report)

BioMarin Pharmaceutical Inc develops and commercializes therapies for people with serious and life-threatening rare diseases and medical conditions. Its commercial products include Vimizim, an enzyme replacement therapy for the treatment of mucopolysaccharidosis (MPS) IV type A, a lysosomal storage disorder; Naglazyme, a recombinant form of N-acetylgalactosamine 4-sulfatase for patients with MPS VI; and Kuvan, a proprietary synthetic oral form of 6R-BH4 that is used to treat patients with phenylketonuria (PKU), an inherited metabolic disease.

Featured Stories

Before you consider BioMarin Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioMarin Pharmaceutical wasn't on the list.

While BioMarin Pharmaceutical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.